Integrated Resources Plan Working Group Wiki

Table of Contents

Integrated Energy Policy Report (IEPR)

Background

The CEC produces an annual load and distributed energy resource (DER) forecast that feeds into system and distributed resource planning models.

2020 Cycle

On January 17, 2020, a draft 2020 IEPR Scoping Order was published that proposed a key focus on three products: (1) a report on transportation trends, challenges, and opportunities; (2) an update to the demand forecast; and (3) an assessment of microgrids. Many parties were supportive of the focus on transportation electrification, with PG&E adding that the scope should include car-sharing electrification and SCE recommending an assessment of whether current programs can ensure achievement of the state’s transportation electrification goals. Regarding demand forecast updates, PG&E commented on the need to reflect dynamic changes with load migration while CSE wished to have a method to include updates that reflect DER impacts. Finally, on microgrids, SMUD and CSE requested that the scope be expanded to consider broader resiliency needs, potential to value stack with microgrids, and V2G for resiliency.

2019 Cycle

On January 31, 2020, the final 2019 IEPR was published that outlined comprehensive energy policy issues as well as the usual demand forecast updates. Notably, building and transportation electrification were featured in the report as critical to eliminating emissions, in addition to the need to equity concerns about ensuring all Californians benefit from the clean energy future

Demand Analysis Working Group (DAWG)

On August 1, 2019, a preliminary energy demand forecast was be shared at a DAWG meeting, including baseline forecasts for EVs and self-generation, which are increasingly leveraging NREL’s dGen model. NREL’s dGen model forecasts DER adoption using agent-based model simulation of consumer decision-making. Currently, the CEC is using this model to forecast distributed solar adoption, which has made improvements to spatial resolution, consideration of different segments such as multi-family buildings, and incorporation of rate impacts. NREL said it is “back-casting” the model to historical adoption levels to validate and calibrate the model and to better understand the effect of geospatial resolution and the influence of payback periods on the goodness of fit. In conducting this calibration, NREL found that historic payback periods do not improve the fit but found that adoption had a modest sensitivity to load and electricity rate growth and a more acute sensitivity to PV prices.

In the 2019 IEPR to take effect in 2020, the additional achievable PV (AAPV) forecast will be incorporated into the baseline PV forecast to account for 2019 Title 24 standards for new homes. Particularly, the CEC shared how it is moving toward hourly loads and hourly projections of energy efficiency, EV, and PV impacts by TAC area to better capture “peak shift” to provide more accurate peak forecasts for the purposes of determining RA and daily ramping needs. New EV load profiles were developed based on residential EV charging data from ChargePoint and the Joint IOU Electric Vehicle Load Research Report. In the future, the CEC plans to incorporate hourly impacts of storage, load-modifying DR, residential TOU rates, and climate-change-driven temperatures. In late September, the CEC will share and discuss their planned updates for energy storage profiles and modeling changes to forecast adoption.

Some of the other key takeaways included the following:

Climate change impacts (e.g., extreme heat conditions) on residential and commercial heating and cooling have recently been incorporated into the high demand scenarios.

SCE recommended the incorporation of higher light-duty ZEV forecasts (e.g., 7.8 million ZEVs by 2030 and 30% electrification of water and space heating as opposed to CEC’s 5.9 million ZEVs and 20% building electrification assumptions in its high-electrification scenario) as done in their PATHWAYS model to meet the state’s GHG emission targets for use in IRP modeling.

SCE recommended the pairing of BTM solar and storage in the IEPR load forecast given adoption trends, along with projected hourly impact where storage is largely charging from mid-day solar and discharging during peak load periods in the evening.

On December 2, 2019, the CEC staff presented on specific forecasts of transportation electrification, additional achievable energy efficiency savings, and BTM distributed generation and storage impacts. For BTM storage, the CEC detailed how it used the SGIP Weekly Statewide Report to determine the installed capacity to date and how it applied different methodologies for forecasting storage adoption for the residential sector (where almost all systems are paired with PV) and for the non-residential sector (where most systems are standalone). The Draft 2019 IEPR Report was published on November 8, 2019.

For non-residential storage forecasts, the CEC proposed a methodology to take the average of 2018 capacity, 2019 capacity, and the SGIP program queue (multiplied by some factor conveying “likelihood of installation”). There are some concerns with this approach since the forecast is limited by the SGIP application queue, not taking into account changes in incentive rates, capital costs, or rate schedules, and appears to constant linear growth based on these anchor historical data points (i.e., trend analysis).

For residential storage forecasts, the CEC proposed a high and low adoption methodology, with the former linking adoption to PV adoption (by calculating a “storage adoption rate” based on storage capacity added in 2018 as a ratio of total installed PV capacity, which is then multiplied against the PV forecast) and the latter using historical trends, similar to what is being used for non-residential storage forecasts. The mid case would use the average of the high and low scenarios.

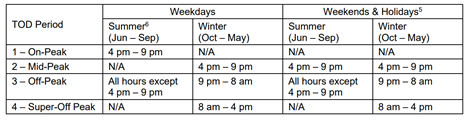

Importantly, the CEC developed hourly forecasts for energy storage systems for the 2019 IEPR to better account for the effect on non-coincident peak demand. The charge and discharge profiles are based on the 2017 SGIP Storage Impact Evaluation report, which accounts for different non-residential building types and system sizes as well as profiles by month and hour. Specifically, the CEC will model non-residential storage systems as reducing demand charges, which involve peak discharge during afternoon hours and peak charging between 9pm and 2am. However, since the SGIP report does not include sufficient data for residential storage projects, the CEC proposed to use NREL’s System Advisor Model (SAM), inputted battery specifications based on the Tesla Powerwall (13.5 kWh capacity, 5 kW rated power), and generated charging and discharging data based on solar production, default hourly household electricity load profiles, and rate structures applicable to different regions in the state. Operational requirements for ITC and SGIP compliance and minimum state of charge (i.e., 20%) for backup constrain the modeled system and was otherwise optimized for bill savings. Notably, based on these constraints and parameters, residential storage systems are only “allowed” to discharge in summer months in peak TOU periods in SAM for PG&E and SDG&E due to the insufficient rate differentials in winter months.

There are several other areas that were discussed at the DAWG, as shown below:

BTM PV energy grows at 8.7% per year (CAGR) and reaches 40,800 GWh by 2030. In addition to historical installed capacity, the forecast is informed by residential and commercial models that calculate payback and fuel savings. Additional achievable PV (AAPV) is incorporated in the baseline PV forecast in the 2019 IEPR, which accounts for Title 24 standards for new homes (80% level of compliance with average system size in the mid case) that takes effect in 2020.

For electric vehicles (EVs), light-duty electric vehicles (LDEVs) consume 15,000 GWh by 2030, with 70% attributed to residential charging, while medium- and heavy-duty (MDHD) EVs grow from 22 GWh in 2019 to 1,300 GWh by 2030.

Climate change impacts are applied to the mid and high cases, while the CEC discussed some of the challenges of forecasting cannabis load impacts in the forecast due to the lack of historical data and uncertainty around energy intensity.

Staff also presented an exploratory analysis of potential fuel substitution impacts, though such impacts will not be included in the CEC’s demand forecasts.

Hello, World!

SB 100 Report

Background

SB 100 established the 100% policy that eligible renewable energy resources and zero-carbon resources supply 100% of all retail sales of electricity to California end-use customers by December 31, 2045 and 100% of electricity procured to serve all state agencies by December 31, 2045. It expanded the RPS as follows:

20% by December 31, 2013

33% by December 31, 2020

50% by December 31, 2026

60% by December 31, 2030

Furthermore, the 100% policy shall not increase carbon emissions elsewhere in the western grid and shall now allow resource shuffling. The CPUC, CEC, CARB, and all other state agencies shall incorporate this policy into all relevant planning and shall do all of the following:

Maintain and protect the safety, reliability operation, and balancing of the electric system

Prevent unreasonable impacts to electricity, gas, and water customer rates and bills, taking into full consideration the economic and environmental costs and benefits

Lead to the adoption of policies and taking of actions in other sectors to obtain GHG emission reductions

Not affect in anny manner the rules and requirements for the California RPS Program

By January 1, 2021, the CPUC, CEC, and CARB must issue a Joint Agency Report in consultation with all California balancing authorities to the Legislature and at least every four years thereafter.

On September 5, 2019, a joint agency workshop was held to initiate the process for developing the joint-agency report and to present each agency’s perspective on the context for the report, including an overview of the state’s existing policies, IRP processes, programs, and reports. icy drivers. The presentations highlighted how California will need a drastic decrease in GHG emissions to achieve the 2030 and 2050 targets, with transportation needing to be a major focus area given that this sector constitutes 41% of total state emissions. Overall, these workshops are focused on the “scoping stage” of SB 100 report development, so there were no details on what the Joint Agencies will do. SB 100 provided limited guidance on this report, so it is unclear on what the Joint Agencies will use this report for. However, as a potential visioning document, CESA will be focused on how energy storage is positioned in the SB 100 discussions. Eventually, SB 100 requirements will feed into the CPUC’s IRP process.

CESA provided a high-level overview of the important role of energy storage resources of all kinds (battery, long-duration, mobile/EV, thermal, hybrid, hydrogen) that can support the state’s SB 100 goals. Given that policymakers were characterizing energy storage as battery storage only, potentially overlooking the wide range of technologies, configurations, and applications, CESA sought to remind policymakers on positioning energy storage more broadly in the Joint Agency Report.

See CESA’s comments on September 19, 2019 on the Scoping Workshop

Draft & Final Results

On August 31, 2020, the joint agencies published the draft results of SB 100 modeling analysis conducted for the statutorily-required Joint Agency Report. The Joint Agency Report is to be prepared collaboratively by the CEC, the California Public Utilities Commission (CPUC), and the California Air Resources Board (CARB). The CEC noted that all results contained in the draft results package are directional in nature and do not yet represent a "state plan" to achieve the goals set forth by SB 100. Within the draft results, the CEC includes three sets of scenarios:

Reference scenario: These scenario models the counterfactual case to SB 100 – i.e., a case where the sole environmental target is the 60% RPS requirement by 2030. This case is used for comparative purposes.

Core scenarios: These reflect the Joint Agency interpretation of SB 100 which does not include T&D and storage losses within the scope of the needed decarbonization.

Study scenarios: These expand the Joint Agency interpretation of SB 100 to include T&D and storage losses.

The modeling uses RESOLVE, the same capacity expansion model utilized in the CPUC's Integrated Resource Planning (IRP) proceeding. Relative to the IRP version of RESOLVE, E3 included the following modifications for this study:

All resources can be selected as candidate resources.

The model has been modified to encompass all of California and not just the CAISO area as it is used in IRP.

The out-of-state wind potential has been increased to 12 GW.

The offshore wind potential has been increased to 10 GW.

The option to select natural gas generation paired with carbon capture and sequestration (CCS) has been removed due to insufficient cost data.

Each of the modeling scenarios were analyzed under different demand cases derived from PATHWAYS, another E3 model. These cases include:

A Reference Case based on the Integrated Energy Policy Report (IEPR) developed by the CEC. This case has the lowest resource adequacy (RA) requirement by 2045.

A High Biofuels Case, where the use of biofuels is more widespread and displaces traditional thermal generation. This case has the second-lowest RA requirement by 2045.

A High Hydrogen Case, where electricity is used to obtain hydrogen through electrolysis, substantially increasing load. This case has the second-highest RA requirement by 2045.

All portfolios presented were discussed as being directional in nature – i.e., it does not represent a “state plan” to reach SB 100 goals. The E3 team concluded that SB 100 is achievable using existing technologies, with further innovations and cost reductions in zero-carbon technologies reducing implementation costs. Portfolio diversity is generally valued by the model, and natural gas capacity is largely retained, though fleet-wide utilization decreases by 50% compared to the 60% RPS future (Reference Scenario). Notably, sustained record-setting resource build rates will be required. In response to previous comments, the joint agencies concluded that attribute-based criteria for zero-carbon resources have been developed instead of a prescriptive list of candidate technologies, many of which may lack adequate data, and consistent with RPS, the modeling will only consider retail sales and state loads and not include system losses in the definition of supply.

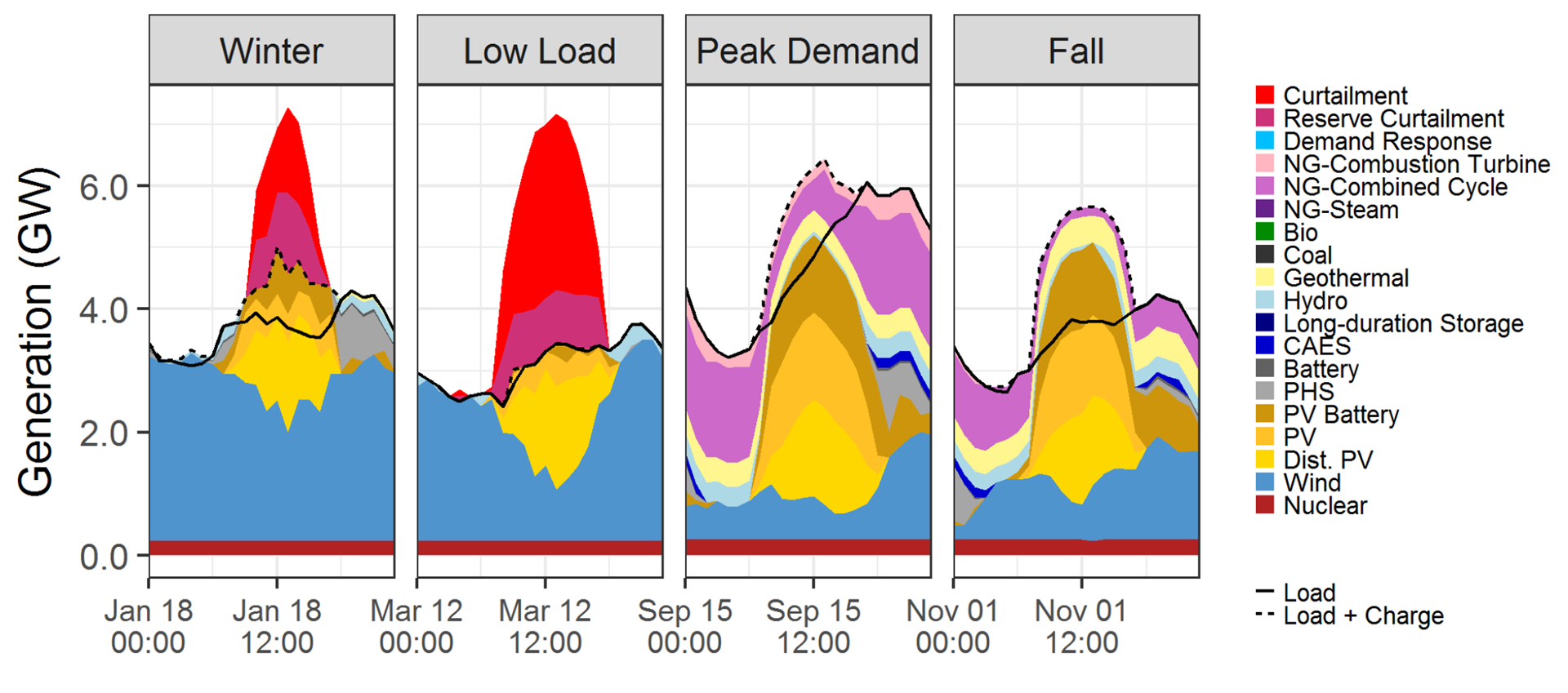

The draft results show future grid mixes that are heavily dominated by solar PV generation and energy storage (see chart below). Specifically, for battery energy storage, the Core and Study scenarios show a need for about 20 GW by 2035 and over 40 GW in 2045. Long-duration storage is selected in all cases, proving to be necessary by 2027. Notably, the need for long-duration storage increases substantially in 2035 within the Core and Study scenarios. Across the different demand cases in the Core scenario, storage selections are stable, with the main source of variation between demand cases being the level of solar PV deployment. While most cases retain the vast majority of natural gas generation, usage of these assets substantially drops in both the Core and Study scenarios (relative to the Reference scenario). In the Reference scenario, gas generation amounts to 24% of all generation; in the Core and Study scenarios, on average, this figure is 9% and 4%, respectively. As expected, costs increase as environmental constraints become more binding. Under the High Electrification case, the draft results show average cost increases of 8% and 16% by 2045 for the Core and Study cases, respectively.

Meanwhile, sensitivities show a clear relationship between wind availability and storage needs (see chart below). As more wind is available, more of it can be used to balance solar generation and less storage is required. Resource selections for long-duration storage are less disturbed by increased wind availability, highlighting that different sorts of storage provide different grid services and benefits. While most cases retain the vast majority of natural gas generation, usage of these assets substantially drops in both the Core and Study scenarios (relative to the Reference scenario). By contrast, under the No Combustion scenario, this case results in sizable increases in the selection of utility-scale solar PV (from about 68 GW to about 90 GW) and battery storage (from about 50 GW to about 65 GW), in addition to the selection of about 25 GW of hydrogen fuel cells, by 2045 relative to the Core scenario under the High Electrification demand case.

The CEC performed analysis including two generic zero-carbon firm resources (ZCFR) to consider the fact that modeling limitations and lack of established cost data precluded a range of ZCFR from being included as candidate resources. The inclusion of these candidate resources (Generic Baseload and Generic Dispatchable) results in a substantial drop in selected capacity, primarily at the expense of long-duration storage, battery storage, and utility-scale solar PV. The CEC also modeled a No Combustion case, which resulted in the selection of about 25 GW of hydrogen fuel cells by 2045. Under the No Combustion case, hydrogen and battery storage fulfill most of the RA requirements of the state by 2045. Notably, the results highlight a deployment challenge with record-level buildouts. For example, in the last ten years, solar PV deployment has averaged about 1 GW per year, with a maximum value of 2.7 GW per year. For storage, the 10-year average is very close to 0, as deployment has yet to reach the GW scale. However, the average build rates to 2030 and 2045 within the High Electrification demand case shows that 1.1 GW of battery storage would need to be built every year to meet the 2030 need. This number increases to 2.2 GW considering 2045 needs. If SB 100 goals are accelerated to 2040, 2035, or 2030, the yearly build rate increases to 3 GW and 2.2 GW per year for solar PV and battery storage resources, respectively.

CESA served on the Resource Buildout panel and recommended that the Joint Agencies use the Draft Results to identify near-term, no-regrets procurement opportunities and adopt the interpretation of SB 100 used for the Study cases, as it most closely reflects the Legislature’s intent that includes retail sales, state loads, T&D losses, and storage losses within the coverage of zero carbon load by 2045. RESOLVE must also be modified to solve for long-duration storage needs and include long-duration storage candidate resources beyond pumped hydro storage. Furthermore, the Joint Agencies should clarify the optimization of energy storage operations within RESOLVE regarding the interactions between RPS and RA incentives. Finally, hydrogen must be integrated as an alternative drop-in fuel within the SB 100 Joint Agency Report, including the benefits and flexibility that hydrogen can bring to the electric sector and as a drop-in fuel to replace natural gas.

See CESA’s comments on September 15, 2020 on the SB 100 Modeling Draft Results

At the workshop, given the directional nature of the workshop that focused less on near-term viability of different resource types, many stakeholders expressed disagreement with some of the resource-specific inputs and assumptions used. The joint commissioners generally sought feedback on what they can do as executives at the regulatory agencies to support 2045 needs, including the substantial resource buildout required (e.g., permitting, siting). To this end, the CAISO expressed how procurement needs to begin as soon as possible to support long-term transmission investments. In comments, many parties highlighted the need to conduct reliability studies, affordability and rate impact analysis, include environmental and land-use screens, and expand the joint-agency team given the need to take a more comprehensive approach.

Deep Decarbonization Scenarios

On September 24, 2019, a joint agency workshop was held by the CEC and CARB on California’s climate and energy policies to discuss the scenarios and assumptions for achieving deep decarbonization by 2050, where significant work is needed in eliminating emissions from the transportation sector and to transition to “sinks” of carbon, not sources. At the same time, reliability must be maintained via control of not only the supply side via control settings for inverter-based generation but also the demand balance via price signals and rates. E3 also highlighted how wind, solar, flexible loads, and batteries provide low-cost GHG emissions reduction (90-95% decarbonization of the electricity) but do not get the state to zero carbon, which requires firm capacity (e.g., gas with CCS, biomethane, nuclear) and long-duration storage (e.g., hydrogen). Overall, the workshop invited non-California and academic stakeholders to present their cutting-edge research and lessons learned.

On November 18, 2019, a technical workshop was held to discuss technologies, inputs, and modeling scenarios for technical analysis to inform the joint agency report. The CEC began with a question around what should count as eligible renewable and zero-carbon resources and proposed the following options:

RPS+ would align with the definition of current RPS resource types and add generation types that count as zero-fossil-emissions (e.g., large hydroelectric, nuclear, natural gas with carbon capture and zero emissions).

No Combustion would be similar to RPS+ but prohibit resources that combust fuel, which would include biomethane reformation and natural gas reformation with carbon capture and zero emissions but not allow biomass and biomethane combustion and natural gas combustion.

However, the CEC noted that accounting differences mean that the same electricity source type might be considered very differently – e.g., RECs for RPS and emissions profile for Mandatory Greenhouse Gas Reporting Regulation (MRR). Meanwhile, the joint agencies will leverage existing studies to conduct some preliminary modeling (e.g., CEC Deep Decarbonization Report, SB 100 2045 Framing Study for CPUC’s IRP).

The CPUC staff presented an overview of their 2045 framing study from the IRP proceeding, finding that beyond 2030 outlooks help to inform near-term thermal retention decisions and that all three scenarios rely heavily on solar and batteries to meet load and GHG goals. The availability of out-of-state or offshore wind displaces in-state solar and batteries and lowers costs, highlighting how resource diversity lowers the cost of meeting long-run GHG goals.

CESA presented on the “Enabling Technology Options” workshop panel to highlight innovation and emerging technologies that could assist with achievement of SB 100 goals by 2045. Specifically, CESA presented on the various energy storage technologies, durations, technologies, performance characteristics, cost trends, and market size. There were a number of other panelists representing different technologies as well, including the following:

Biomass & biofuels: A UC Davis speaker presented on the potential for biofuels to provide energy-dense liquid fuels and cross-sectoral benefits (e.g., transportation, agriculture) but face barriers in terms of RPS ineligibility and problematic definition for gasification.

Demand flexibility: LBNL identified load shifting as the biggest market opportunity and shared its analysis of DR market potential and cost trends for various end-uses and technologies, including battery and thermal storage.

Gas retrofits: Noble Thermodynamics presented on the necessity of gas and how carbon capture technologies and other gas retrofits can support GHG emissions reduction while ensuring reliability.

Geothermal: Fervo Energy discussed how the future of geothermal technologies is flexible and reliable and has a low land footprint.

Hydrogen: Green Hydrogen Council (GHC) highlighted how green hydrogen can decarbonize multiple sectors and provide seasonal storage shifting capabilities.

Nuclear: Breakthrough Institute presented on emerging technologies that are modular and more flexible but face challenges due to the statewide ban on new nuclear and the lack of value as a low-carbon resource.

Wind: Pattern Energy discussed how wind technologies are increasing energy yields with taller hub heights and larger rotor diameters and how out-of-state wind can support regional diversity that reduces costly curtailment. Meanwhile, Offshore Wind California highlighted the state’s resource potential but discussed how there are barriers to transmission capacity, permitting, and creditworthy off-takers.

Finally, SCE presented on its updated Clean Power and Electrification Pathway white paper that found that economy-wide carbon neutrality by 2045 will require a transformation of how the state sources and uses energy, especially in transportation and buildings and that a sense of urgency is needed to achieve 2030 goals.

CESA provided feedback on how energy storage can enable California to reach its SB 100 goals. Specifically, CESA commented on the need for storage diversity to accomplish decarbonization goals and the potential of energy storage to minimize the environmental impacts of fossil-fueled capacity via retrofitting. CESA also recommended the inclusion and consideration of demand-side solutions and technologies (such as electrical space and water heaters) as a means to shape and shift load, potentially lowering future resource costs. Finally, the CEC should reform the modeling approach currently considered to include multi-day optimization of dispatch, additional storage technologies as candidate resources, and LOLE reliability tests on future resource-build scenarios.

See CESA’s comments on December 2, 2019 on the technical workshop

Modeling Overview

PATHWAYS is E3’s economy-wide infrastructure-based greenhouse gas (GHG) emissions and energy analysis tool that models physical energy flows in all sectors of the economy (e.g., building appliances, on-road vehicles) and tracks electrification load shapes by sector and end-use. Rather than making forecasts, PATHWAYS allows hypothesis testing predicated on meeting emissions targets and bottom-up electricity demand projection based on end-use appliance stocks and macroeconomic drivers (e.g., number of households). PATHWAYS outputs include annual loads by category (GWh/year), normalized 8760 load shapes, and electricity sector GHG trajectories that can be provided to capacity expansion models such as RESOLVE.

RESOLVE is a linear optimization model explicitly tailored to study of electricity systems with high renewable and clean energy policy goals. The optimization balances fixed costs of new investments with variable costs of system operations, identifying a least-cost portfolio of resources to meet needs across a long time-horizon. RESOLVE is a zonal model that optimizes investment decisions in the “main” zones and treats other zones with exogenous assumptions. Flows are impacted by intertie constraints (e.g., min/max, simultaneous, ramping) and hurdle rates. Flexible resources are selected in RESOLVE when the avoided cost of renewable overbuild falls below the marginal cost of the integration solution. For each year in the analysis horizon, RESOLVE models the operations for 37 separate representative dispatch days – a sampling algorithm designed to approximate long-run distributions of hourly load, renewable generation, and hydro energy.

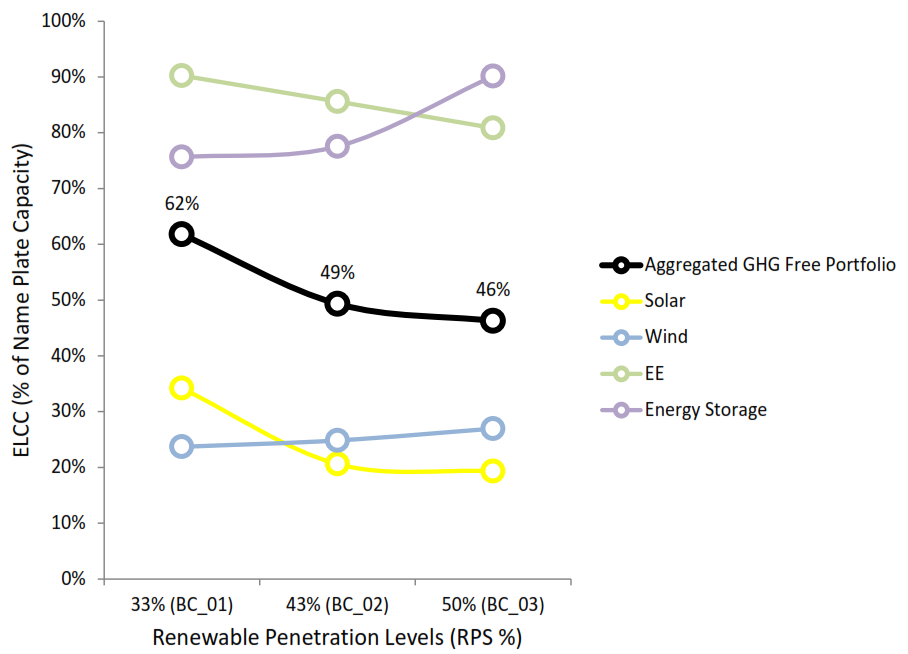

The capacity of new build resources are variables that the model can optimize, expanding existing units or building completely new units. Existing thermal resources can be economically retired if ongoing fixed cost is not supported by value of system services. New renewable costs include not only installation and fixed O&M costs but also new transmission costs, if needed, ranging from $11/kW-year to $89/kW-year depending on the Competitive Renewable Energy Zones (CREZ). Out-of-state transmission costs represent the cost to wheel power across adjacent utilities’ systems or the cost of developing new out-of-state and in-state transmission lines, with full capacity deliverability costs derived from OATTs and the CEC’s Renewable Energy Transmission Initiative 2.0 (RETI 2.0), ranging from $29/kW-year to $143/kW-year. Storage costs are broken into additive power ($/kW-year) and energy ($/kWh-year) components, which allows RESOLVE to optimize power and energy duration independently. In addition to unit commitment and production simulation, RESOLVE includes constraints for load following reserves, energy sufficiency, and resource adequacy. Variable resources provide capacity toward PRM based on ELCC surface expressed as a piecewise linear function of wind and solar penetration, while storage provides capacity toward PRM requirement based on NQC derate and qualifying duration. Shed DR is included based on the LBNL DR Potential Study and is assumed to have an NQC toward PRM equal to 1-in-2 ex ante peak load impact.

On February 24, 2020, a joint agency workshop was held to discuss inputs and assumptions for the SB 100 study. Staff and consultants presented background on the model to be used for the quantitative SB 100 analysis, including inputs, assumptions, and planned scenarios. While the current modeling efforts will focus on capacity expansion modeling and production cost modeling, CEC staff solicited input on ideas for future modeling possibilities around environmental protection, affordability, and safety. In previous comments, CEC staff observed support for a diverse portfolio, considerations around air pollution, and the need to properly define candidate resources eligible for SB 100 goals. Four PAHTWAYS load scenarios will be used in SB 100 modeling as an input into RESOLVE, with the main difference across the scenarios being around on-road vehicle electrification:

Reference Scenario using updated state reference aligned with the 2019 IEPR Mid Scenario

High Electrification Scenario including electrification of building and transportation, high energy efficiency and renewables, and limited biomethane

High Hydrogen Scenario including more fuel-cell trucks and fewer all-electric vehicles

High Biofuels Scenario including higher biofuels and purpose-grown crops and thus fewer GHG mitigation measures needed in transportation and other sectors

Seven scenarios have been proposed by the joint agencies using three zero-carbon resource options, where “RPS+” includes RPS-eligible technologies, large hydroelectric, nuclear, and natural gas with carbon capture and sequestration and “No Fossil Fuel Combustion” is the same as “RPS+” but without allowing any natural gas combined with CCS.

Unlike for the CPUC’s IRP modeling process where modeling was only conducted for the “CAISO zone”, the SB 100 analysis will include all four California balancing area authorities, such that RESOLVE will model a single “California zone”. Both supply-side and demand-side resources are included as candidate resources, with the only notable addition as compared to the IRP modeling being carbon capture and sequestration (CCS). Storage resource capital and O&M costs will come from Lazard Levelized Cost of Storage (LCOS) 5.0 and NREL’s Solar+Storage Study, as previously recommended by CESA. Furthermore, hydrogen fuel cells are modeled as candidate resources, though hydrogen can also be modeled as a drop in fuel for existing gas generators.

Notably, E3’s presentation also showed how battery storage and PHS are able to share energy between days, a feature that was not previously available when only intra-day optimization could occur. However, it is unclear if this enables inter-day optimization since E3 also shared in its modeling documentation that storage dispatch is constrained by energy neutrality with each dispatch day. CAISO discussed some of the unanswered questions around whether and how solar and storage can meet the majority of flexibility and energy needs that can no longer rely on gas and other dispatchable resources. CAISO estimated that 25 GW of flexible ramping capacity will be needed by 2030.

Especially on multiple days of cloud coverage, CAISO said they are exploring the strategic retention of gas for energy and other grid services. On low solar production days, CAISO expressed concerns with the ability of storage to recharge. Interestingly, the CAISO expressed their view that limited testing of more technologies is needed to prove potential scaling before making a significant investment in a limited, non-diverse portfolio.

A stakeholder panel discussed considerations for inputs and assumptions related to reliability, land use, equity and environmental impacts. Municipal utilities and irrigation districts also discussed the SB 100 reliability, operational, and stranded/investment cost challenges for a grid that includes less inertia, more variable load, and more intermittent generation, but at the same time, they highlighted the need for various storage technologies and capabilities. Other topics covered included:

Reliability: CAISO discussed some of the unanswered questions around whether and how solar and storage can meet the majority of flexibility and energy needs that can no longer rely on gas and other dispatchable resources, especially on multiple days of cloud coverage. New duck curve data was shared on actual 2019 ramping needs and projected 2030 ramping needs based on the IRP Reference Portfolio..

Land use: The Nature Conservancy (TNC) provided an overview of the need to integrate environmental and land use data in long-term energy models to improve projects and policy decisions. With clean resources sourced from a broader west, TNC argued for the cost-effective and land conservation benefits of expanded resource availability, with out-of-state wind being preferred as a balancing resource, displacing battery storage even in scenarios with higher levels of land protection. In the highest land use protection scenario, battery storage still represented a major balancing resource.

Workforce development: Citing research on the potential employment impacts of renewable electricity development and building decarbonization and the SOMAH Program as a case study, GRID Alternatives presented on the importance of a equity-focused workforce development strategy. GRID recommended funding set-asides within program budgets, use of cross-sector partnerships, and engagement with community groups.

CESA supported the modeling efforts but recommended that the Joint Agencies should clarify and interpret SB 100’s intent to phase out the use of fossil fuels. In addition, CESA commented on how RESOLVE is not currently equipped to solve for long-duration storage needs and recommended that transmission planning cannot be done solely in an ex post fashion. In response to workshop participant discussion, CESA added reliability concerns within the CAISO footprint can be solved with modifications to existing market mechanisms and that energy and capacity needs can be addressed in ways that minimize fossil fuel use.

See CESA’s comments on March 9, 2020 on the Inputs & Assumptions Workshop

A number of other parties submitted comments. Technology-specific parties advocated for the inclusion or fair consideration of their resource, such as hydropower, hydrogen, carbon capture and sequestration (CCS), offshore wind, and CAES. In particular, some parties were concerned that offshore wind and out-of-state wind were the only resources that were only available in certain scenarios. Others commented on the need to consider affordability and projected T&D costs and to provide more transparency and allow for detailed technical input into the assumptions used. Meanwhile, some utilities expressed concerns with the limitations of the RESOLVE model as being zonal and utilizing weather years based on sampling (i.e., 37 representative days); this is limiting in the sense that it fails to capture internal transmission constraints, is unable to model multiple and simultaneous constraints, does not look at unplanned events, and does not capture 8760 reliability. SCE also had concerns with expressing affordability and costs in average $/kWh and instead recommended “share of wallet” analysis that accounts for energy efficiency gains and reduced gasoline consumption.

Hello, World!

Solar-Storage Modeling Tool

Background

The CEC opened a new docket titled “Modeling Tool to Maximize Solar + Storage Benefits” (Docket 19-MISC-04) to introduce a new modeling tooldeveloped by E3, which interfaces with an enhanced LNBA tool and optimizes the operation of dispatchable DERs based on an optimization algorithm. Specifically, this tool evaluates the benefits of solar, storage, and other DERs and estimates the value proposition of the integrated systems based on their expected optimal operations, location on the grid, market prices, and other characteristics. This project is being conducted as part of EPC-17-004 and the resulting tool will be used to evaluate solar-plus-storage systems being researched in other EPIC projects (GFO-16-309).

Tool Development & Demonstration

On June 13, 2019, a workshop was held to introduce the tool, review the user guide and functionalities, discuss how the tool can simulate the operations of DERs under tariff and program designs, and determine which design will maximize the benefits of DERs to ratepayers. The tool co-optimizes dispatch of storage with other DERs (either via fixed DER shapes or optimized dispatch) and uses a nesting model of local distribution benefits. The tool is capable of evaluating and sizing a DER portfolio for distribution deferral while producing financial pro forma models (e.g., all-in project costs, financing options) and cost-effectiveness analysis for the utility (e.g., LNBA, bid evaluation, DER program design) and for the customer, developer, and aggregator (e.g., customer payback, expected return on investment). The dispatchability function seeks to minimize net costs, subject to technology, market, incentive, and price-taking constraints, over different windows (daily, monthly, annual) or intervals (hourly, 15 minutes, 5 minutes) and is capable of taking into account customer comfort level and other DER technologies. The model is also able to capture the nesting impact of DERs not only deferring direct distribution investments but also further upstream investments.

There was further discussion on use cases, how the tool can be used in the DRP proceeding, and the development of a storage roadmap. E3 explained that this tool will enable the IOUs to incentivize customer use of DERs through their tariffs and programs and align this use with the needs of the electricity grid. By incentivizing the provision of grid services from DERs, IOUs can avoid buying those services from other providers, reduce fuel burn, avoid investments in new generation capacity, and defer investments in new transmission and distribution infrastructure, leading to lower electricity costs to ratepayers.

On August 19, 2019, a workshop was held where CEC staff, in consultation with E3, presented and discussed the cost-effectiveness results produced by the modeling tool for an ongoing EPIC-funded project by Humboldt State University Sponsored Programs Foundation that aims to address key market barriers to deploy a solar and storage technology system at the Blue Lake Rancheria gas station and convenience store located in Blue Lake, CA. E3 also provided a hands-on demonstration and training for stakeholders who are interested in using the tool and guided stakeholders through the process of creating inputs, analyzing the cases, and viewing the final results. CEC/E3 staff were specifically looking for feedback on the usefulness, user-friendliness, and key features of the modeling tool.

CESA offered feedback on how this tool could be improved to be more useful for stakeholders beyond the "policy use case" that looks at all the potential theoretical value stack of solar-plus-storage resources and instead accounts for real-world constraints as well as linking to capacity methodologies and values used in CPUC proceedings to ensure usefulness of the tool's outputs to utility and industry stakeholders.

See CESA’s comments on September 9, 2019 on the Second Workshop

On December 12, 2019, a final workshop on the tool was held to summarize the Solar + Storage Modeling Tool, discuss the changes and improvements to the tool since the initial public release, review case studies in which the tool was used to assesses the cost effectiveness of PV, storage, and other DER technologies, and discuss recommendations and next steps.

Hello, World!

Technology & Resource Roadmaps

Background

The CEC is the state agency in charge of developing a roadmap to map out the opportunities, barriers, and potential pathways to realize a state policy objective or goal. The CEC, for example, developed the Energy Storage Roadmap to support progress toward AB 2514 energy storage procurement targets.

Vehicle-Grid Integration (VGI) Roadmap

The intent of updating the roadmap is to address the needs to use open standards that advances greater grid integration and support the state’s 2025 zero-emission vehicle (ZEV) adoption goals.

On September 6, 2018, a joint agency webinar workshop was held on September 6 to kick off the process to update the California VGI Roadmap. The CEC presented the approach and schedule for the roadmap update, as well as the matrix that includes proposed VGI roadmap goals and the problems/issues to address to achieve such goals.

On October 29-30, 2018, a two-day workshop was held to receive public input on specific roadmap actions and priorities. The workshop featured a vehicle and charging technology showcase for the public and stakeholders to learn about VGI efforts, followed by a staff presentation on an overview of the VGI Roadmap process as well as updates to the draft matrix of goals, issues, and barriers. The California Electric Transportation Coalition (CalETC), representing utilities, auto OEMs, and some EVSE providers, highlighted the need to open up different applications, control approaches (e.g., TOU and demand charge rate design, dispatching), and VGI communication pathways, and recommended policy steps to be taken on exploring DR program participation, LCFS program design for smart charging incremental credit (effective January 2019), and storage mandate design to qualify both V1G and V2G. E3 and LBNL also shared their learnings on the potential of V1G and V2G to support the grid.

CESA focused on how to realize greater value to customers and ratepayers and better achieve our decarbonization goals by enabling the smart operationalization of EVs and EVSEs. CESA focused on the barriers related to market participation pathways, dual DR program participation and multiple-use applications, and compensation structures that should be included in the roadmap and addressed in CPUC, CAISO, and CEC proceedings.

See CESA’s comments on November 21, 2018 on the VGI Roadmap Update Workshop

Renewables Roadmap (19-ERDD-01)

The CEC is developing a roadmap for prospective renewable energy expansion in California. The purpose of the research roadmap is to identify, describe, and prioritize research, development, demonstration, and deployment (RDD&D) on technology opportunities that have potential to achieve high penetration of renewable energy into California’s electricity grid. These efforts seek to identify and prioritize research on the most critical RDD&D gaps that need to be addressed to achieve California’s goals for integrating high penetrations of renewable energy resources in IOU service territories. Results of the analyses may be used to strategically target future EPIC investments. The CEC retained Energetics, Inc. to conduct this project and prepare the roadmap and reached out to CESA to complete a survey to support this effort.

On March 25, 2019, CESA provided feedback on how energy storage related RDD&D should focus on key applications that will likely be needed to achieve the state's SB 100 goals and mitigate climate risks such as wildfires. Rather than focusing on technologies, CESA recommended a focus on applications, such as resiliency and long-duration storage.

On June 28, 2019, a webinar was held to discuss the current baseline, best in class, cost, performance targets, and recommended initiatives for PV solar, concentrated solar, land-based wind, offshore wind, bioenergy, geothermal, small hydropower, grid integration, and energy storage technologies. The key questions were around the cost and performance targets for each technology and whether there were any gaps in the identified research areas and initiatives. For the grid integration technologies technology area, the draft report focused on T&D infrastructure, devices and controls, modeling and resource planning, and resilience. Initiatives were proposed to support continued advancement of high-temperature low-sag conductors as well as advancement of smart inverters to improve communication and cybersecurity. For the energy storage technology area, initiatives were proposed to support research into long-duration energy storage systems and to fund recycling programs for energy storage systems (particularly lithium-ion batteries)

CESA supported the initiatives but recommended that energy storage funding initiatives should focus on applications and performance attributes, including storage for resiliency and non-wires solutions as a topic in the grid integration strategies area of the roadmap. CESA added that multi- day and season system modeling capabilities are needed to support the valuation of long and seasonal duration storage technologies, and that hydrogen storage is a seasonal energy storage resource that warrants attention in the roadmap.

See CESA’s comments on July 12, 2019 on the Draft Renewable Energy Generation Roadmap

On February 5, 2020, the CEC staff held a webinar to present the R&D opportunities identified for the EPIC research roadmap on renewable energy generation technologies for utility-scale applications to support higher penetrations of renewable energy. Two “mid-term” initiatives were identified for energy storage systems to achieve “success” in a 3-5-year timeframe:

Initiative ESS.1: Lengthen storage duration of energy storage systems (8 hours or greater). The roadmap seeks to demonstrate the ability to provide 10-12 hours of storage duration at utility-scale, which help to reduce capacity and overbuild requirements for 4-8-hour storage by 2045 and provide renewables integration and resiliency benefits.

Initiative ESS.2: Optimize recycling process for lithium-ion batteries. The roadmap seeks to hit a 90% recycling rate for lithium-ion batteries to improve environmental impacts and reduce lifetime costs, improving upon the current less-than-5% recycling rate.

While the analysis of the long-duration needs and the cost metrics would benefit from more rigor, CESA found it promising that the roadmap continues to focus on the need to explore ways that the CEC could support through applied R&D, pilot demonstrations, deployment support, and market facilitation activities. However, as the roadmap progresses, CESA may need to comment on how the initiative needs to be shaped to better target the appropriate benchmarks, such as achieving certain $/kWh numbers for different storage durations. Furthermore, the roadmap ambiguously targeted 10-12 hours of storage duration without reference to cost targets or why even longer-duration (e.g., multi-day, seasonal) storage should not also be included in this initiative, given that this roadmap is targeted toward 2045 needs. Finally, the recycling initiative was reasonable but lacking in much detail.

On February 25, 2020, the CEC held a technical forum at the EPIC Symposium to highlight innovative new clean energy technologies that can help improve the resiliency of California’s electricity sector to climate change impacts and extreme weather events.

DER Roadmap (19-MISC-01)

The purpose of the DER Roadmap is to provide the CEC with insight and recommendations and to develop a research roadmap that identifies, describes, and prioritizes key research and demonstration needs to enable high penetration of DERs in California. This Draft Technical Assessment provides the first step toward that end, identifying what further EPIC investments may be needed for DERs to support California’s energy and climate goals. The Draft Technical Assessment characterizes the current state of DER technologies, answering the following questions about key technologies and strategies:

What is the technology/strategy?

What does the technology/strategy do and how does it compare to other technologies/strategies?

What do we know about the technology’s/strategy’s limits?

What is preventing the technology/strategy from further supporting California’s energy policy goals?

What research on this technology/strategy is active in or planned by other entities?

On March 25, 2019, Gridworks and Navigant (in conjunction with CEC staff) hosted a public workshop to solicit feedback on the Draft Technical Assessment component of the DER Research Roadmap Project. The purpose of the workshop is to get expert feedback on the Draft Technical Assessment, which will serve as the foundation of our Roadmap, including recommendations to the CEC on how to prioritize future RRR&D funding in the DER space.

CESA delivered remarks at the workshop and provided feedback on the energy storage and vehicle-grid integration sections of the assessment. The draft report was a bit unclear at times, so CESA recommended a different framework that assesses the landscape of specific energy storage technologies across three categories: performance characteristics, market penetration, and prospective benefits. CESA also provided input on how certain energy storage technologies (thermal), configurations (hybrids), and tools (modeling, standard testing protocols, calculators) should be considered in this assessment as well as our feedback on the key regulatory drivers for the energy storage market. Finally, we echoed our comments on Energy Storage Research Needs to the CEC in November, proposing near-term and medium-term use cases for energy storage that the CEC should invest money.

See CESA’s comments on April 8, 2019 on the public workshop

On June 25, 2019, a Final Technical Assessment was published that incorporated many of CESA’s suggestions, edits, and corrections, including the need to create a framework for quantifying the potential resiliency benefits of energy storage, focus on hybrid storage configurations as a near-term RDD&D target, and develop modeling tools with multi-day or seasonal storage optimization dispatch as a medium-term RDD&D target.

On July 25, 2019, a workshop was held to introduce a prioritization methodology to rank potential DER research needs and produce the final Research Roadmap. Energy storage, smart inverters, DERMS, EV integration, and DERs as non-wires alternatives were identified as current research need areas. The screening and prioritization process were proposed as follows:

CESA provided feedback on key DER research priorities for energy storage and EV integration. CESA was generally supportive of the listed research areas, which were generally comprehensive, though we requested clarification and refinement to the research areas to provide clearer outcomes and insights.

See CESA’s comments on August 9, 2019 on the Draft DER Research Roadmap

On September 17, 2019, a workshop was held to summarize the research ideas submitted for the DER Research Roadmap, discuss the screening process, and share the preliminary scores and ranks of the research ideas. Staff discussed how the process has advanced; the initial feedback; the next steps in the process; and the remaining timeline for the DER Research Roadmap. Based on survey results, the Navigant team identified the following research areas as the highest priority areas.

The lowest-ranking areas revolved around PV-related and generalized (e.g., DER impact) topic areas, which have generally already had significant investment and garner sufficient understanding of their capabilities. For energy storage, the evaluation of use cases for lithium-ion and wholesale market participation of thermal storage resources ranked moderately and garnered some attention. This is the second of three public workshops to develop and prioritize DER research recommendations.

On May 29, 2020, a workshop was held to present the draft final results of the assessment to prioritize DER research and development needs. For the energy storage research need area, the following high-priority topics were identified that highlighted the role of diversifying the storage toolkit while improving the performance of existing lithium-ion battery storage technologies, all in the short- to medium-term timeframe:

Distributed Thermal Energy Storage Aggregation: Control aggregate BTM thermal loads in response to wholesale grid signals, including communications and controls

Evaluate Alternative Storage Technologies: Evaluate non-lithium ion storage technologies with a particular focus on multi-day energy shifting applications

Next Generation Lithium-ion Storage: Continue to develop lithium-ion batteries with a focus on improved controls for extended battery life as well as the opportunity for local geothermal-backed lithium extraction

Green Electrolytic Hydrogen for Long-Duration Storage: Implement distributed multi-day green electrolytic hydrogen solution to reduce wind and solar generation curtailment

Meanwhile, for the vehicle-grid integration (VGI) research need area, the CEC is also seeing the need to advance the role of EVs in providing resiliency, building on CESA’s V2G interconnection and microgrid work and lining up with the CPUC’s recent focus on this area as well:

Vehicle-to-Building for Resiliency: Test ability of EV batteries to power community resiliency centers during unplanned outages and PSPS events

Assess Second Life EV Batteries: Resolve questions on second-life EV batteries such as degradation rate, optimal cell matching, customer concerns, and target market price

Assess EV Charging Technology Efficiencies: Research the impact on charging efficiency of charging at different states of charge and current and transformer capacity levels to optimize V2G requests with respect to losses

Finally, some of the key research need areas related to DER planning and strategies continue with a near-term focus on DER integration and resiliency, including:

Valuing Resiliency for Microgrids: Develop consensus benefit figures to be used in determining the effectiveness of a microgrid or other technology that improves resiliency

Residential Outage Backup: Prototype small battery backup systems that would seamlessly operate garage doors, emergency lighting and life safety devices in the event of wildfire or safety shutoff

Other research need areas where research priorities were identified include those for flexible load technologies and DER communications and controls.

Microgrids Future

On July 7, 2020, a workshop was held to discuss the microgrid policies, challenges, and opportunities from the perspective of CPUC/CEC staffers and vendors. Some of the key challenges that were highlighted include:

Difficulty to fully finance with private funding: This highlights the need for public investment funds (e.g., DOE/EPIC grants, SGIP, resiliency tariff), as well as the need to standardize contracting terms. The CCAs could potentially serve as a central PPA counterparty and facilitate public sector bond funding.

Long time to design, construct, and deploy: In addition to more complex permitting, testing, and interconnection processes, it involves a number of different vendors to coordinate and put together a microgrid configuration. The need for

Need for significant education: Critical facility operators need education to understand the importance and optimal design of microgrids. The need for better models on value streams and technical design was also highlighted.

Complex operations and maintenance: O&M responsibility must be pre-planned and utility bill savings must be optimized in non-islanding modes.

CESA presented at the workshop on a high-level overview of the role of storage in microgrids, including for longer-duration technologies, pairing with solar, providing economic signals, and supporting interconnection processes. The workshop was mostly informational for the benefit of the CEC and to draw lessons learned from CEC EPIC projects, technology vendors, and developers. Based on the presentations, the technology is there but it involves a number of challenges to bring projects together, interconnect and operate them, and address various financing and policy barriers. Fortunately, the Microgrid proceeding (R.19-09-009) appears to finally be getting some traction on making headway on some of these issues. Notably, the IOUs were supportive of microgrids but offered notes of caution recommended against duplicating activities in the CPUC’s R.19-09-009 proceeding. SDG&E focused on ensuring safety through testing and commissioning while SCE commented that microgrids are just one resiliency tool and how incentives for microgrids should not be funded by utility ratepayers.

Given the growing need for resiliency due to climate change risks and Public Safety Power Shutoff (PSPS) events, CESA strongly supported the joint-agency focus to support the acceleration of microgrid deployment. CESA encouraged the CEC to consider creating economic signals to value resiliency, leveraging and layering existing incentive programs to maximize ratepayer investments, funding the development of tools and additional microgrid use cases where gaps are identified, and developing commercialization pathways, including third party-owned microgrids.

See CESA’s comments on July 30, 2020 on the IEPR Workshop

Hello, World!

2012 Long-Term Procurement Plan (R.12-03-014)

Background

The Long-Term Procurement Plan (LTPP) proceedings were established to ensure a safe, reliable, and cost-effective electricity supply in California. Every two years, the CPUC opens an LTPP proceeding to review and approve the utilities' ten-year, forward-looking procurement plans, which dictate the amount and types of resources that the IOUs need to procure through 2024. The 2012 LTPP proceeding evaluated the IOU’s need for new energy resources for system/local reliability and operational flexibility, and established rules for rate recovery of approved procurement transactions in four separate procedural ‘tracks’. The long-term nature of resource planning is necessary given that resource procurement decisions typically take three to nine years until fruition.

The CPUC updates the planning assumptions on an annual basis in coordination and collaboration with the CAISO and the CEC through an Assumptions & Scenarios (A&S) Document.

Key decision, D.07-12-052 (LTPP Decision) and D.13-10-040 (Energy Storage Procurement Framework Decision) set requirements for the IOUs in order to enter into a utility-owned contract. D.07-12-052 determined that the IOUs must first show that holding a competitive RFO is infeasible and provided five categories of exceptions with requirements for making this showing that are unique to each category - i.e., market power mitigation, preferred resources, expansion of existing facilities, unique opportunity, and reliability. The CPUC will determine exceptions for utility ownership outside of the competitive process in these five categories on an individual case-by-case basis through an IOU application.

On June 23, 2016, D.16-06-042 was approved that closed this proceeding and transferred the one remaining unresolved set of modeling methodology issues to the successor Integrated Resources Planning (R.16-02-007) proceeding.

2012 LTPP Authorizations

2012 LTPP Authorization for LCR in SCE's LA Basin

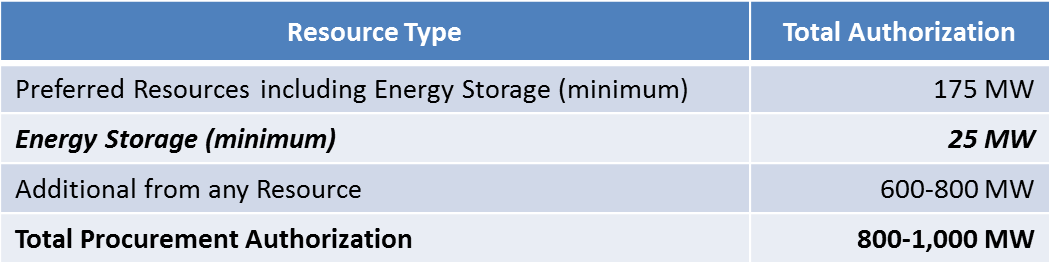

The CPUC issued an LTPP decision ordering SCE to procure between 1,400 and 1,800 MW of energy resource capacity in the LA Basin to meet long-term local capacity requirements (LCR) by 2021. Of this amount, at least 50 MW was required to be procured by SCE from energy storage resources, as well as up to an additional total of 600 MW of local capacity required to be procured from preferred resources - including energy storage resources.

2012 LTPP Authorization for Local Capacity Requirements (LCR) in SDG&E

For SDG&E, the CPUC issued an LTPP decision directing the procurement of 500-800 MW, which includes 25-200 MW of energy storage, in its service area to meet long-term local capacity requirements (LCR) by the end of 2021.

SCE 2013 Local Capacity Requirements RFO - Western LA (A.14-11-012)

On November 21, 2014, SCE filed its Western LA LCR RFO Results Application (A.14-11-012) seeking approval of contracts with selected bidders in its 2013 LCR RFO, which included a minimum procurement target of 50 MW for energy storage. The results showed that SCE had procured five times its minimum requirement in the first-ever utility procurement of energy storage in an all-source solicitation. CESA submitted comments and testimony supporting the RFO results.

On November 19, 2015, the resulting contracts were approved in D.15-11-041, but denied six NRG contracts because they relied on natural gas-fired backup generation to reduce the amount of energy served by the grid, which did not constitute either Demand Response (DR) or Preferred Resources. It also authorized, but did not require, SCE to procure additional Preferred Resources as required by the original authorizing decisions. The seventh NRG DR contract with was approved because NRG offered to amend its contract to preclude use of behind-the-meter fossil-fueled backup generation.

On December 21-24, 2015, four parties (Los Cerritos Land Trust, Sierra Club, EnerNOC, and Powers Engineering) submitted Applications for Rehearing of D.15-11-041, which has held up the approved contracts above.

On June 1, 2016, the CPUC denied rehearings (D.16-06-053) and ordered SCE to procure an additional 169.4 MW of preferred resources or energy storage, per the requirements of D.13-02-015 and D.14-03-004.

On July 1, 2016, two of the four parties that filed Applications for Rehearing subsequently filed a Petition with the California Court of Appeals (see Powers Engineering, et al. vs. CPUC). The Petition asserts that the CPUC failed to proceed “in the manner required by law,” discriminated against preferred resources and energy storage, and abused its discretion when it refused to consider whether changed circumstances would serve to lower the need for gas-fired generation. The petitioners argued that SCE failed to meet the minimum preferred resource and energy storage requirements, even as its bid analysis showed preferred and energy storage resources were available and cost-effective.

On September 1, 2016, the Court of Appeals summarily dismissed the Petition. However, the Petitioners have been allowed to submit a late-filed Petition to the California Supreme Court.

On November 30, 2016, the California Supreme Court denied a review of the Petition from Powers Engineering. This likely concludes the legal challenges of this procurement, unless Powers Engineering petitions the US Supreme Court by February 28, 2017.

SCE 2013 Local Capacity Requirements RFO - Moorpark (A.14-11-016)

On February 13, 2013, D.13-02-015 ordered SCE to procure a minimum of 215 MW and a maximum of 290 MW of electrical capacity in the Moorpark sub-area to meet identified long-term local capacity requirements by 2021. This need existed in large part due to the expected retirement before 2021 of once-through-cooling generation facilities located in Oxnard, CA.

On November 26, 2014, SCE filed a separate Moorpark LCR RFO Results Application (A.14-11-016) seeking approval of contracts with selected bidders in its 2013 LCR RFO, which included solar and energy storage projects.

On May 26, 2016, a Decision (D.16-05-050) was issued that approved six contracts for energy efficiency (6 MW) and two contracts for renewable distributed generation (5.66 MW). D.16-05-050 also approved the 20-year NRG contract for 262 MW of gas-fired generation (Puente Project) while deferring the consideration of the 10-year NRG California South refurbishment agreement for the existing 54-MW Ellwood Generating Station (along with an attached 0.5 MW energy storage contract) to a subsequent decision in order to develop the record and determine if there is a reliability need that it would meet. The Ellwood contract was determined to exceed the maximum amount authorized under D.13-02-015 and was not considered an incremental resource. The refurbishment would extend the life of the plant by an additional 30 years to 2048 and is intended by SCE to provide 54 MW (out of the 105 MW) of capacity needed to avoid an N-2 contingency during the loss of the Goleta-Santa Clara 230-kV transmission line.

On June 30, 2016, the Center for Biological Diversity (CBD) filed an Application for Rehearing contending that the CPUC acted beyond its jurisdiction and that the Decision’s findings are not supported by the record (e.g., violating the loading order, demonstration of need). CBD also argued that the California Environmental Quality Act (CEQA) review should have preceded CPUC action.

On July 1, 2016, the California Environmental Justice Alliance (CEJA) and Sierra Club jointly filed an Application for Rehearing focused on the legal error of not considering environmental justice in procurement decisions and on the requirement to await the CEC's environmental review before CPUC action.

On December 1, 2016, an Order was issued that denied the applications for rehearing of D.16-06-050 focused on the procurement of the Puente contract due to environmental justice issues being one of many needs to be addressed, among other reasons cited.

On August 16, 2017, the CAISO Moorpark subarea local capacity special study was published regarding alternatives to the Puente Power Project, which is undergoing CEC environmental review. The CAISO analyzed three portfolios of local capacity alternatives in the absence of Puente, but did not address the timing or feasibility for procurement of the alternative resource portfolios. The three alternative scenarios include a 135-MW baseline of incremental DERs that consists of 80 MW of storage-enabled DR, 25 MW of solar-plus storage resources, and 30 MW of existing slow-responding DR resources coupled with incremental energy storage. The baseline alternative scenario was not found to be sufficient to meet the local capacity requirements. The additional “grid-connected” resources needed to meet the local capacity technical study criteria for each of the three scenarios are detailed below:

Scenario 1: 125 MW of IFOM energy storage resources with 9-hour continuous discharge duration would be necessary to satisfy local capacity requirements consistent with the local capacity technical study criteria.

Scenario 2: A 240 Mvar reactive power device would be necessary to satisfy local capacity requirements consistent with local capacity technical study criteria. Unlike Scenario 1 and 2, however, the reactive support does not also provide protection from loss of load through load shedding to avoid thermal overloads; load shedding is not desirable but is permitted under the local capacity technical study criteria in the circumstances being studied.

Scenario 3: If the 54 MW Ellwood Generating Facility is retired rather than refurbished, 240 MW of energy storage resources would be necessary to satisfy local capacity requirements consistent with the local capacity technical study criteria. 115 MW of this energy storage capacity would need 5-hour continuous discharge duration, 65 MW would need 9-hour continuous discharge duration, and 60 MW would need 10-hour continuous discharge duration.

CESA relayed its appreciation and support for the CAISO’s study, perhaps the first of its kind where an ISO evaluated energy storage as an alternative to traditional power generation or infrastructure, but recommended a reexamination of the energy storage costs used and how a competitive solicitation is the best means to obtain real cost information. Such outdated cost assumptions are likely the drivers for why energy-storage-based alternative portfolios resulted in such high comparative costs. Specifically, CESA contested some of the methodologies and assumptions used:

With more BTM PV, the peak of the load curve narrows and thus allows shorter-duration energy storage to meet underlying local capacity needs in the future, in contrast to the 9-hour duration tested in the study

The CAISO’s use of $1,940/kW ($485/kWh) by 2020 for a 4-hour system is on the high-end of the range predicted by other sources, such as EPRI, GTM, and ESA, which predict lower costs in 2016

The CAISO inappropriately scales the costs for a 4-hour system linearly to a 9-hour system

The CAISO does not factor all the other benefits of energy storage and thus understates the full range of benefits

Additional consideration of the role and capabilities of BTM energy storage is needed, including how it is unfair to measure the full costs of these systems that are already deployed

See CESA's comments on August 30, 2017 on CAISO's Loacl Capacity Alternatives Analysis.

On September 14, 2017, evidentiary hearings were held. CESA will not provide testimony given the focus of these evidentiary hearings on the permitting decision for the Puente project. Following some backlash on cost assumptions used in the study, the CAISO submitted post-hearing comments in support of preferred resource alternatives, with a new expedited RFO to determine economic feasibility. The new local capacity resources would need to be in place and operational prior to the summer 2021 peak-load period. Subsequently, the CEC Committee issued a statement recommending against the approval of the project because it is “inconsistent with several Laws, Ordinances, Regulations, or Standards” and will “create significant unmitigable environmental effects". Meanwhile, NRG Energy, the developer of the project, asked the CEC to end hearings over its proposal as it reviews whether or not to withdraw its application, following the comments and statements made by the CAISO and the CEC. NRG subsequently asked the CEC to suspend its application for the proposed Puente project for six months, while it works with SCE to determine if preferred resources could replace the 262 MW project.

On September 28, 2017, D.17-09-034 was issued by ALJ De Angelis that rejected the 10-year, 54-MW Ellwood Generating Station to give the CPUC additional time to explore whether any approved need in the Santa Barbara/Goleta area can be met in a manner more consistent with the CPUC’s goals of reduced reliance on fossil fuels. The 30-year refurbishment Ellwood contract and 0.5 MW energy storage contract (linked to the Ellwood contract) are thus rejected because there is no reliability-based urgency and due to the CPUC’s preferences to have SCE conduct an all-source solicitation to consider clean energy alternatives, rather than to extend the life of a gas-fired plant for an additional 30 years. The CAISO identified the local capacity need to be 29.6 MW without Ellwood. The reasons provided in the decision include the following on how Ellwood may not be the ‘optimal’ solution:

The low and unknown probability of an N-2 contingency due to the loss of the Goleta-Santa Clara 230-kV transmission lines

The potential to drop load during an N-2 contingency

Existing air permits by Santa Barbara County Air Pollution Control District that restrict and limit Ellwood’s operations to perform short circuit duty and during an N-2 contingency

Planned upgrade of the Santa Clara 66-kV distribution system minimizing the need for Ellwood

Energy storage procurements may result from this decision. SCE described how the process would unfold if it had to run a new solicitation seeking another portfolio of LCR resources targeting the Moorpark Sub-Area. SCE also explained how it attempts to solicit participation of various types of resources, as well as the challenges related to attempting to procure resources with specialized reliability characteristics, in a short amount of time. SCE noted that among those challenges is the effect on customer costs. Such cost pressures arise not only from the compressed timeline of a new solicitation, but also from the disruption of established procurement processes. SCE also described the results of other recent SCE solicitations (i.e., RPS, 2016 Energy Storage RFO) expressing a preference for specific areas, like Goleta, and noted that it could not tell what kind of portfolio would emerge to fill the Moorpark Sub-Area need if SCE conducted a new solicitation. One concern seemingly presented by discussion in the decision is that the CPUC may be entertaining the idea of prohibiting offers that combine existing generation with incremental energy storage capacity going forward. The decision discussed the CPUC’s procurement rules, which are intended to “prevent market distortions and ensure a level playing field among bidders”. This may be an issue that CESA targets going forward as there are potential cost-effective energy storage retrofit opportunities.

On November 27, 2017, the CPUC directed SCE to submit a Moorpark sub-area LCR procurement plan to the CPUC’s Energy Division for review given that the Puente Project was put on suspense and the Ellwood contract was rejected in a decision.

On December 21, 2017, SCE filed its Moorpark Procurement Plan. The OTC unit retirements, the retirement of several other thermal plants (e.g., Ellwood, Mandalay #3) in the Moorpark sub-area, and the contingency of losing the three Moorpark-Pardee 230-kV lines has created a 318 MW LCR deficiency by 2022, according to the CAISO’s Moorpark Sub-Area Local Capacity Alternative Study in August 2017. The 10-MW of energy storage contracted under its 2016 ES&DD RFO has reduced that LCR deficiency to 308 MW. Part of this RFP will focus on resiliency in the Santa Barbara/Goleta area, which is exposed to a prolonged 230-kV N-2 contingency that could result in extended outages, but it will count towards the Moorpark LCR need as well. There are two Goleta-Santa Clara 230-kV transmission lines being the only points of connection between Goleta and Santa Barbara with the rest of the SCE transmission system. These lines are at risk of loss due to its towers being located on mountainous terrains that are at higher risk of wildfires and mudslides and require significant time to repair in the event of a disaster. The total LCR MW need is reduced to 76 MW with SCE’s proposed Moorpark-Pardee No.4 230-kV circuit. SCE noted that the fourth line will address voltage collapse issues upon loss of the first three lines.

Dependent on the RFP portfolio mix, energy storage with discharge durations of 4 hours and greater than 9 hours may be required to fully satisfy the LCR need. Given that there is insufficient generation available during an N-2 event to charge additional energy storage during off-peak hours due to the limited capacity of the adjacent 66-kV sub-transmission lines in Santa Clara, energy storage bidders will need to consider or identify a generation source (e.g., peaker, fuel cells, and/or solar). The adjacent sub-transmission lines can re-route about 100 MW to the Santa Barbara/Goleta area in the event of an outage within one hour, with a planned upgrade in May 2019 expected to increase this backup capacity to 180 MW, but it still falls short of the 285 MW forecasted annual peak load and these lines do not provide adequate short circuit duty. As a result, SCE indicated that it will consider proposals for small (less than 55 MW) gas-fired generation projects connected to the Goleta system due to potential charging constraints as mentioned above, even as it provides a greater preference for preferred resources and energy storage to meet a 105 MW shortfall.

The differences between the terminated Goleta RFO and this new RFP are highlighted below:

Eligible BTM and IFOM resources must be electrically connected at or downstream of: Santa Clara 220/66kV Substation (preferred resources only), Goleta 220/66kV Substation, and Moorpark 220/66kV Substation (preferred resources only). SCE is looking for new (incremental) resources with year-round delivery from proven, commercialized technology, and/or configurations and from offerors must be experienced developers. Contract terms by delivery period and minimum offers can vary by type of product, summarized below:

CESA supported SCE’s plan but recommended that this solicitation should operate in line with the Commission's determinations of need and should not assume incremental or unapproved transmission solution reduce the need. Additional information on how energy storage resources can address voltage collapse issues would support non-wires transmission alternatives. CESA also requested that the definition of incrementality should be expanded to ensure the best outcome for ratepayers.

See CESA's informal comments on January 16, 2018 on the SCE Moorpark Procurement Plan.

On February 2, 2018, the CPUC approved SCE’s procurement plan with minor modifications. In response to stakeholder comments around its consideration of new gas-fired generation in the solicitation and in alignment with SB 350, SCE modified its solicitation to actively seek and express a preference for renewable and GHG-free resources in disadvantaged communities. SCE also clarified that it may approve contracts that do not have the highest net present value (NPV) based on these preferences.

On March 22, 2018, since the CAISO Board approved SCE’s proposed Moorpark-Pardee Line No. 4 transmission line, SCE revised its RFP to no longer seek projects interconnected at or electrically downstream of the Moorpark 220/66 kV substation.