Resource Adequacy Working Group Wiki

Table of Contents

Resource Adequacy (Continued)

Aliso Canyon Reliability

Background

On October 23, 2015, a significant natural gas leak was detected at Southern California Gas Company’s (SCG’s) Aliso Canyon natural gas storage facility. After several unsuccessful attempts to plug the leak near the wellhead, the California Department of Conservation issued an order to SCG prohibiting the further injection of gas into the facility in December 2015, and Governor Brown issued an Emergency Proclamation in January 2016.

On February 12, 2016, SCG successfully stopped the leak, and the well has been permanently sealed and Aliso Canyon, which normally operates at its full capacity of 80 billion cubic feet (Bcf), is now capped at 15 Bcf of natural gas storage for the foreseeable future. Aliso Canyon is the sole gas supply resource for 18 fast-ramping natural gas generation facilities (9,800 MW in total) in the LA basin during summer peak periods. Removal of Aliso Canyon from service has created a great concern about reliability during summer 2016, when peak demand for natural gas reaches 3,211 Bcf (a massive 61% comes from electric generation facilities). With the legislature in recess, CESA is assessing its 2016 legislative prospects and considering adjustments to its strategies.

On May 10, 2016, SB 380 was approved, which prohibited the reinjection of gas into the facility until a comprehensive safety review was completed.

2016-2019 Reliability Assessments & Plans

The Joint Agencies (CEC, CPUC, CAISO, ARB, LADWP) commenced and published studies on the impact of the Aliso Canyon gas leak on gas and electricity grid reliability. The message is clear that Southern California is likely to experience future curtailments of non-core customers, and in extreme situations, core customers could be at risk as well.

On April 5, 2016, the Joint Agencies released a draft Action Plan to preserve reliability of electrical service this summer in the greater LA area, which includes the following near-term actions:

Use of 15 Bcf of natural gas that was preserved in the Aliso Canyon facility for use during periods of peak demand

Strong energy conservation programs, such as the “Flex Alert” campaign, to help local residents reduce their energy use during peak demand

Greater coordination among state and local gas and electric utilities

More energy efficiency programs

Closer matching of gas supply and demand by large gas customers

In collaboration with LSA and SEIA, CESA brainstormed a short-list of energy storage options.

On April 8, 2016, a joint agency workshop was held on April 8 to discuss the near-term gas and electricity reliability risks to the LA Basin due to SCG’s Aliso Canyon gas storage facility leak, as well as the Joint Agencies’ draft Action Plan. At this workshop, CESA presented its ideas on near-term energy storage solutions to Aliso Canyon reliability issues as well as the feasibility of summer and winter installations. CESA submitted comments on April 22 advocating for the many advantages of energy storage in addressing LA Basin grid reliability issues and sharing that 22 MW and 225 MW could be operational by August 1 and December 1, respectively. To achieve this, CESA said that several ‘support actions’ are needed to accelerate new capacity and quickly re-purpose existing capacity.

See CESA's comments on April 22, 2016 on the Joint Agency Workshop

On August 22, 2016, a draft Winter Action Plan was released that included staff recommendations for additional near-term mitigation measures. Notably, the report concluded that the continued inoperability of the Aliso Canyon gas storage facility should not compromise Southern California's gas and electric reliability in the coming winter, barring extreme cold winter weather. The agencies assessed 12 scenarios – i.e., three types of weather conditions for each of four Aliso Canyon availability cases – and found that SCE, LADWP, and SDG&E should be able to replace lost gas-fired power generation if SCGs’ supply becomes constrained during winter 2016-2017, making blackouts unlikely. The report also highlighted 10 additional measures to “reduce, but not eliminate,” which did not include energy storage as a measure.

On August 26, 2016, a Joint Agency Workshop was held in Diamond Bar, CA to present a draft Winter Action Plan to preserve LA Basin reliability for winter 2016.

On January 17, 2017, the CPUC published its report on the Aliso Canyon gas storage facility's working gas inventory, production/injection capacity, and well availability for reliability. The analysis found that the current number of wells available, even assuming optimistic production rates, was not sufficient to assure reliability in the short term. As additional wells are tested and brought into service and with improved withdrawal rates, capacity requirements should, under current estimates, be able to be met. However, the timing is such that there will not be enough completed wells for the 2016-2017 winter season or the 2017 summer season.

On January 31, 2017, the CPUC issued its Aliso Canyon Demand-Side Management Impact Summary. With electric demand in the LA Basin reaching 18,800 MW on a peak summer day, the CPUC estimated the impact of load reduction measures to be 676 MW: marketing and research (540 MW), accelerated deployment of energy storage (98.5 MW), and demand response (37.8 MW). Other mitigation policies include tightening of gas-balancing rules, reprioritizing existing energy efficiency, intensifying deployment of energy savings assistance program measures, and changing the CSI thermal program, which combined to reduce 49 million therms of natural gas.

On December 11, 2017, the CPUC’s Energy Division published its final report on the Aliso Canyon working gas inventory, production capacity, injection capacity, and well availability for reliability. The report noted that there have been unprecedented levels of outages on the SoCalGas system, which posed winter system reliability risks. The report noted that it is likely that SoCalGas will withdraw gas from Aliso Canyon this winter in order to meet gas demand that cannot be met by gas from pipelines or other storage fields and thus authorized a greater range of gas inventory in Aliso Canyon to meet gas demand on a peak winter demand day (a 1-in-10 year cold day) as well as under “normal” conditions. In the meantime, SoCalGas continued to push for removal of some limitations on the Aliso Canyon facility to manage potential reliability issues in the coming winter based on its analysis. The Environmental Defense Fund (EDF) submitted a protest on November 20, 2017 that highlighted several deficiencies in SoCalGas’ analysis to begin further injections into the Aliso Canyon facility and offered suggestions designed to further strengthen the efficiency and reliability of the system. Specifically, EDF pointed to SoCalGas’ mistaken assumptions about the capacity of different storage fields and needed curtailment, and highlighted flaws in their claims that full receipts of supply are unrealistic and the need for winter period injections into storage to maintain inventory and deliverability.

On January 18, 2018, the California Council for Science and Technology (CCST) released its independent study on the long-term viability of underground natural gas storage in California and found that the risks associated with underground gas storage can be managed and, with appropriate regulation and safety management, may become comparable to risks found acceptable in other parts of the California energy system. CCST added that California’s energy system currently needs natural gas and underground gas storage to run reliably and that replacing underground gas storage in the next few decades would require very large investments to store or supply natural gas another way, which would come with its own infrastructural risks. CCST could not investigate the feasibility and impacts on reliability of closing one or more underground gas storage sites in the state while leaving the others open. Importantly, the study found that natural gas would be needed to meet generation needs in the winter, when there is reduced solar insolation and slower wind speeds, in a 2030 world with significant renewables to reach the state’s climate policies and goals. A major takeaway from this study would be that there is a major role for seasonal storage as a potential alternative to these underground natural gas facilities. This study was mandated by the California Legislature in 2016 and was conducted in an 11-month period in 2017.

On May 8, 2018, a joint agency workshop was held that included staff presentations Southern California reliability issue updates and tracking progress on conventional generation, preferred resources, transmission upgrades, and contingency mitigation measures related to the Aliso Canyon gas storage facility limitations. The CEC plans to address these issues as part of the 2018 IEPR update. The CEC and SoCalGas also presented on the reliability issues associated with natural gas pipeline outages and the assessment and actions being taken to address energy reliability.

On August 28, 2018, a CCST workshop was held to discuss their comparative analysis on the risks of individual gas storage fields, as well as the impacts of these fields on public health and grid reliability.

On December 6, 2018, the CPUC staff also published a report on natural gas and electric system operations in Southern California from November 2017 through March 2018. During this winter period, the CPUC found high gas reliability risks attributed to transmission pipeline outages and post-leak restrictions on Aliso Canyon usage. These high risks were mitigated in part by unusually warm weather conditions in Southern California, which kept demand for natural gas low. However, the CPUC concluded that SoCalGas’ use of storage and system operations during this time were warranted and followed the established Withdrawal Protocol.

On January 11, 2019, a joint agency workshop was held as part of the CEC’s IEPR proceeding to discuss the topic of recently high natural gas prices in Southern California and potential solutions to reduce the spread between SoCal Border and SoCal Citygate prices. The potential solutions could impact this proceeding.

On April 2, 2019, SoCalGas submitted a Summer 2019 technical assessment reporting that the increased pipeline capacity has positioned the SoCalGas system to be in better reliability position in the “best case” for the upcoming summer months as compared to last summer but could still face insufficient storage inventory heading into the next winter.

On May 10, 2019, the CPUC published a report on SoCalGas’ conditions and operations in Winter 2018-2019, which were found to be largely similar as the previous winter due to ongoing pipeline maintenance, reduced capacity at Aliso Canyon, and the Aliso Canyon Withdrawal Protocol still in effect. Price volatility was also a concern heading into the winter. An early warm winter mitigated the need to rely on Aliso Canyon, but a prolonged stretch of cold weather and inaccurate weather forecasts in the late winter led to gas price spikes in the SoCal Border and SoCal Citygate markets. Non-Aliso inventory levels decreased by 61% from the start of the winter to handle this volatility. Importantly, the report found that SoCalGas followed the protocols and highlighted how gas storage plays an important role on system ramping hours and on electricity prices.

On May 23, 2019, a joint CPUC-CEC workshop was held on energy reliability in Southern California related to the Aliso Canyon issue. A key discussion issue was the pipeline outages and repairs faced by SoCalGas, which has limited the flexibility and operations of the gas system. SoCalGas defended against criticism from the joint agencies and LADWP that the pipeline repairs and replacements are taking longer than similar types of work elsewhere, noting that not all pipeline projects are similar.

On August 2, 2019, a webinar was held to describe the methodology and results of a Root Cause Analysis into the SoCalGas’ Aliso Canyon leak. Blade Energy Partners, an independent engineering firm, was selected to perform this analysis by the CPUC and the Division of Oil, Gas, and Geothermal Resources (DOGGR).

On June 20, 2019, a workshop was held to discuss preliminary results of the economic, hydraulic, and production cost modeling. SoCalGas commented on the preliminary analysis, focusing on how historical analysis is needed on the CPUC staff difference-in-difference economic analysis since PG&E customers cannot be the control group and on concerns about assumptions of unachievable and unrealistic flowing supplies in the hydraulic analysis – i.e., the interaction between receipt points and networked nature of transmission system must be considered.

On September 20, 2019, the CPUC Executive Director issued a letter on that reported on the concerning low inventory levels at the non-Aliso gas storage facilities, which is due to specific areas of pipeline maintenance reducing pipeline flow capacity and the insufficient build up in inventory at these facilities. As a result, the CPUC directed SoCalGas to increase injection capacity at all its storage fields to ensure winter reliability.

On December 6, 2019, Resolution G-3560 was issued that directed SoCalGas to make temporary modifications to allow more underground gas storage injection capacity to be made available to storage customers due to low inventory levels and concerns of reliability risks in Winter 2019-2020.

On April 1, 2020, SoCalGas prepared a technical assessment to provide a forecasted outlook of system reliability during the coming 2020 summer months based on analysis of pipeline capacity available to bring gas into the system, forecasted summer demand, available system capacity to serve demand, forecasted storage inventory for the following winter season, and various existing and potential outages and the operating restrictions on gas transmission and storage assets. With or without the use of Aliso Canyon, SoCalGas reported that it has sufficient capacity to serve the forecast summer peak demand of 3.32 BCFD under the “best case” supply scenario, but insufficient capacity to serve the forecasted summer peak demand of 2.97 BCFD under the “worst case” supply scenario. SoCalGas also found that the current maximum allowable system storage inventory of 84.4 BCFD can be reached by November 1, 2020 (as specified by the Aliso Canyon Withdrawal Protocol) under a “best case” supply scenario assumption. However, under a “worst case” supply scenario assumption, available supplies are insufficient to meet forecasted demand through the summer season, resulting in non-core curtailment over the season even with all storage fields completely depleted by the end of the season.

On April 15, 2020, the CPUC published a 2020 summer reliability assessment report for Southern California, reporting that the gas system approaches summer in better condition than at the same time last year, with more gas in storage and an additional gas transmission line in service. As of March 31, 2020, SoCalGas’ non-Aliso storage fields were approximately 67% full, up from 45% last year. SoCalGas was also able to draw down the four fields in a more balanced way in 2020 compared to 2019 due to an additional gas transmission line becoming back in service (Line 235-2), which had been out of service since October 2017. Contrary to SoCalGas’ report, the CPUC’s findings showed that non-Aliso withdrawals would be sufficient to meet demand under both best-case and worst-case scenarios at the daily level, though hydraulic modeling of hourly demand was not performed.

TPP Special Study

The CAISO affirmed that significant risk remains, with this summer still not being over and it being unknown when the safety review will be completed. A special study in the 2016-2017 TPP looked at gas-electric coordination issues for summer 2017. The study examined four scenarios that looked at different supply shortfalls between scheduled and actual gas flows. The most critical reliability concern is post-transient voltage instability, which can be mitigated by timely additions of planned dynamic reactive supports. These planned transmission projects, however, are under construction and cannot be in service until December 2017 at the earliest. The CAISO also identified thermal loading concerns in the LA Basin.

The CAISO plans to perform a longer-planning horizon reliability assessment through summer 2026, which will include the CPUC-approved energy storage projects as well as other resource and transmission project assumptions. These results will be presented in November 2016.

SDG&E 2016 Aliso Canyon Energy Storage Procurement

Developed in response to Resolution E-4791, SDG&E contacted qualified respondents in its ongoing 2016 Preferred Resource Local Capacity Resource RFO, which solicited both turnkey and third-party-owned systems, to determine if expedited energy storage projects could come online by the end of 2016.

On July 18, 2016, SDG&E announced awards to two AES Energy Storage projects for a total of 37.5 MW of RA capacity to be sited within existing substation property. Two identical Engineering, Procurement, and Construction (EPC) contracts have been awarded for a 30-MW, 4-hour project and a 7.5 MW, 4-hour project, both of which will be owned by SDG&E and operated and maintained by AES (with performance guarantees). The projects will be online by January 31, 2017.

On August 19, 2016, Resolution E-4798 was issued that approved Advice Letter 2924-E for 37.5 MW of energy storage projects. The projects are contracted to meet the targeted online date.

Relatedly, SDG&E submitted an Advice Letter to approve its proposed tracking mechanism for local San Diego sub-area 2017 RA capacity costs due to concerns regarding the availability of the Aliso Canyon gas storage facility. Local RA obligations have thus shifted from the LA Basin to the San Diego sub-area. D.16-06-045 identified 865 MW of incremental need for the local San Diego sub-area due to Aliso Canyon.

SoCalGas Injection Plan & Withdrawal Protocols

On June 30, 2017, the CPUC issued Resolution G-3529 that approved SoCalGas’ proposed gas storage Injection Enhancement Plan but denied temporary modifications to the System Operator Injection Capacity Limits in an effort to maintain summer reliability through September 30. Specifically, the Resolution would allow SoCalGas to increase and maximize storage injection at facilities other than Aliso Canyon. This is in response to SoCalGas’ letter to the CPUC on April 28 that expressed concern that the system’s physical ability to provide reliable service on peak demand days and response to abnormal operating conditions is at risk.

On July 19, 2017, the CPUC approved the re-opening of the Aliso Canyon gas storage facility and allowed for a withdrawal rate of up to 2.43 BCF per day in the winter and 2.46 BCF per day in the summer to be used in times where there is an electrical reliability threat. The upper bound of gas storage inventory for Aliso Canyon is now up to 23.6 BCF, meaning that 8.8 BCF of natural gas will likely be injected into the facility. While contentious, this stabilizes the gas system considerably in the LA area for the time-being.

On July 21, 2017, CEC Chair Robert Weisenmiller released a letter urging the CPUC to plan for the future closure of the Aliso Canyon gas storage facility. On the same day, the City of Los Angeles announced that they will file suit to stop the reopening of Aliso Canyon. Governor Brown has also stated on the record that Aliso Canyon should be retired from service.

On October 17, 2017, the CPUC and CEC Commissioners submitted a letter to SoCalGas instructing SoCalGas to identify mitigation measures for reliable service during the winter.

On October 30, 2017, SoCalGas issued a response letter that pushed back against the CPUC and CEC Commissioners for not including “enhanced reliance” on Aliso Canyon as part of the mitigation measures, citing how the facility has been subjected to months of rigorous inspection and has been safely operational for many months. SoCalGas also expressed their concern with the continued limitations on the facility (i.e., withdrawal protocols, curtailment rules) and use of the facility as a last resort despite potential energy risks in the winter.

On March 30, 2018, CPUC issued a letter to SoCalGas directing it to immediately begin maximizing gas storage injections because the overall storage inventory levels are critically low for the upcoming spring.

On May 11, 2018, the CPUC issued Resolution G-3540 that approved SoCalGas’ request for its Second Injection Plan to maintain summer 2018 reliability by continuing to implement temporary modifications to increase storage injections and increase storage injection capacity available to the market. However, Resolution G-3540 denied SoCalGas’ request to increase the allowable inventory and modify the withdrawal protocol to allow for more flexible use of Aliso Canyon to manage storage inventories. Since the approval of the First Injection Plan, SoCalGas’ systems have suffered several pipeline outages, placing additional stress on the system to necessitate urgent storage injection, especially as its other fields were critically low in inventory during a several week period in February and March where there were below-average temperatures in the SoCalGas territory. As I.17-02-002 proceeds, the CPUC is proposing to allow for temporary injections to help SoCalGas to get through the summer months but denied any “longer-term” modifications to allow for increased reliance on the gas storage facility.

On June 29, 2018, the CPUC issued its update to the 715 Report and a corresponding letter that recommended that the maximum allowable Aliso inventory be increased from the current 24.6 Bcf to the proposed 34 Bcf due to continuing pipeline outages on the SoCalGas system, consideration of the impact that declines in inventory at non-Aliso fields have had on withdrawal capacity, examination of whether 1-in-10 peak day demand can be met at forecasted inventory levels, and limited injection capacity at non-Aliso fields. Unlike previous reports, this update also looked at both summer 2018 and winter 2018-2019, not just the coming season, and reflected declines in gas storage inventory and withdrawal capacity at non-Aliso fields in conducting its assessment on what is required to manage Southern California gas reliability over the short term. Finally, the report noted that, as of May 31, 2018, 46 wells completed all testing and remediation requirements and were operational at Aliso Canyon. Note that SB 380 added Section 715 to the Public Utilities Code that requires the CPUC to determine the range of Aliso Canyon inventory necessary to ensure safety, reliability, and just and reasonable rates.

Parties who commented on the draft report focused their concerns on the three SoCalGas transmission pipelines that continue to be out of service, resulting in reductions in gas receipts into the LA Basin. Porter Ranch Neighborhood Council (PRNC) and the County of Los Angeles suspected that SoCalGas is “slow-walking” repairs that have necessitated increased inventory at Aliso Canyon, leading them to recommend that the CPUC investigate the pipeline outages and repairs and to direct action by SoCalGas to fix this situation more quickly. PRNC also recommended that the determination on whether to increase inventory levels of Aliso Canyon could wait until the low-demand months in the fall to meet winter 2018-2019 reliability needs, creating an opportunity for the CPUC to direct action against SoCalGas on pipeline fixes, while the County of Los Angeles went further and recommended penalties or removal of the pipelines from the ratebase.

In sum, the CPUC found an urgent need to rely on Aliso Canyon in the short-term due to “extensive” pipeline outages that limit imports of gas that would be stored in non-Aliso fields, making Aliso Canyon a more critical resource. This situation raises some flags, but ultimately the key assessment will be conducted in I.17-02-002 where the long-term need and feasibility of Aliso Canyon will be determined, whereas the PUC Section 715 Report is intended to assess short-term reliability needs.

On August 10, 2018, SCE filed an expedited motion to seek expedited action by the CPUC to ameliorate the sharp spikes in SoCalGas gas prices driven by the application of SoCalGas’ Tariff Rule 30 Operational Flow Order (OFO) non-compliance charges. This effect was observed to be particularly acute during periods of high temperatures that have coincided with a period of restricted operations at the Aliso Canyon natural gas storage facility and current capacity reductions of SoCalGas’ transmission pipelines. Specific action requested by SCE is that CPUC cap the OFO non-compliance charges to address the price spikes to electric and gas retail customers, which will not enhance or adversely impact reliability. SoCalGas, however, opposed this Motion because they said it was outside the scope of I.17-02-002.

On July 23, 2019, the CPUC staff issued a proposal to revise the Aliso Canyon Withdrawal Protocol to help address energy reliability challenges and price impacts in Southern California. The CPUC has witnessed increased scarcity of gas supply caused by pipeline outages and the operational restrictions of Aliso Canyon. Thus, the revisions are intended to help preserve inventory levels at the non-Aliso storage fields, increase their corresponding withdrawal capacity, and enable those fields to supply gas when needed at critical hours of peak customer demand. Specifically, the CPUC staff proposal specified that withdrawals from Aliso Canyon would be allowed if any of the following conditions are met:

Preliminary low Operational Flow Order (OFO) calculations for any cycle result in a Stage 2 low OFO or higher for the applicable gas day.

Aliso Canyon is above 70% of its maximum allowable inventory between February 1 and March 31; in such case, SoCalGas may withdraw from Aliso Canyon until inventory declines to 70% of its maximum allowable inventory.

The Honor Rancho and/or Goleta fields decline to 105% of their month-end minimum inventory requirements during the winter season.

There is an imminent and identifiable risk of gas curtailments created by an emergency condition that would impact public health and safety or result in curtailments of electric load that could be mitigated by withdrawals from Aliso Canyon.

New Gas Connections

On December 15, 2017, Draft Resolution G-3536 was issued that proposed to require SoCalGas to implement an emergency moratorium on new commercial and industrial natural gas service connections in both incorporated and unincorporated areas of Los Angeles County area from January 11, 2018, until further Commission action, or March 31, 2018, whichever is earlier. This response was made in response to the Aliso Canyon Winter Risk Assessment Technical Report for 2017-2018, which identified an emergency moratorium on new connections as a potential measure to avoid increased demand for natural gas and to avoid gas service disruptions to existing customers in the event of a colder than normal series of days in the winter.

On February 22, 2018, Draft Resolution G-3536 was withdrawn because multiple business associations and gas-related parties opposed the moratorium due to the impact on new businesses, projects, and economic development, which may rely on getting new gas service extensions. Others protested on the grounds that the resolution provided extremely short notice to adjust. A few parties, such as Sierra Club, supported the proposal as advancing the state to greater end-use electrification.

SoCalGas DR Program Application (A.18-11-005)

On November 6, 2018, SoCalGas filed an application to implement three DR programs for natural gas ($50.6 million budget) use during times of anticipated system stress:

Four DR Pilots will focus on load control programs for space and water heating for residential customers and non-residential customers, a commercial and industrial load reduction program, and a behavioral messaging program.

Gas DR Emerging Technologies Program will test new technologies for gas equipment to support potential future gas DR efforts.

Winter Notification Marketing Campaign will incorporate an over-arching communication campaign throughout the winter season and a notification component to support reducing gas usage in response to DR events that are called or during periods of anticipated system stress.

These program proposals will support a continuation of previous DR efforts that supported SoCalGas during the 2016-2017 and 2017-2018 winter seasons.

Investigation to Minimize/Eliminate Aliso Canyon (I.17-02-002)

Background

On May 10, 2016, Governor Brown signed into law SB 380, which directed the CPUC to open a proceeding by July 1, 2017 to determine the feasibility of minimizing or eliminating the use of the Aliso Canyon natural gas storage facility. The CPUC has jurisdiction over the above-ground infrastructure beginning where Aliso Canyon connects to the pipeline (or at the wellhead) as well as over the recovery of costs related to the facility.

On February 17, 2017, the CPUC approved a Decision to open an Order Instituting Investigation (OII) to determine the feasibility of minimizing or eliminating the use of the Aliso Canyon gas storage facility, pursuant to SB 380. SoCalGas, the operator of Aliso Canyon, is named as the respondent to this OII. The OII calls for a two-phased approach. In Phase 1, the CPUC will investigate whether it is feasible to reduce or eliminate the use of Aliso Canyon while maintaining electric and gas reliability for the region. The Phase 1 analysis will include an assessment of energy cost impacts, electric/gas reliability impacts, viability of alternatives, and safety implications. Phase 2 will take into consideration the results of the Phase 1 analysis to identify the conditions, parameters, and timeframe of reducing or eliminating the use of Aliso Canyon, if determined prudent to do so. Workshops to determine the scope of Phase 1 will be held in the summer of 2017, with the Phase 1 study completed in the winter of 2017. Phase 2 will occur across the first half of 2018, and a final decision is expected in mid-2018. Overall, the CPUC has slated a 24-month timeframe from opening of the proceeding to complete all the work.

Energy storage procurements could result from this OII, and CESA will track the new proceeding closely as necessary. CESA supported the Investigation and recommended that it quantify the costs of past and future methane gas mitigation in the analysis. CESA also recommended that the CPUC model the potential closure of the Aliso Canyon gas storage facility in IRP system modeling.

See CESA's response on March 9, 2017 on the Aliso Canyon OII

On June 27, 2019, similar to the investigation into PG&E’s governance, an OII (I.19-06-014) was issued to determine whether the organizational culture and governance of SoCalGas and its parent company, Sempra Energy, prioritize safety and adequately direct resources to promote accountability and achieve safety performance goals, standards, and improvements. The CPUC may consider revising existing or imposing new orders and conditions on SoCalGas or Sempra Energy, as necessary and appropriate, to optimize public utility resources and achieve operational and safety performance record required by law, and to promote a high-functioning safety culture that promotes continuous safety improvement. The OII cited the natural gas leak related to its Aliso Canyon storage facility and a subsequent gas-line explosion as some of the reasons for this OII.

Phase 1 (Modeling Scenarios)

On March 10, 2017, the CPUC issued an OII to determine whether the Aliso Canyon gas storage facility has remained out of service for nine consecutive months, and if so, whether the CPUC should disallow all costs related to Aliso Canyon to be recovered through rates by SoCalGas. This is a very specific investigation that CESA will just track at most.

On April 17, 2017, a prehearing conference was held in Los Angeles, CA to discuss the issues, scope and scheduling of the formal proceeding, the relationship of this proceeding to other Commission proceedings, and to address any outstanding motions. A number of local communities and environmental organizations attended the PHC. Multiple stakeholders recommended that the scope be expanded to include health and other broad impacts and that the hydrology studies should be done by an independent consultant. Various parties differed on whether to consolidate or phase this proceeding. Notably, SoCalGas, Coalition of California Utility Employees (CUE), and the CAISO all supported the scope and schedule.

CESA attended the PHC to support the OII. CESA pointed to the success of the Aliso Canyon energy storage procurements and the introduction of SB 801 as reasons to include reliance on local energy storage deployment as a near-term mitigation measure in any assumptions and scenarios.

On May 17, 2017, EES Consulting presented its study, which was contracted by LA County to evaluate the alternatives that would mitigate or eliminate the need to withdraw gas from the Aliso Canyon gas storage facility during the summer of 2017 and winter of 2017-2018. Some of the key findings in the assessment include:

Mitigation measures are proving to be successful in reducing the overall demand for gas and therefore gas withdrawals from Aliso Canyon should not be necessary in the summer of 2017

The increase in hydroelectric generation due to the wet season should but some time for additional mitigation measures

There are not sufficient wells available at Aliso Canyon to withdraw gas to meet peak summer demand

On June 20, 2017, a Scoping Memo was issued that will outlined the scope of studies to be conducted in this investigation, including:

Hydraulic modeling (gas and electric reliability): These models simulate the impact of hourly changes in gas supply and demand on pressures in the pipeline network. Hydraulic modeling has been used previously for the Aliso Summer and Winter Technical Assessments.

Production cost modeling (electric costs and reliability): These models estimate the production costs and expected reliability of a particular electric system over a given time period. The availability of gas storage can impact nearby electric generation due to gas’ relatively slow transport speed.

Economic modeling (gas prices for residential/commercial customers): Storage is used to reduce the economic impact of fluctuations in natural gas prices and to help moderate costs during temporary price spikes, which typically occur during extreme weather events. Since gas is a pass-through cost, loss of storage could increase customers’ exposure to market volatility.

The Scoping Memo also highlighted the two overarching questions of this proceeding:

Is it feasible to reduce or eliminate the use of the Aliso Canyon Natural Gas Storage Facility while still maintaining electric and energy reliability for the region?

Given the outcome of Question 1, should the Commission reduce or eliminate the use of the Aliso Canyon Natural Gas Storage Facility, and if so, under what parameters?

The CPUC plans on two phases for the proceeding. In Phase 1, the CPUC will undertake a comprehensive effort to develop the appropriate analyses and scenarios to evaluate the impact of reducing or eliminating the use of Aliso Canyon with a goal to develop models that understand the impacts of reduction or elimination of the facility. Phase 1 will be resolved by the issuance of an Assigned Commissioner’s Ruling, likely in November 2017. Phase 2 will begin in Q1 2018 and will evaluate the impacts of reducing or eliminating the use of Aliso Canyon using the scenarios and models adopted in Phase 1.

On June 26, 2017, a Ruling was issued on June 26 that attached the CPUC Energy Division’s Initial Phase 1 Scenarios Proposal for feedback and discussion at an August 1, 2017 workshop. The initial models are intended to set a baseline on the need for Aliso Canyon for reliability and the cost to the system of various Aliso Canyon inventory levels if the gas and electric systems continue to operate close to the planned status quo, which includes all increases in renewables, conservation, and energy efficiency currently required by California legislation. These baselines will be critical in determining the cost and viability of long-term alternatives to Aliso Canyon.

On August 1, 2017, the CPUC held a workshop in Los Angeles, CA to provide an overview of its Initial Phase 1 Scenarios Proposal for its production cost, hydraulic, and economic modeling.

On April 4, 2018, a Ruling was issued that announced a CPUC contract with Los Alamos National Laboratory to oversee and independently evaluate hydraulic modeling to be conducted by SoCalGas while the CPUC Energy Division undertakes the production cost modeling and economic modeling efforts as part of the Phase 1 Scenarios Framework. The inability to find an external contractor to conduct the hydraulic modeling led to the CPUC opting to allow SoCalGas, which has the internal technical expertise, to conduct the necessary work with the oversight of a third party in order to mitigate conflict-of-interest concerns. Similar failed attempts to find a third-party contractor to conduct the economic and production cost modeling led to the CPUC assessing and affirming that it had the internal bandwidth and capabilities to do this work in-house. This is not ideal, especially as SoCalGas has pushed hard for re-opening Aliso Canyon, so CESA will continue to monitor this initiative closely to ensure fair and unbiased outcomes in the Phase 1 scenario analysis.

On May 23, 2018, a Ruling was issued that updated the Phase 1 schedule now that SoCalGas has been determined to conduct the hydraulic modeling with Los Alamos National Laboratory overseeing the process and the CPUC Energy Division has been announced to undertake the economic and power production modeling for the Phase 1 analysis. The assumptions and scenarios developed in Phase 1 will be used to conduct the actual analysis in Phase 2.

On June 15, 2018, a Ruling was issued that circulated an updated Phase 1 Scenarios Framework for informal comment and feedback. The updated framework maintained the three types of modeling that will be conducted in this proceeding: hydraulic, production cost, and economic. CESA’s main interest in this analysis will be in identifying whether alternatives to Aliso Canyon reliance in the form of increased energy storage deployment could be feasible. Thus, CESA was supportive of Sierra Club’s concern that the analysis does not recognize demand reduction as a tool to eliminate or minimize reliance on Aliso Canyon, as the demand inputs in the production cost modeling do not vary. Along those lines, CESA will focus our involvement in this proceeding on ensuring that the modeling accurately reflects future grid conditions, such as assuming retirements of plants that would reduce reliance on Aliso Canyon. If models reflect these two points, CESA believes that the results may highlight the role of energy storage in eliminating or reducing the reliance on Aliso Canyon.

The key analysis task for the hydraulic modeling is to determine the minimum level of gas in the underground gas storage facility needed to maintain reliability of both the electricity and gas systems and to maintain reasonable rates, with preference given to operations of non-Aliso Canyon gas storage facilities to determine whether closing Aliso Canyon would be feasible. The framework will take a “graded approach” where full monthly analysis will be completed for 2019, 2024, and 2029 for the peak winter and summer months. The operating conditions will be run under 1-in-10-year and 1-in-35-year scenarios, where no curtailment of gas load is allowed in the former and curtailment of all non-core gas load is acceptable in the latter. In informal comments submitted on June 28, 2018, many parties (Magnum, Southern California POUs, CAISO, SoCalGas) focused on some of the assumptions about the operational capabilities of the SoCalGas system that were either overly optimistic or not tied to historical performance. For example, the assumed 95% receipt point utilization rate should be closer to 80% and the assumption to study a single unplanned outage of pipelines or gas storage facilities should be expanded to study multiple outages, given historical receipt point utilization rates and historical/current outage rates.

In coordination with the hydraulic modeling, the production cost modeling (PCM) efforts will test the effects of electric system reliability and production costs due to the gas limitations found in the hydraulic modeling reliability assessment. Using the SERVM model and IRP assumptions, the PCM will reflect a reduced rate of gas delivery to 17 natural gas-fired power plants in the LA Basin served by the Aliso Canyon facility, which then affect their ramping ability, ability to start up on short notice, among other operating parameters. The power plants served by Aliso Canyon were highlighted below. It is important to note several plants below are OTC plants with compliance-based scheduled retirements, including several of SCE’s in the near term and many of LADWP’s in the long term (e.g., Scattergood units in December 31, 2024 and Haynes and Harbor units in December 31, 2029). According to its 2016 IRP, LADWP has put a hold on all planned local repowering projects to first conduct a system-wide independent analysis on the need and capacity for repowering these OTC plants.

The CPUC Energy Division will also simulate the effect of more distant gas delivery. Conversely, the inputs and outputs from the PCM analysis (e.g., expected hourly dispatch of electric generators) will be fed back into the hydraulic modeling. A “perform as found” scenario from the IRP where the system is unconstrained by natural gas curtailment will serve as the baseline that feeds into the hydraulic modeling. Loss of load expectation (LOLE) and total production costs will be used as measures of reliability and cost, respectively.

The goal of the economic modeling study is to estimate the impacts of reduction in Aliso Canyon gas storage on core natural gas ratepayers. Four analyses will be conducted:

Natural gas price volatility impacts on natural gas customer bills

Factors that motivate gas storage decisions

Gas storage availability impacts on ratepayer bills

Tighter gas supply impacts on power generation in outside of Southern California but in other parts of CAISO territory

In addition to the above modeling exercises, the CPUC will also conduct a feasibility assessment to determine whether minimum gas storage inventory levels can be maintained throughout the year (i.e., over a longer period of time). Generally, many parties had problems with the updated framework, with their critiques falling along the following themes:

The assessment should not focus strictly on historic and current performance or conditions, but should reflect future expectations of grid conditions.

Reliance on SoCalGas for many inputs in the modeling exercise and to conduct the hydraulic modeling raise potential conflict-of-interest concerns.

Hourly hydraulic and production cost modeling is insufficient to assess potential reliability issues stemming from post-contingency ramping needed for the system.

Scheduled shutdown of plants served by Aliso Canyon should be accounted for in the modeling scenarios.

The study should use 2020 as the first study year instead of 2019 to increase usefulness since the study is expected to be completed in 2019.

The study should expand beyond the CAISO balancing authority area to include other balancing authorities (i.e., LADWP, IID) that are affected by Aliso Canyon’s operations and potential closure.

Notably, SoCalGas offered a number of modifications to the framework that seem reasonable. For example, SoCalGas highlighted how the preference for non-Aliso storage fields does not reflect the CAISO’s economic dispatch requirements, how unplanned outages should not just focus on Aliso Canyon but also other non-Aliso gas storage fields, and how the production cost modeling should examine other plants beyond the 17 identified. Elimination or reduced reliance on Aliso Canyon would increase reliance on non-Aliso fields, which may impact the available gas supplies for a range of other gas plants in Southern California. In addition to these modifications, SoCalGas commented on the potential reliability risks of prioritizing interstate pipeline supplies over gas storage supplies and recommended that hearings be allowed before a Phase 1 decision. Meanwhile, the CAISO recommended that the framework incorporate its power flow modeling into the production cost and hydraulic analysis in a parallel analysis to determine the minimum generation requirement to meet local reliability needs, not just to identify the available gas as done in the CPUC’s proposed analysis.

On July 31, 2018, a technical workshop was held in Simi Valley, CA that discussed the Phase 1 scenarios for hydraulic, production cost, and economic modeling and solicited feedback from stakeholders. The CPUC staff explained that the reliability assessment will determine the minimum monthly inventory targets for underground storage at each facility to support system demand under stressed conditions (i.e., 1-in-10, 1-in-35) while accounting for pipeline transmission constraints. The model will determine needed withdrawals from non-Aliso fields before withdrawing from Aliso Canyon. If the analysis finds that Aliso Canyon withdrawals are needed, then the modeling will identify evaluate the impact of Aliso Canyon and non-Aliso outages and compute the required withdrawals from Aliso Canyon.

Several parties provided comments and recommendations during the workshop to improve the Phase 1 assessment. The CPUC made several changes in response to stakeholder comments, such as the use of 2020 instead of 2019 as the near-term study year, and feedback was sought on whether modeling each month, modeling over the long term, and including certain historical time periods is necessary for the hydraulic modeling. The CPUC, however, responded that the consideration of non-gas solutions, such as energy storage and demand-side resources, is outside the scope of this Phase 1 assessment. The CPUC also explained that hydraulic modeling runs without Aliso Canyon are unnecessary because the current modeling will rely on non-Aliso fields first before withdrawing from Aliso Canyon. Finally, the CPUC tried to reassure stakeholders that there will be close oversight and verification from the CPUC and Los Alamas National Laboratory (LANL) as SoCalGas conducts the hydraulic modeling, which many stakeholders viewed skeptically as a major conflict of interest. As for the production cost modeling, the CPUC is considering several key questions to inform this modeling exercise. For example, the CPUC is trying to simulate the effect on flexibility in dispatch from electric generation resulting from more distant gas delivery when Aliso Canyon is unavailable, which could be done by reflecting increased startup times and/or decreased ramp rates.

On September 14, 2018, a Ruling was issued on September 14 that adopted the CPUC staff’s Final Phase 1 Scenario Framework on scenarios, assumptions, and models. As compared to the draft framework, the CPUC made the following changes:

Utilized smart meter data to shape core gas demand

Developed unconstrained gas supply scenario

Developed minimum local generation scenario (i.e., forced curtailment of generation except for minimum amount necessary for LCR)

Removed assumption that total gas receipts are 95% of total scheduled capacity.

Derived synthetic profile for core gas load

Changed plant operating parameters to implement gas constraints (e.g., restrict ramp rate, increase startup time, and extend startup profile to simulate scheduling in advance)

On October 9, 2018, comments were filed by parties that offered a number of recommendations to improve the framework. A recurring recommendation from the CAISO, CUE, and Magnum has been the need to model more than one planned and unplanned gas transmission or gas storage outage to study WECC-wide reliability since SoCalGas serves SDG&E customers as well, and to use 30-minute intervals to capture sub-hourly ramping issues. SoCalGas requested that the CPUC test sensitivities for changing future conditions, including for the possibility for using existing infrastructure to promote renewable natural gas and hydrogen, rather than just based on historical averages. Meanwhile, environmental parties such as EDF and Sierra Club offered comments that recommended that the CPUC adjust its flawed assumption of continued new investments in natural gas generation, consider a high-electrification pathway, clarify where demand reduction measures could eliminate the Aliso Canyon need, and identify other operational actions (e.g., market rule changes, grid operations, on-demand pricing) to reduce the Aliso Canyon requirements.

On January 4, 2019, a Ruling was issued that adopted the final scenarios with some modifications from the September 14, 2018 version of the framework, as summarized below. For hydraulic modeling, the key changes were:

Reduced the number of simulations required for the Reliability Assessment from 12 to 9 per reliability standard for the near-term (year 2020): In other words, there will be 18 instead of 24 for 2020. The near-term Reliability Assessment will be performed every other month for the shoulder months and every month for the remainder of the year. No changes are made for the reliability assessment of years 2025 and 2030.

Added a sensitivity analysis to the 1-in-10 Reliability Assessment that investigates full zonal utilization with or without an unplanned outage for the near-term and for a future year: The sensitivity analysis has two more simulations for a future year to be determined later based on production cost model results.

Use of smart meter data to extract only one load profile shape that represents both the peak and the extreme peak: The profile shape would then be stretched using peak use and total daily use parameters to match forecasted peaks. Previously, CPUC staff intended to extract two shapes (highest demand for the 1-in-35 reliability standard and the 3rd highest for the 1-in-10 reliability standard). Smart meter data is appropriate because the highest demand resulting from the meter data is still lower than the 1-in-10 and 1-in-35 peaks and therefore provides a closer representation of those peaks.

Developed an analytical framework to select the most plausible unplanned outage for the Reliability Assessment and how these outages will affect the Feasibility Assessment: The CPUC staff will determine the optimal outages to include based on this analysis.

Introduced the “mass balance sheet” approach in the Feasibility Assessment while still keeping the methodology for a “full transient simulation”: This is because the “mass balance sheet” approach would yield correct results only if the bottleneck of the pipeline network system is the injection capacity at the underground storage facility. Otherwise, one must rely on historical data and make assumptions regarding the monthly injection capacities. This would also address concerns about the high number of simulations.

For production cost modeling, the key changes were:

Added Expected Unserved Energy (EUE) and Loss of Load Hours (LOLH) to the list of metrics: This will add another metric, not just the Loss of Load Expectation (LOLE) metric, as originally proposed.

Follow the all-electric generators in two levels of curtailment for electric generation in the Rule 23 curtailment protocol, C.1(2) and C.1(4): This would relax the 1-in-35 curtailment standard, as originally proposed, to be the most consistent with the “Minimum Local Generation” scenario.

Updated the hydraulic modeling section to reflect a more detailed series of curtailment protocols for the hydraulic model: Rule 23 describes a sequence of curtailments of Dispatched Electric Generation, first attempting curtailment of only 40% of “Dispatched Electric Generation” during the summer months and 60% curtailment in winter months, with the added requirement that all electric curtailments need to be coordinated with the CAISO (Tariff Rule 23, section C.1(2)). If this level of curtailment does not alleviate overloading of the gas transmission system, a more stringent curtailment protocol is effectuated (Tariff Rule 23, section C.1(4)). The gas utility can curtail all electric generators, including “Dispatched Electric Generation” as well as non-electric non-core customers, followed by curtailing core customers, until the overloading conditions are resolved.

Simulate 1-in-35 standard for electric generation curtailments with Rule 23 section C.1(2): This would involve curtailments of up to 40% to 60% of electric generation depending on the season relative to the Unconstrained Gas Scenario, while preserving those electric generators required to meet the FERC Local Capacity Area Resource Requirements. If that is not adequate to prevent exceeding maximum allowable operating pressure on the gas pipeline system, CPUC staff will then implement curtailment protocols in the hydraulic model from section C.1(4), preserving only the Minimum Local Generation from the power flow model and nothing else. This corresponds to the Minimum Local Generation scenario. Non-core non-electric gas demand will also be completely curtailed consistent with Rule 23 section C.1(3).

For economic modeling, the key changes were:

Assume volatility exists and proceed with the volatility analysis without pre-assessment: The CPUC staff previously suggested using a pre-assessment analysis to see if volatility exists after the Aliso Canyon well failure.

Use the daily commodity price (only) paid by core customers for both SoCalGas core customers in specific zip codes and core customers in specific zip codes in PG&E territory: Using other bill components are not relevant to the analysis of this proceeding.

Removed the Congestion Rent Assessment and will only perform the Implied Market Heat Rate Assessment: The CPUC staff determined that, while Implied Heat Rate analysis can be performed using both historical data from CAISO and output data from the Production Cost Model for future forecasting, the Congestion Rent assessment cannot.

This concluded Phase 1 of this OII and commenced Phase 2 actual model runs. Given the novelty of this modeling exercise, the Ruling adopted a process whereby Rulings would be issued upon updates to scenarios, assumptions or inputs with opportunities for party comment and workshop input.

Phase 2 (Modeling Results)

On March 29, 2019, a Phase 2 Scoping Memo was issued that set the scope of issues as:

System reliability and electric/gas rate impacts of reducing or eliminating the use of the Aliso Canyon natural gas storage facility

Whether to authorize the reduction or elimination of the use of the Aliso Canyon natural gas storage facility based on factors such as safety reliability, rates, and clean energy goals

Notably, the Scoping Memo disagreed with comments from Sierra club that the CPUC consider actions to be undertaken to ensure the closure of the facility as being within the Phase 2 scope or within the statutory requirements of SB 380.

On November 13, 2019, a workshop was held to present the analysis performed to date in economic modeling, hydraulic flow modeling, and production cost modeling. First, the CPUC staff discussed the inputs to the downstream end of the pipeline network for the hydraulic analysis, including the development of gas demand and hourly demand profiles. Notably, based on its analysis, CPUC staff recommended that SoCalGas include a warming climate scenario or assumption in the California Gas Report. Second, the CPUC staff provided a status update on the two modeling outputs that feed into the PCM analysis. With the development of the Reference System Plan, this proceeding could forecast gas use (i.e., hourly gas demand shapes) from electric generation for each power plant out to 2030. Similarly, the power flow studies for summer and winter reliability from LADWP and CAISO would ensure that PCM keeps gas to run those local generation units from being curtailed. Third, the CPUC staff presented results for Step 1 (volatility) and Step 2 (difference in difference) of the econometric analysis. Since the Aliso event, SoCal City Gate and SoCal border natural gas prices have been more volatile. In 2017, same-day gas price increases of 25% became common, and in 2018, increases even greater than 25% became common. The risk and potential loss for natural gas buyers from these hubs increased in 2017 and 2018. In its difference-in-differences analysis of SoCalGas customers (treatment) and PG&E customers (control), the CPUC staff found that the average gas procurement cost from 2016-2018 increased by $1.82/bill after the Aliso incident, with higher levels in 2017 and 2018 due to the partial and full effect of pipeline outages.

On March 9, 2020, a Ruling was issued that provided an update that Synergi model has been retained to conduct part of the hydraulic simulation work and explained that it will conduct seasonal, not monthly, simulations to reduce the number of runs, given the general similarities across months in a season. Staff also explained that the non-Aliso storage fields will likely be full regardless of month and that gas system design standards are established annually.

Phase 3 (Replacement Scenarios)

On December 20, 2019, a Phase 3 Scoping Memo was issued that requested party input on the baseline analysis and cost estimates for replacement scenarios in order to study the merits of closing Aliso Canyon. Sierra Club, particularly, questioned the baseline analysis for not including building electrification as reducing gas demand while others commented on the need to quantify the benefits of Aliso Canyon closure and to model the potential of DERs to provide the type of electrical services that gas plants currently do. SoCalGas emphasized the current risks of reliance on out-of-state natural gas deliveries without Aliso Canyon gas storage and highlighted the IRP modeling findings that there are reliability risks associated with a future of solar and storage. The Southern California POUs and many others also echoed the need to ensure that Phase 3 inputs and assumptions are aligned with those from Phase 2 as part of this investigation’s analysis as well as the IRP assumptions, though the modeling results there need to be improved (i.e., with specific, not generic, resources)

Power Charge Indifference Adjustment Mechanism (R.17-06-026)

PCIA Overview

The Power Charge Indifference Adjustment (PCIA) ensures that the above-market costs of generation-function energy storage are recovered from those for whom the resources were procured. The PCIA is a rate applied to customers who choose to receive electric commodity service from third-party service providers, such as community choice aggregators (CCAs) or energy service providers (ESP) serving direct access (DA) load, to ensure those customers continue to pay their proportion of above-market costs associated with resource commitments made by the utility on their behalf before their departure. Essentially, it protects bundled customers from financial harm due to load departures and is intended to maintain bundled customer indifference by ensuring that above-market costs associated with prior resource commitments are not shifted from departing load customers to the utility's bundled customers. Bundled customers pay their proportion of above-market costs through the utility's generation rate.

Each IOU calculates vintaged PCIA rates on an annual basis in its Energy Resource Recovery Account (ERRA) forecast application. Generation resources and departing load customers are assigned a "vintage" based on the year the resource is committed and the customers' departure date, respectively, to ensure that departing load customers are appropriately charged/credited for the above- or below-market costs of generation resources procured on their behalf prior to their departure. For each vintage year:

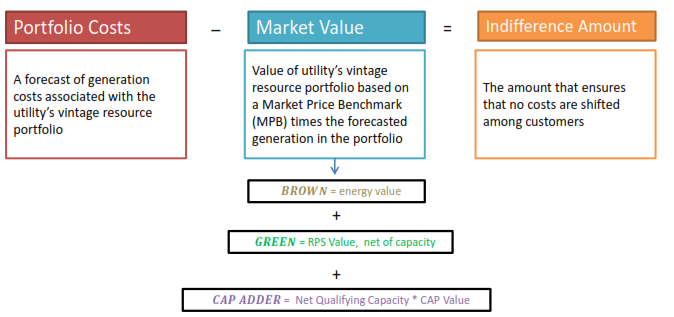

Indifference Amount = Forecasted Portfolio Costs - Market Portfolio Value

where Portfolio Costs include "vintaged" utility-owned generation, PPA contracts, capacity contracts, etc. and Market Portfolio Value includes capacity value, energy value, renewable adder, etc.

Annual forecast generation costs are compared to the forecast market value of the generation portfolio. These above-market costs become stranded when customers depart bundled utility service (i.e., departed load) unless departing customers pay their fair share of those above-market costs. These costs are shared by current and departed customers from that vintage year.

Indifference amounts represent the total above-market cost of the vintaged portfolio (i.e., the total to be collected if all customers depart bundled service) and are allocated to rate groups based on a "Top 100 Hours Allocation" - i.e., rate group contributions during the top 100 hours of IOU system demand (similar to generation allocators determined in GRC Phase 2 proceedings).

The IOUs conclude that no adjustment to the PCIA methodology adopted in D.11-12-018 and Resolution E-4475 is necessary for storage procurement contracts. The IOUs see no difference in the generation aspect of energy storage resources versus a conventional gas generation resource. The IOUs propose the following protocols to include in the PCIA calculation for energy storage:

Energy storage resources add to total portfolio costs based on fixed price of resource (contract), "fuel" costs associated with charging, and O&M

Multiply forecasted portfolio generation, which includes the storage resource's MWh discharged to the market, by the energy component of the market price benchmark for each vintage year

Multiply the portfolio net qualifying capacity (NQC), which includes the NQC of the storage resource, by the capacity value for each vintage year.

The CCAs disagree with the IOUs in that they believe that the PCIA calculation must be adjusted to incorporate energy storage. According to the CCAs, the same PCIA calculation for traditional generation resources should not apply because the CPUC has already recognized that energy storage is unlike any other generation resource (e.g., multi-functional, multi-domain) and because the energy storage market is rapidly evolving. The CCAs conclude that energy storage will not reflect the value of stranded resources. The IOUs' methodology does not capture system benefits, ancillary services, or reliability benefits, which will remain with the IOUs when customers depart from bundled service. As a result, either the PCIA should not apply, or adders should be applied to reflect these additional values. The CCAs are concerned that all energy storage contracts will be well-above market from the start given high capital costs and lack of valuation of the aforementioned adders in contracts.

The CCAs conclude that energy storage will not reflect the value of stranded resources. The IOUs' methodology does not capture system benefits, ancillary services, or reliability benefits, which will remain with the IOUs when customers depart from bundled service. As a result, either the PCIA should not apply, or adders should be applied to reflect these additional values. The CCAs are concerned that all energy storage contracts will be well-above market from the start given high capital costs and lack of valuation of the aforementioned adders in contracts.

Overall, this is a second-order Track 2 issue for CESA, and it will avoid the battle between the IOUs and CCAs on this matter. CESA has limited its comments on the PCIA to recommending a separate proceeding or track to focus on cost recovery issues.

ERRA Forecast Overview

The purpose of the ERRA forecast is to forecast the energy production and costs from the IOUs' portfolio of generation resources. It sets the fuel and purchased power revenue requirement for bundled service customers, the new system generation (CAM) revenue requirement for all customers, and sets the PCIA and Competition Transition Charge (CTC) for departing load customers. The initial forecast is filed between April and June and an advice letter submitting relevant data for the Green MPB is filed on October 1. Updates to the initial forecast are filed in November. Revenue requirements and rates are effective January 1 or as soon as practicable upon receiving a final decision.

The forecast is developed using proprietary models from the IOUs based on least-cost dispatch of its portfolio of resources using hourly forecasts of market prices and operating characteristics of resources. The energy forecasts for each resource are determined using model outputs for dispatchable resources and contractually expected deliveries for renewable and must-take (non-dispatchable) resources. Costs for each resource are determined using the sum of its fixed/capacity contract costs and model outputs for dispatchable resources and the sum of its fixed/capacity contract costs and contractually expected deliveries multiplied by contract costs for non-dispatchable resources.

The November update is intended to refresh the generation resource portfolio for project expected online dates, success factors, and expected deliveries, for removal of contracts that are no longer expected to deliver in the next year, for the addition of newly executed contracts, and for updates to resources' NQC based on a CAISO report. Price forecasts for gas, GHGs, and power are also included based on the least-cost dispatch model. The same forecast methodology and tools used to set bundled customers' generation rate is used to set the PCIA.

Phase 1

On June 29, 2017, this rulemaking was opened to review the current PCIA mechanism and will follow up and expand upon the recent consideration of the PCIA undertaken by participants in a workshop facilitated by Energy Division staff that issued a report in September 2016, and in the PCIA Working Group that issued a report this April. Participants in the PCIA Working Group identified three potential alternatives to the PCIA as it now exists: (1) a new portfolio allocation methodology (PAM); (2) a lump-sum buyout of what would otherwise be CCA customers’ PCIA obligations; and (3) the assignment of certain procurement contracts of the IOUs to CCAs in lieu of imposing the PCIA. This OIR will continue the work by the PCIA Working Group.

The preliminary scope of issues includes the following:

Improving the transparency of the existing PCIA process

Revising the current PCIA methodology to increase stability and certainty

Reviewing specific issues related to inputs and calculations for the current PCIA methodology

Considering alternatives to the PCIA

Optimizing IOU portfolio management to minimize stranded costs

Examining the status of exemptions from the PCIA for customers using California Alternative Rates for Energy (CARE) and Medical Baseline (MB) rates

Implementing SB 350 regarding bundled customer indifference

In view of the approach and scope of this proceeding, the CPUC dismissed the Joint IOU Application (A.17-04-018) for approval of the Portfolio Allocation Methodology (PAM) for all customers until PCIA alternatives are considered in this proceeding. Consistent with its Policy Principles, CESA will monitor this proceeding and continue to avoid cost allocation issues.

On August 24, 2017, D.17-08-026 was adopted that granted the joint PFM of D.06-07-030 by the joint IOUs and CCAs that requires the IOUs to utilize a common PCIA calculation workpapers template in their respective annual ERRA forecast proceedings. The purpose of the common template is to improve transparency underlying the PCIA. This PFM was a direct outcome of the six-month PCIA Working Group from October 2016 to March 2017.

On August 31, 2017, a Prehearing Conference was held. Key topics of discussion included data access/confidentiality issues and the applicability of the new PCIA to currently forming CCAs, which were proposed by certain stakeholders as additions to the scope of the proceeding. Various parties discussed the principle of whether only unavoidable costs should be included in the new PCIA mechanism, whether customers would be able to “buy out” their future PCIA obligations, and whether customers should be cost-neutral regardless of whether they are departing or bundled customers. There was also discussion on the number and appropriate scoping of tracks, need for workshops, and changing the categorization of the proceeding from quasi-legislative to ratesetting.

On September 25, 2017, the CPUC issued a Scoping Memo to set the scope, schedule, hearings and other procedural issues. Track 1 of the proceeding (PCIA Exemptions for CARE and Medical Baseline) will provide an opportunity for parties to submit briefs addressing the legal issues regarding exemptions from the PCIA for customers participating in the California Alternative Rates for Energy (CARE) program or who are served on medical baseline rates. Track 2 (Evaluation and Possible Modification of the PCIA Methodology) will examine the current PCIA methodology and consider alternatives to that mechanism.

On October 24, 2017, a workshop was held to provide a review of the current PCIA methodology, including the rate calculation and the Energy Resource Recovery Account (ERRA) forecast process. The workshop reviewed how the PCIA, per D.11-12-018, must:

Adhere to the bundled customer indifference requirement

Reflect current market value

Be transparent while maintaining confidentiality

Be administratively feasible

Be durable and scalable to reflect changing markets

Challenges with the PCIA were discussed. First, the workshop discussed how the market price benchmark is flawed because it does not reflect forecasted or realized market prices for brown, green, and capacity values. As a result, the PCIA is only forward-looking and requires some sort of true-up to actual costs, actual volumes, and realized market prices. Second, workshop participants identified how the PCIA is not transparent as it uses administratively-set benchmarks that are not reflective of actual market prices, making it difficult to predict. Some participants highlighted how the benchmarks currently overstate market value and the process for updating the benchmarks is contentious.

On November 22, 2017, a Ruling was issued that directed parties in the proceeding to continue to work out issues around ensuring access to necessary data to enable parties to review and understand the current PCIA methodology. In doing so, the proceeding can move forward with developing any possible replacement methodology. This Ruling is the result of the IOU, CCA, and ESP parties failing to submit a report with consensus around various data access issues, as most areas remained “contested” or “open” issues. Without this initial policy resolution, the proceeding may just drag on and not be able to meet the proposed schedule.

On December 5, 2017, a second workshop was held that reviewed the current PCIA methodology. Importantly, the workshop discussed how 70-80% of the variation in the PCIA to date can be explained by changes in the market price benchmarks, primarily in the “Green Adder” derived from the newly-delivering IOU-contracted resources. Market prices of renewable energy credits (RECs) have dropped as renewable resources have been built under the RPS program. As load departures grow, the impact on bundled service customer bills grow based on how understated or overstated the benchmark is.

On January 16-17, 2018, a workshop was held to provide a forum for data-based discussion of cost responsibilities and going-forward solutions. Multiple parties submitted proposals and ideas for consideration, including the following:

Commercial Energy proposed the creation of a “clearinghouse” whereby IOUs maintain all contracts, generating assets by contract bucket would be allocated in an auction, and PCIA is assessed on difference between contract and bid amounts.

TURN submitted four different proposals that seek to: (1) reform the market price benchmark inputs to rely on actual market revenues instead of administratively-determined values; (2) cap the PCIA charge with a balancing account to track and recover any under-collections from CCAs in future years; (3) coordinate with the IOUs to engage in longer-term sales; or (4) have CCA voluntarily subscribe to IOU resources and be an off-taker for energy, capacity, and Renewable Energy Credits (RECs).

Phase 2

A second phase of this proceeding has opened and established a working group process to enable parties to further develop a number of proposals for further consideration.

On December 19, 2018, a prehearing conference was held to discuss how the CPUC will establish working groups to address the following Phase 2 issues:

Benchmark true-up for RA and RPS

Prepayment

Portfolio optimization and cost reduction

Allocation and auction

PG&E stated it would co-chair Working Group 1 (Benchmark True-Up) with CalCCA, SDG&E stated that it would co-chair Working Group 2 (Prepayment) with AReM and DACC, and SCE stated that it would co-chair Working Group 3 (Portfolio Optimization & Allocation/Auction) with CalCCA and Commercial Energy. An initial workshop will be held on March 1 to discuss benchmark true-up and other benchmarking issues (Working Group 1).

On February 1, 2019, a Scoping Memo was issued that memorialized and prioritized the scope for Phase 2 of this proceeding, with Working Group 1 issues to be resolved with the highest priority, Working Group 2 issues to be resolved in early 2020, and Working Group 3 issues to be resolved by mid-2020.

On December 16, 2020, an Amended Scoping Memo was issued that added the following issues to the Phase 2 scope:

Whether to remove or modify the PCIA cap

Whether to modify deadlines or requirements for Energy Resource Recovery Account (ERRA) and PCIA-related submittals and reports

Whether to adopt a methodology for crediting or charging customers who depart from the utility service during an amortization period

Whether to consider any other changes necessary to ensure efficient implementation of PCIA issues within ERRA proceedings

Cost Allocation Mechanism (CAM)

Background

The CAM is a cost recovery mechanism to recover costs from all benefiting customers and allocates resource attributes and net costs to all benefiting LSEs. The CPUC first adopted the CAM in D.06-07-029 and later refined it in D.11-05-005 as a mechanism for allocating net capacity costs to all benefiting customers. In this manner, capacity and energy are "unbundled" and the rights to the capacity are allocated to all LSEs in the utilities' service territory to be used towards each LSE's RA requirements. Customers receiving the benefit of this additional capacity pay only the "net costs" of the capacity through a "wires" charge, determined as a net of the total cost of the contract minus the energy revenues associated with dispatch of the resource.

The "net capacity cost" for energy storage CAM resources are calculated as the costs resulting from the charging of each battery in the lowest-priced hours of a 24-hour period, which are netted against the revenues resulting from discharging that battery during the highest-priced hours in the same 24-hour period, to determine the net revenue received from the resource. That proxy for net revenue is then credited back to the contract cost to calculate the net capacity cost of the resource to be recovered through the New System Generation Charge from all delivery service customer

Power Charge Indifference Adjustment Mechanism (R.17-06-026)

Track 1 (PCIA Exemptions)

As part of Track 1 of this proceeding, the CPUC aims to address PCIA exemptions for CARE and Medical Baseline (MB) customers and will provide an opportunity for parties to submit briefs addressing the legal issues regarding those exemptions.

On February 20, 2018, opening briefs were filed with all parties generally agreeing that it is appropriate to eliminate the exemption because it has served its purpose of protecting CARE and MB customers from rate increases due to wholesale market price disruptions of the energy crisis. However, while the IOUs and ORA support the immediate removal of the exemption, the CCAs argued in favor of a phase out of the exemption to avoid abrupt bill increases.

On June 12, 2018, a PD was issued that resolved the Track 1 issues in this proceeding around current exemptions for certain departing load customers in IOU territories from paying the PCIA charge. The PCIA exemptions are eliminated for SCE’s and SDG&E’s departing load CARE and MB customers as well as CARE and MB customers of new CCAs. This was a fairly easy decision as few parties advocated for retention of PCIA exemptions, which was a legacy of the 2001 electricity market crisis aftermath where the CPUC sought to shield CARE and MB customers from rate increases arising from future wholesale market price disruptions. The CPUC directs the SCE and SDG&E to implement measures and outreach to avoid rate or bill shock but provides that the elimination of the exemption shall take effect immediately.

On July 2, 2018, comments were submitted with all parties in support of the broad determination to eliminate the PCIA exemption, but with the IOUs recommending minor modifications around timing and implementation issues. While supportive in general and despite outreach efforts directed in the PD, the CCAs, ORA, and Center for Accessible Technology (CforAT), recommended the PD be modified to allow the PCIA exemption for existing customers to be phased out over time to balance concerns about rate shock. ORA conducted bill impacts analysis that showed that affected customers could see up to $12/month increases in their bills if this decision is to take immediate effect.