Emerging Technology and Long Duration Storage Working Group Wiki

Electric Program Investment Charge (EPIC) Program

Background

The CPUC established the purposes and governance for the Electric Program Investment Charge (EPIC) in D.12-05-037 for R.11-10-003 on May 24, 2012. In this decision, the CPUC designated the CEC and each of the three IOUs as the administrators of the program. The portion of the EPIC Program administered by the CEC will provide funding for applied research and development, technology demonstration and deployment, and market facilitation for clean energy technologies and approaches for the benefit of ratepayers through a competitive grant solicitation process and that address strategic objectives and funding initiatives as detailed in the appropriate EPIC Investment Plan. These plans are coordinated with the EPIC investment plans of the IOUs, which develop their own technology demonstration and deployment funding initiatives.

All EPIC research initiatives are expected to do the following:

Address the state's pioneering energy priorities

Accelerate technology innovations and tools

Provide benefits to California ratepayers

In previous the 2012-2014 and 2015-2017 EPIC Investment Plans, the CEC focused on testing energy storage value and potential, testing the value of energy storage as part of a system solution (e.g., microgrids), and building- and community-scale PV and storage. The Solar+: Taking the Next Steps to Enable Solar as a Distribution Asset (GFO-16-309) was launched as one of the results of this investment plan.

EPIC Policy + Innovation Coordination Group (PICG)

The EPIC PICG was created by CPUC decisions to ensure EPIC investments are optimally aligned with and informed by key CPUC and California energy innovation needs and goals. The PICG is intended to improve information sharing and coordination both among the EPIC administrators and between the EPIC administrators and CPUC.

On March 23, 2020, the EPIC PICG held a stakeholder call to discuss the process for identifying the set of key priority areas around which to focus the group’s coordination efforts over the next year. The workshop also broadly discussed CPUC electricity policies and programs as they relate to the CPUC’s EPIC research, development, and deployment (RD&D) program.

2018-2022 Triennial Investment Plan

On March 14, 2017, the CEC held a workshop on its Proposed EPIC 2018-2022 Triennial Investment Plan. This workshop was one of a series where the CEC and the three IOUs sought stakeholder feedback on the proposed plans and to contribute to ongoing coordination and understanding among administrators, stakeholders, and the CPUC, pursuant to D.12-05-037. The CEC staff highlighted how 12 energy storage projects were supported by EPIC, and that seven have gone on to compete in IOU RFOs.

On April 17, 2017, the CEC published its Proposed EPIC 2018-2022 Triennial Investment Plan, which will fund $350 million in programs. Unlike previous years, the CEC will consider funding initiatives for energy storage as a standalone technology solution rather than just as a component of a larger system (e.g., pairing with PV or being part of a microgrid). The proposed plan includes the following themes and sub-themes that may affect energy storage technologies and systems:

Theme 2: Accelerate widespread customer adoption of DERs

S2.1: Increase the cost-effectiveness of zero-net-energy (ZNE) buildings and communities

S.2.1.2: Assess and test innovative strategies to employ cost-effective combinations of advanced EE technologies, DG, and energy storage to provide grid benefits

S2.2: Push low-carbon microgrids closer to commercial viability

S2.3: Improve the business proposition of integrated distributed energy storage

Theme 3: Increase system flexibility from low-carbon resources

S3.1: Accelerate broad adoption of automated DR capabilities

S3.1.1: Market design for the next-generation DR landscape

S3.2: Enable EV-based grid services

S.3.2.1: Demonstrate advanced VGI functions

S3.3: Increase the value of DERs/renewables to the T&D system

S.3.3.2: Reduce the cost/time needed for interconnection

S.3.3.5: Facilitate adoption of communication protocols for grid-connected devices, including for energy storage

S3.4: Define and demonstrate the locational benefits and optimal configurations of grid-level storage

S.3.4.1: Assess and simulate optimization of grid-level energy storage (including baseline assessment)

There are a number of opportunities for CESA members to apply for and secure CEC funds to demonstrate new innovative deployment strategies and project operations. There may be additional opportunities under Themes 5 and 8 funding initiatives to support pre-commercial energy storage technologies and energy storage projects in disadvantaged communities, respectively. CESA in particular may apply for funds in S.2.3 to fund the development of the distributed energy storage permitting handbook, which is being pushed by the proposed AB 546 legislation, which CESA has sponsored. The CEC noted that it has an active relationship with the New York State Energy Research & Development Authority (NYSERDA), which recently announced RFP 3407 to develop a comprehensive strategy to reduce soft costs associated with distributed energy storage systems in New York by 25% per kWh by 2019 and 33% or more by 2021 compared to a 2015-16 baseline of approximately $220/kWh. The CEC plans to draw lessons with NYSERDA.

On April 27, 2017, the CEC approved the EPIC 2018-2022 Triennial Investment Plan.

On May 2, 2017, the CEC published its 2016 Annual Report, which outlined the progress and status of CEC activities funded by EPIC for the 2016 calendar year. In 2016, the CEC approved 111 projects totaling more than $216 million. The CEC particularly noted the success of funding flywheel batteries from Amber Kinetics and zinc-air batteries from Eos Energy Storage as successful research investments in the 2012-2014 Investment Plan that have gone onto utility procurements.

2015-2017 Triennial Investment Plan

Background

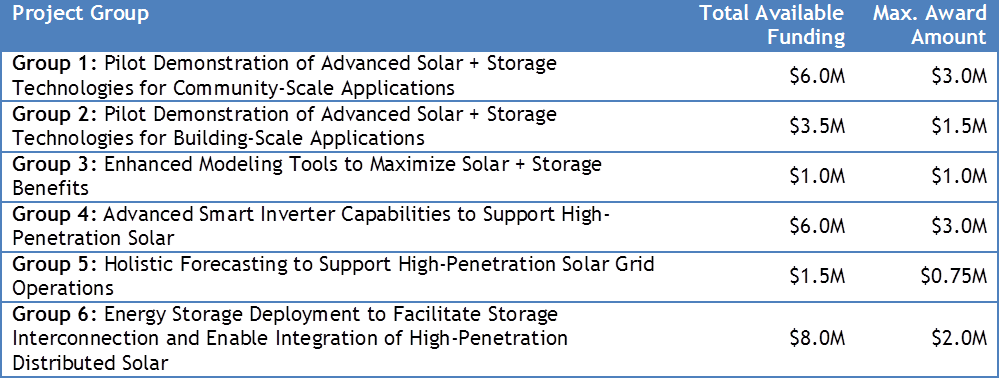

In 2016, the CEC announced it will award up to $26 million in grants to support technologies and solutions to increase adoption and integration of distributed solar resources. The purpose of this solicitation is to advance the deployment and grid integration of distributed solar resources through the use of energy storage, smart inverters, advanced forecasting, and advanced modeling techniques that help limit mid-day export of large amounts of solar onto the grid. The available funding is divided into six groups:

On January 20, 2017, applications were due. Details on each project group can be found in the pre-application workshop presentation here. Specific requirements are detailed in the solicitation documents here.

On September 8, 2017, Evergreen Economics presented their independent evaluation to the CPUC of the EPIC Program to identify opportunities to improve program management and effectiveness. The key recommendation from this evaluation was that the IOUs could improve information sharing and stakeholder engagement.

On November 6, 2018, the CEC held a workshop at ESNA in Pasadena, CA to discuss whether and what energy storage technologies are needed to support our grid future in light of SB 100 and to provide resilience against wildfires. CESA submitted informal comments that recommended that the CEC prioritize commercialization funding support for long-duration storage applications capable of balancing renewable energy on a daily basis and over multiple days, which will be vital to the achievement of SB 100 goals. CESA also highlighted the need for commercialization funding support for other key applications, including synthetic inertia provision, grid resiliency, and contingency support. CESA also provided our feedback on the types of demonstration projects, planning tools, and testing facilities that would be beneficial to California. This feedback will inform the assignment of funding from the 2015-2017 investment plan.

Microgrid Lessons Learned

On April 26, 2019, a workshop was held on ongoing microgrid R&D projects and on the key takeaways from interviews from awardees. Some of the key lessons learned include the following:

Demonstration projects reported utility bill savings of 20-60% but payback was not a primary driver, with resiliency and displacement of backup diesel generators being the primary reasons for customers to deploy microgrids.

Reducing the number of contracts involved in the project (ideally one vendor) improves meeting project milestones and project performance, while turnkey agreements lower the system integration burden and help manage risk.

Choosing an experienced integrator is critical in finding the correct technology mix for the DER portfolio and the controls approach for the microgrid.

Maintain frequency and voltage in microgrid islanding mode makes it difficult to rely exclusively on inverter-based technologies and may require needing a traditional generator (as an “island master”), but this role is increasingly being met by energy storage.

Energy storage systems continue to face local permitting challenges and inconsistencies with less experienced AHJs.

Microgrids typically fail Rule 21 Fast Track Initial Review and face wide-ranging timelines for approval.

DC microgrid architectures have the advantage of higher average utilization of on-site generation (by 7-10%), lower energy losses, minimal grid interconnections, lower investment costs, among other advantages compared to conventional AC microgrids, but require greater adoption of DC loads.

Revenue generation through demand response or CAISO market participation is still unproven.

Component and controller standardization is needed to enable communication protocols and streamlined integration.

These lessons learned provide some helpful insights into other proceedings where microgrid tariffs, interconnection, and procurement are receiving increased attention.

2018-2022 Triennial Investment Plan

Background

On March 14, 2017, the CEC held a workshop on its Proposed EPIC 2018-2022 Triennial Investment Plan. This workshop was one of a series where the CEC and the three IOUs sought stakeholder feedback on the proposed plans and to contribute to ongoing coordination and understanding among administrators, stakeholders, and the CPUC, pursuant to D.12-05-037. The CEC staff highlighted how 12 energy storage projects were supported by EPIC, and that seven have gone on to compete in IOU RFOs.

On April 17, 2017, the CEC published its Proposed EPIC 2018-2022 Triennial Investment Plan, which will fund $350 million in programs. Unlike previous years, the CEC will consider funding initiatives for energy storage as a standalone technology solution rather than just as a component of a larger system (e.g., pairing with PV or being part of a microgrid). The proposed plan includes the following themes and sub-themes that may affect energy storage technologies and systems:

Theme 2: Accelerate widespread customer adoption of DERs

S2.1: Increase the cost-effectiveness of zero-net-energy (ZNE) buildings and communities

S.2.1.2: Assess and test innovative strategies to employ cost-effective combinations of advanced EE technologies, DG, and energy storage to provide grid benefits

S2.2: Push low-carbon microgrids closer to commercial viability

S2.3: Improve the business proposition of integrated distributed energy storage

Theme 3: Increase system flexibility from low-carbon resources

S3.1: Accelerate broad adoption of automated DR capabilities

S3.1.1: Market design for the next-generation DR landscape

S3.2: Enable EV-based grid services

S.3.2.1: Demonstrate advanced VGI functions

S3.3: Increase the value of DERs/renewables to the T&D system

S.3.3.2: Reduce the cost/time needed for interconnection

S.3.3.5: Facilitate adoption of communication protocols for grid-connected devices, including for energy storage

S3.4: Define and demonstrate the locational benefits and optimal configurations of grid-level storage

S.3.4.1: Assess and simulate optimization of grid-level energy storage (including baseline assessment)

There are a number of opportunities for CESA members to apply for and secure CEC funds to demonstrate new innovative deployment strategies and project operations. There may be additional opportunities under Themes 5 and 8 funding initiatives to support pre-commercial energy storage technologies and energy storage projects in disadvantaged communities, respectively. CESA in particular may apply for funds in S.2.3 to fund the development of the distributed energy storage permitting handbook, which is being pushed by the proposed AB 546 legislation, which CESA has sponsored. The CEC noted that it has an active relationship with the New York State Energy Research & Development Authority (NYSERDA), which recently announced RFP 3407 to develop a comprehensive strategy to reduce soft costs associated with distributed energy storage systems in New York by 25% per kWh by 2019 and 33% or more by 2021 compared to a 2015-16 baseline of approximately $220/kWh. The CEC plans to draw lessons with NYSERDA.

On April 27, 2017, the CEC approved the EPIC 2018-2022 Triennial Investment Plan.

On May 2, 2017, the CEC published its 2016 Annual Report, which outlined the progress and status of CEC activities funded by EPIC for the 2016 calendar year. In 2016, the CEC approved 111 projects totaling more than $216 million. The CEC particularly noted the success of funding flywheel batteries from Amber Kinetics and zinc-air batteries from Eos Energy Storage as successful research investments in the 2012-2014 Investment Plan that have gone onto utility procurements.

Emerging Technologies

Background

AB 2514 requires that eligible energy storage systems must be “commercially available” to be procured under the Energy Storage Procurement Framework. Subsequent CPUC decisions have defined the technology-specific eligibility criteria and procurement criteria around cost-effectiveness, but it did not differentiate the definition between emerging and commercially available energy storage technologies. In its Storage Framework Decision, D.13-10-040, the CPUC clarified that eligible energy storage projects could receive funds from public funding programs that support technology commercialization and demonstration, such as the Electric Program Investment Charge (EPIC) Program, so long as the projects provide grid support, renewables integration, or GHG reductions.

While AB 2514 energy storage procurement is making good progress, the focus of procurement has been on lithium-ion battery technologies, although there have been a few new technologies procured, such as Amber’s flywheel in PG&E’s 2014 ES RFO. More focus and support for emerging energy storage technologies may be needed to commercialize these non-battery technologies to address future renewable integration needs and hedge against technology risk.

CESA thus formed a new Emerging Technologies WG that will provide thought leadership to support non-lithium-ion and emerging energy storage technologies as well as to identify technical, commercial, financial, regulatory, and solicitation barriers to commercialization and deployment. Input from CESA members will be needed in this WG to brainstorm solutions, translate these into strategic CESA initiatives, and to present recommendations for action to the CESA Board by the end of 2018.

Working Group Meetings

On May 31, 2018, the first meeting was held where CESA gathered initial stakeholder input on barriers and solutions. Consistent with the survey and the first Working Group meeting, CESA identified the top barrier categories as the bankability of emerging energy storage technologies and the ease of comparability of emerging technologies with battery storage technologies (e.g., modeling deficiencies). As next steps, CESA formed sub-groups that will gather to prioritize top solutions for each topic and develop implementation strategies for each initiative.

Demand Response Emerging Technology Programs

Background

As part of the regular five-year demand response (DR) applications, each of the investor-owned utilities (IOUs) manage a portfolio of emerging technology programs.

Semi-Annual Report

On March 31, 2020, each of the IOUs submitted their semi-annual reports that reported on some key emerging DR programs using technologies such as storage. Some of the key highlights include:

PG&E WatterSaver Pilot: Approved as part of its AB 2868 Application, PG&E reported that it is currently in the process of testing program implementation approaches, including user interfaces, platform functions, OpenADR signal capability, and multiple incentive levels for customer adoption. An interim finding was that the reduction from the HPWH with storage operations is 0.24 kW or a drop of 64.6% relative to the baseline (non-heat pump) unit. Most of the reduction, 0.19 kW (51.5% drop), is due to the efficiency of the heat pump. Once you factor in efficiency, there the amount water heater load available to shift is very small, 0.18 kW per unit (4-9 pm average).

SCE Residential Energy Storage Study: The overall goal of the project is to better understand how smart inverter APIs can demonstrate the monitoring and automated control of BTM residential batteries for grid support, demand response, and price elasticity to dynamic tariffs. SCE is leveraging three residential participants from a previous CEC EPIC grant project. The next step will be commissioning the special APIs for the smart inverter so that price signal schedules that support SCE rates such as TOU-D-PRIME can be uploaded into the battery systems and the smart inverters can communicate back the storage state of charge.

SCE Low-Income Multi-Family Solar & Storage Pilot: SCE aimed to understand this specific use case and configuration. Currently, the project is working through technical issues around installation and deployment, so no results are yet reported.

SCE Willbrook Low-Income Multi-Family DER Pilot: SCE is seeking to understand the use of DR strategies with storage is a new concept that will be investigated in this project, as part of the overall DER design in this zero-net-energy (ZNE) building. Construction is still pending.

SCE/SDG&E Refrigeration Battery PLS Pilot: SCE and SDG&E aimed to demonstrate the refrigeration battery’s ability to maintain the desired temperature set-points of a supermarket’s medium temperature refrigeration systems without running the central compressors or condensers for up to 8 hours at a time. A final report on the project economics will be prepared by Q2 2020.

SDG&E BTM Battery Market Study: Through its consultant (ETCC), SDG&E reported that this study was completed in February 2020 that concluded that, while the total potential value of battery storage technology is projected to be large, the total observable net economic benefits remain relatively small due to insufficient market signals.

Some of the above projects are more of a market potential study as opposed to a DR pilot; however, some of these programs highlight the challenges of multi-DER deployments and more capital-intensive technologies (e.g., HPWH, battery storage).

EPIC Renewal (A.19-10-005)

Background

On October 18, 2019, an Order Instituting Rulemaking (OIR) was issued on the CPUC’s own motion to consider the renewal, funding levels, and program improvements of the EPIC Program beyond 2020. The OIR catalogued the guiding principles of the program around societal benefits, GHG emissions mitigation, loading order, low-emission vehicles and transportation, economic development, and efficient use of ratepayer monies. The EPIC Program also has the following investment areas for applied R&D, technology demonstration and deployment, and market facilitation, with the CEC (80% of budget) and IOUs (20%) serving as the administrators. The Policy + Innovation Coordination Group (PICG), in particular, will be operational in early 2020 to support greater policy coordination between CPUC and EPIC investments.

The IOUs and CEC requested expeditious resolution (no later than October 31, 2020) in order to support execution of initiatives and projects and prevent a funding gap if the authorization is extended. CEC and Bay Area Science & Innovation Consortium (BASIC) supported ongoing funding at the current level at minimum and cautioned against narrowing of research through excessive prioritization. Public Interest Research Advocates (PIRA) recommended that EPIC prioritize research on the impacts of policies on disadvantaged communities (DACs) and low-income customers, on transportation electrification, and on retail electricity prices and consumer responses, but not for changes in wholesale electricity markets. CEC and IOUs disagreed on whether market facilitation best supports the DAC policy goals, though they agreed on the need to consider the number and duration of investment cycles to provide balance between balance and continuity.

On March 6, 2020, a Scoping Memo was issued that set forth a two-phase process for the proceeding. In Phase 1, this proceeding will consider the quantifiable results, benefits, and impacts to determine whether the EPIC Program will be renewed. If so, there are questions related to the funding levels, program duration, investment cycle duration, relative shares for administrators, and administrator expenses. Phase 1 is expected to conclude in July 2020. In Phase 2, the proceeding will consider the process for determining or modifying guiding principles and priorities, administrative and program structure improvements, and future of program evaluations. Phase 2 is expected to conclude by January 2021.

Application Review

On April 17, 2020, opening briefs were submitted with the CEC and each of the IOUs in strong support of continuance of the EPIC Program given the quantifiable results, impacts, and benefits. The CEC recommended that the current funding level should be continued and authorized through at least 2031 and investment cycles should be modified to five years to enable an expanded planning horizon. PAO agreed with authorizing long-term funding at the current level but criticized the IOUs, unlike the CEC, for not meeting its administrative obligation to quantify ratepayer benefits.

On May 4, 2020, the IOUs and CEC affirmed its appropriate role as EPIC administrators and recommended continued funding at the current level, authorized for 10 years and operating in five-year cycles, with mid-cycle mechanisms to increase EPIC budgets. However, PAO opposed the curtailment of CPUC oversight and favored shorter investment cycles.

On September 2, 2020, D.20-08-042 was issued that renewed the EPIC Program for ten years, through December 31, 2030, and authorized two five-year investment plan cycles (referred to, respectively, as EPIC 4 and EPIC 5). In reaching these determinations, the CPUC examined the program results and concluded that EPIC has yielded quantifiable benefits as well as other benefits, such as how 65% of projects were located low-income and disadvantaged communities. Notably, the record found that EPIC investments have supportive innovative projects (e.g., microgrids) and attracted over $2 billion in private and other investment sources to supplement these projects. The adjustment from the three-year cycle (current) to a five-year cycle (proposed) was made to support longer planning horizons that allow for flexibility to respond to technology changes.

The decision also authorized the CEC to continue as administrator, with an annual budget of $147.26 million for the first five-year investment plan cycle (2021-2025, or EPIC 4) and grant it the ability to adjust for inflation during the second five-year investment plan cycle (2026-2030, or EPIC 5). In other words, fund collections were extended at its current levels. While this decision authorized fund collection for EPIC 4 beginning on January 1, 2021, it did not approve any investment plans for this period. However, among other possible administrative and program improvements, the decision declined to consider the role of the three IOUs in administering the EPIC Program. In support of this conclusion, the decision cited a third-party consulting evaluation that found that the IOUs, unlike the CEC, are not effectively tracking and reporting on benefits metrics.

Most parties supported the Proposed Decision (PD). However, CEC recommended that the PD be modified to include an inflation adjustment to funding levels. Each of the IOUs opposed their removal as EPIC administrators given their unique understanding of customer needs and the potential to utilize the IOUs’ facilities, equipment, and grid-integration expertise. SCE went further and offered accommodations to maintain their EPIC administrator status, such as temporary reduced funding and opportunities to cure non-compliance. By contrast, with only the CEC as the administrator, there would be little insight, for example, into demonstration projects at the distribution level for wildfire mitigation and resiliency. PAO, meanwhile, continued to push for a three-year cycle since longer cycles are less compatible for frequent updates and is not supported by the record. In response to comments, the PD was revised to explain how Phase 2 will consider the role of IOU administration of the EPIC Program, though the CPUC continues to value their participation.

At a high level, the renewal of the EPIC Program was obvious, and welcome given the many benefits that it provides in supporting emerging technologies and demonstrations, including for the new class of storage technologies. However, the decision essentially reduced the total available EPIC funding by only authorizing the CEC’s share of collections at current levels, deferring the determination on the IOUs’ share of funds and role as an administrator. However, the potential removal of the IOU as an EPIC administrator can also have a downside where the IOUs may be less engaged as a potential collaborator on projects, which may play a critical role for projects that involve their distribution system, such as for interconnection, microgrids, and/or DER dispatch and operations.

Joint IOU EPIC Research Administration Plan (A.19-04-026)

Background

On April 23, 2019, the IOUs submitted a joint application seeking approval of their Research Administration Plan (RAP) for the Electric Program Investment Charge (EPIC). The first section of the application details the steps it is taking or proposes to take to modify program administration, while the second section details utility-specific modifications to 2018-2022 investment plans. Notably, SCE is proposing to replace an existing initiative with a new “Beyond Lithium-Ion Energy Storage Demonstration” initiative to support new energy storage technologies.

CESA was strongly supportive of the proposed new initiative that will promote a diverse range of storage technology solutions, which CESA agreed was smart to future-proof our toolkit as grid conditions change. In particular, CESA recommends a focus on long-duration storage technologies, which has already been demonstrated as a growing need in the future (e.g., see IRP modeling results, urgent fire-resiliency needs). Furthermore, while not entirely in the scope of this application specifically, CESA recommended that the CPUC open a new energy storage proceeding to focus on commercial procurement frameworks to fully bring new and emerging storage technologies to the market. Without such a framework, such as what we proposed in response to the Storage Diversity Ruling, new and emerging storage technologies will face barriers and be trapped in demonstration/pilot stages of deployment.

See CESA’s response on June 3, 2019 on the Application

On July 1, 2019, a Ruling was issued directing parties to file prehearing conference (PHC) statements. A number of questions are raised on whether the Joint Application follow the guidance and directives of D.18-10-052 to modify program administration and on the information needed for the CPUC to assess the reasonableness of the Application. CESA recommended that the scope focus and prioritize the reasonableness assessment of the EPIC replacement projects, which include alignment to EPIC values and goals, incrementality of the project need, and adherence to program administration guidelines. CESA also recommended that the scope not include an assessment of whether the EPIC Program should be renewed, which is a larger policy issue that should be addressed elsewhere, without bogging down this narrow application.

On July 12, 2019, a prehearing conference was held to discuss the scope and schedule of the proceeding, which will include some discussion around the future of EPIC programs. While not the sole factor in determining EPIC renewal, the ALJ indicated that it will be a contributing data point.

See CESA’s PHC statement on July 9, 2019 on the Ruling

On August 9, 2019, a Scoping Memo was issued that proposed a PD be issued in Q4 2019 and sets the following scoping issues for this Application:

Does the Joint Application comply with all applicable requirements found in the Commission’s procedural rules?

Does the Joint Application comply with all applicable requirements found in D.18-10-052 and other applicable CPUC decisions?

Do the replacement projects proposed by SCE meet the applicable requirements found in D.18-10-052 and other CPUC decisions?

Should each Applicant now be authorized to encumber or otherwise commit to spend its one-third 2018-2020 EPIC funding allocation presently beyond such authorization pursuant to D.18-10-052 Ordering Paragraph 6?

Application Review

On August 9, 2019, a Ruling was issued requesting responses from the IOUs on specific questions around their application, including details around stakeholder outreach and related non-EPIC programs. For the proposed replacement project, SCE is directed to provide information on past and planned future stakeholder engagement efforts as well as to justify how this project is non-duplicative with other EPIC programs.

CESA offered our responses to a list of scoping issues focused narrowly on how SCE’s proposed replacement project meets the applicable requirements, which largely revolve around whether the project meets the guiding principles and tenants of the EPIC Program. PAO, representing ratepayer interests, submitted comments that SCE should provide more information on their “Beyond Lithium-Ion” replacement project to verify that technologies supported fit within the definition of technology demonstration and deployment activities. Specifically, PAO expressed concern that SCE seeks to expand the definition beyond pre-commercial technologies to “less mature” technologies – e.g., lithium-sulfur, zinc-air, and sodium-ion.

See CESA’s comments on August 30, 2019 on the Scoping Memo

On February 6, 2020, D.20-02-003 was issued approving the IOUs’ Research Administration Plan (RAP) for the Electric Program Investment Charge (EPIC), with minor revisions to the PD. The decision found that the application complied with the requirements set forth in D.18-10-052 to conduct a robust process for extensive stakeholder outreach and engagement for their EPIC Programs but also recommended that the IOUs continue making improvements beyond the minimum compliance threshold in several areas (i.e., not just the letter but also the spirit of the requirements). For example, while the threshold for non-competitive bidding and direct award contracts (e.g., under $100,000-$250,000, depending on IOU) and the stakeholder engagement and benefits tracking proposals were disappointing but sufficient and technically compliant for now, they may be refined in other proceedings. Among other items, the decision directed the IOUs to improve their matrices to identify technologies and projects to policy areas and CPUC proceedings to avoid duplication and maximize investment coverage. Additionally, the decision authorized one third of the IOUs’ 2018-2020 EPIC budgets that had been withheld and defers the IOUs’ compliance with many of Evergreen’s recommendations to a future proceeding.

Importantly, the decision approved SCE’s request to replace two existing EPIC projects (Reliability Dashboard Tools Project and Beyond The Meter Phase 2 Project) with a Wildfire Prevention & Resiliency Technology Demonstration Project and a Beyond Lithium-Ion Energy Storage Demonstration Project. While the wildfire-related replacement project was undisputed and thus easily approved in the decision given the critical importance to California, Public Advocates Office (PAO) was opposed to the storage-related replacement project and subject to closer review in the decision. PAO opposed the PD, focusing on how SCE’s proposed Beyond Lithium-Ion Energy Storage Demonstration is inconsistent with EPIC requirements. Specifically, PAO suggested that SCE’s project replacement proposal requires additional evidence to ensure that the project uses pre-commercial technologies (i.e., replacement technology was not specified) and the PD fails to address whether the proposed replacement project is duplicative of other SCE efforts. SCE disputed PAO’s claims and argued that this pilot would focus on commercially available technologies, not pre-commercially available technologies that EPIC covers. SCE also mentioned how it has undergone initial screening and evaluation of two sample storage chemistries (i.e., zinc air and sodium ion).

However, despite PAO’s opposition, the decision agreed with SCE and CESA and found the discussion of where the unknown technology is on the development trajectory to be premature and stated that specific identification of replacement technologies is neither required nor beneficial at this stage. The CPUC argued that no prior EPIC decisions explicitly require identification of the specific technology to be deployed or explicitly define “pre-commercial” technologies.

PG&E EPIC III Projects

On June 19, 2020, a workshop was held to share candidate projects that PG&E has included in its EPIC III Investment Plan, developed in 2017. Any emergent projects that are selected will be submitted to the CPUC for approval in a Tier 3 advice letter pursuant to D.15-09-005. Most investments areas support PG&E’s grid modernization and wildfire mitigation strategies, but some relevant focus areas include:

Multi-customer microgrids utilizing IFOM and BTM DERs: Develop utility microgrid operations, control, and tariff capabilities to island grid infrastructure, for the purpose of mitigating PSPS by utilizing both IFOM and customer-owned DERs for multiple day islanded operation

Transactive energy platform for facilitation of two-way transactions from DERs: Evaluate and assess a software platform that can conduct energy transactions online for customers with DERs to leverage excess energy