Distributed Energy Resources Working Group Wiki

The Distributed Energy Resources Working Group meets biweekly on Wednesday 9-10am PT.

Table of Contents

Storage Equipment List

Background

According to Go Solar California, all solar energy systems receiving ratepayer-based incentives in California must utilize CEC-listed equipment. With the enactment of SB 1 (Murray) in 2006, the CEC was directed to establish eligibility criteria, conditions for incentives, and rating standards for projects applying for ratepayer-funded incentives for solar energy systems. The Eligible Equipment Lists cover PV modules, inverters (including smart inverters beginning in September 2017), meters, and related equipment. The CEC is now considering whether to develop a Storage Equipment List, similar to the lists already established for qualifying solar and smart inverters.

List Development

On August 16, 2018, CESA presented at a workshop to discuss the merits of a Storage Equipment List, as well as to consider whether non-smart-inverters should be “de-listed” from the CEC list. CESA conveyed that listing energy storage equipment on these lists will ensure consumer protection, mitigate safety concerns, support consideration for different energy storage technologies in key programs and solicitations, and provide standard performance information. CESA supported the CEC’s role in listing energy storage equipment that meet minimum criteria around safety and reliability (which is done through verifying equipment have the appropriate certifications) and in supporting the development of standard testing conditions to represent consistent and accurate performance. Until these standard test conditions are established, however, CESA did not recommend the listing of OEM-provided performance data in the Storage Equipment List.

See CESA’s comments submitted on August 31, 2018 in post-workshop comments

On February 26, 2019, a kickoff meeting for an energy storage technical advisory working group was held to discuss the merits of a Storage Equipment List. The working group will cooperate to identify the safety standards and appropriate testing protocols, including performance data on the list. The CEC changed the SB 1 guidelines to include battery energy storage systems (i.e., UL 9540 and UL 1973), but the CEC said it would be open to expand this list. The CEC explained that UL 9540 would be sufficient since it requires that certified energy storage systems be compliant with grid-support functions (i.e., UL 1741 and IEEE 1547.1). When asked about UL 9540A for thermal runaway, the CEC said it did not include it because it produces a variety of tested data that may not have much value now. The California Building Standards Office (BSO) requested that the CEC include the JA12 standard adopted in 2019 that allows battery storage as a compliance option, which would otherwise require a separate list to be maintained. Furthermore, stakeholders raised the issue of field certification and how energy storage systems are installed, which may have site-specific factors to consider. PG&E and NEXTracker proposed that the list also consider microgrid islanding mode (e.g., synchronization and anti-islanding modes) and proper control settings as part of the scope of this list. Finally, the CEC said that performance standards for this list is not a priority at this time, as the focus is currently on minimum safety and reliability standards. Once testing standards are developed to cover the range of technologies, the CEC said it would take up this issue. CESA expressed that safety and performance can be interrelated, so a pathway to explore this intersection should be included in the scope.

On March 22, 2019, a working group meeting was held to share the initial draft of the list and explain different sections. The IOUs expressed their preference to separate the list for energy storage equipment since there are separate electrical and fire codes for energy storage systems (e.g., IFC Chapter 12, NFPA 1 Chapter 2), as well as their preference to include “hybrid” inverters on the battery inverter list. Inverter manufacturers added that there are additional NRTL efficiency tests for solar inverters that may not be applicable to hybrid storage inverters. Further review was discussed as being needed on UL 9450 Section 24 that deals with utility-grid interaction. Importantly, stakeholders were still confused to the purpose and use case of this list since the NRTL will already have a list of data. Given this, UL recommended that a link to NRTL databases be established to produce data for the equipment list. To address any confusion, the IOUs and UL clarified that energy storage systems (not used just for backup) will need to comply with UL 1741-SA and IEEE 1547 for grid compatibility since standards like UL 9540 is just a testing standard and references UL 1741-SA for certification.

On June 28, 2019, a working group meeting was held where UL provided a status update on their efforts to develop performance-testing procedures for energy storage systems and batteries. The NEMA ESS 1 (2019) and IEC 62933-1-1 (2017) standards as well as the PNNL and NREL 2016 protocols were reviewed to determine a standard reporting methodology for RTE for the purposes of the JA12 requirements.

Phase 1 Implementation

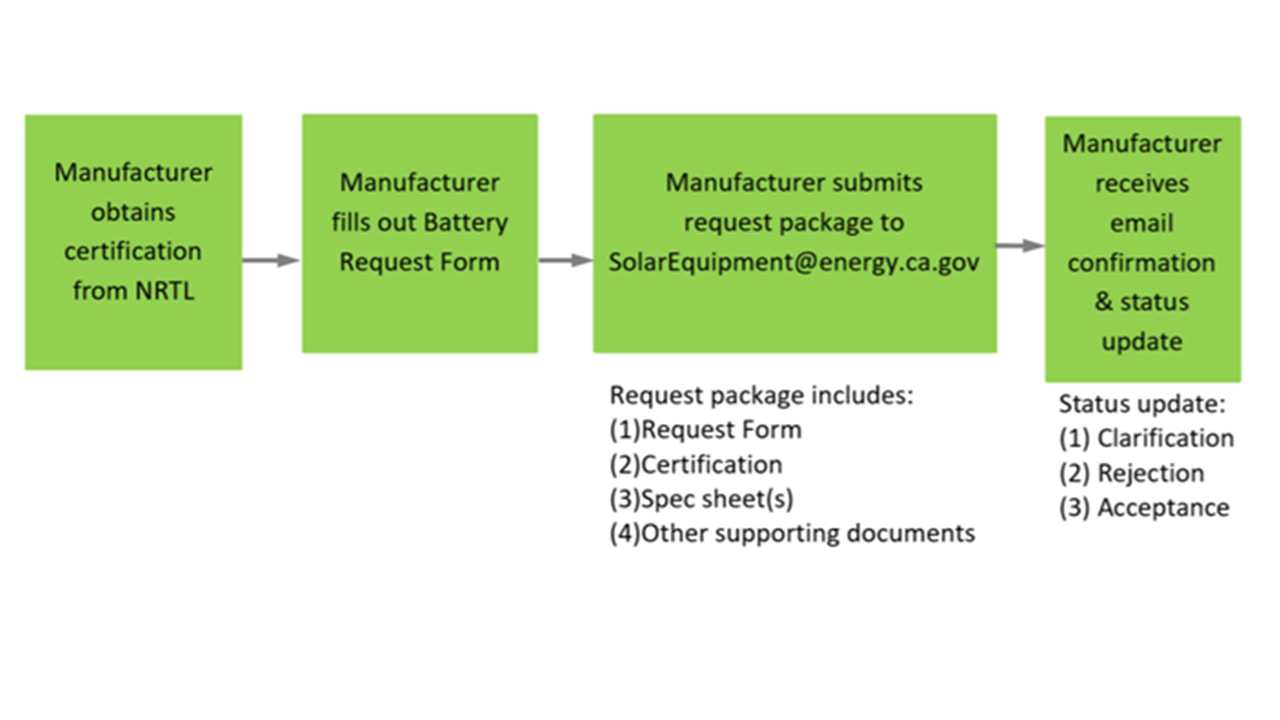

Beginning August 21, 2019, manufacturers can submit Battery and Energy Storage Systems (ESS) listing requests by accessing forms and instructions available on the new ESS web page, where the CEC provides general information, listing request forms, and instructions. Unlike batteries, note that ESS is defined as a “system” that includes batteries, inverter, energy management system (EMS), electrical circuits, and other electrical components, all together in one system.

To be listed, the manufacturer must do the following:

Obtain NRTL certification to UL 1973 for Batteries or to UL 9540 for ESS systems, including the test report in both cases

Manufacturer’s spec sheet(s) for all the requested model number(s), including the maximum continuous discharge rate

Optional certification or testing by NRTL to UL 1741 including Supplemental SA, including to verify Volt/Var test with reactive power priority enabled and other test report summaries for Phase 3 smart inverter functions (for interconnection use cases)

Optional certification by NRTL or SunSpec Alliance to the Common Smart Inverter Profile (CSIP) conformance testing procedures, including whether inverter is “Grid Support Utility Interactive” (for interconnection use cases)

Electrochemical batteries, intended to be uses in stationary applications, and have safety certificate to UL 1973 from a NRTL can be considered for listing. The CEC also established optional listing documentation requirements (declaration form) for Joint Appendix 12 (JA12) of the 2019 Building Energy Efficiency Standards, which outlines how a battery energy storage system, in combination with an on-site PV system, to qualify for compliance credit towards meeting the required energy budget. Requests are processed on a first-in, first-out basis, and involve an administrative screening (Phase 1) and technical evaluation (Phase 2). Only those requests Phase 1 will be reviewed for Phase 2. Listing requests can take between 30 and 45 days. The CEC updates the solar equipment lists twice a month, typically on the 1st and the 15th business day of the month.

Similar to solar and smart inverters, this development marks an important addition to support storage deployment, including in facilitating streamlined, safe, reliable, and compliant interconnection and program eligibility. In the next phase of the proceeding, the CEC will consider performance testing standards to be added to the storage listing information.

2018-2022 DR Application

Background

On January 17, 2017, each of the IOUs filed their applications. PG&E (A.17-01-012) proposed modifications to its existing programs - Capacity Bidding Program (CBP), Base Interruptible Program (BIP), SmartAC Program, and Automated DR (ADR) Program - and continuation of its two pilots - Supply Side II DR Pilot (to determine the customers' willingness to be dispatched frequently for RA and local distribution needs) and Excess Supply DR Pilot (to address mitigation of excess supply situations). SCE (A.17-01-018) proposed changes to BIP to provide higher incentives for resources that are able to meet 20-minute response requirements, discontinuation of the BIP aggregation option, reprogramming of BIP meters to record 5-minute interval data, and reduction of annual capacity payments for the Peak Time Rebate (PTR) Program. SCE also submits its Charge Ready DR Pilot for approval to examine charging behavior in workplaces, destination centers, and multi-unit dwellings. SDG&E (A.17-01-019) explained its intention to focus primarily on BIP and its Technology Incentive Program and proposed two pilot programs - Armed Forces Pilot (to test armed forces' ability to participate in an ADR program) and Overgeneration Pilot (to test the role of distributed storage at times of excess renewable supply).

On March 1, 2017, a prehearing conference (PHC) was held to determine the parties, scope, and and schedule of this proceeding to develop future DR portfolios. CESA raised the same issues as in the above-referenced comments to ensure that net-export constraint issues are scoped into the proceeding for the 2018-2022 DR Applications. In a reply to protests, PG&E asserted that the net export constraint issue is outside the scope of this Application.

See CESA's response on February 28, 2017 on the IOUs' 2018-2022 DR Applications.

On March 15, 2017, a Ruling and Scoping Memo was issued for the IOUs’ 2018-2022 DR programs to review the applications for compliance, reasonableness, and cost-effectiveness.

On April 5, 2017, a workshop was held where the IOUs each provided an overview of their 2018-2022 DR applications. One key issue to address in these applications is to ensure consistent baselines for supply-side DR resources and IOU DR programs. The CPUC staff also presented their proposal to integrate energy efficiency and DR programs to have common goals, funding sources, outreach, and policies. The IOUs generally supported this idea, while the DR parties generally did not. Other topics discussed at the workshop include focusing DR in particular geographic areas, cost-effectiveness, and coordination with other proceedings.

On June 26, 2017, PG&E and various stakeholders filed a Motion for approval of a settlement agreement.

On December 21, 2017, D.17-12-003 was issued approving the IOUs DR programs, pilots, and other activities for 2018-2022, with authorized budgets of $333 million for PG&E, $751 million for SCE, and $78 million for SDG&E. The decision directed closer oversight and monitoring of SDG&E’s DR programs and portfolios given the “less than satisfactory” cost-effectiveness ratios. Some funds were authorized and allocated for pilot DR programs intended to target transmission-constrained local capacity areas and disadvantaged communities. The decision also rejected the recommendations of the Joint DR parties to require uniform parameters for DR programs due to differences in marginal costs and load shapes across the IOUs that drive cost-effectiveness analyses, but directed the IOUs to identify parameters that could be made consistent and uniform statewide. Finally, the decision approved a settlement of A.17-01-012 between PG&E and various stakeholders, with the key provisions related to the Base Interruptible Program (BIP) and Capacity Bidding Program (CBP) summarized below. The only modification to the settlement agreement is that PG&E’s proposed Permanent Load Shifting (PLS) Program is not authorized. The settlement also framed issues that need to be addressed with further collaboration, including the CBP penalty structure, CBP operating hours, and CBP cost-effectiveness calculations, alternative baseline methodologies, and list of eligible residential Auto Demand Response (ADR) enabled end-use devices.

CESA’s interest in this application is specifically to address the “dual DR participation issue”. As noted in the decision, the CPUC has previously established three rules relevant to this issue: (1) duplicative payments for a single (overlapping or simultaneous) instance of load reduction or load drop is prohibited with payment only under the capacity program; (2) dual participation is permitted in two DR activities if one provides an energy payment and the other provides capacity payments; and (3) dual participation in two day-ahead or two day-of programs is prohibited. Electric Rule 24/32 also prohibits customers from simultaneously participating in a program provided by a third-party and bid into the CAISO market and an event-based utility-administered DR program. Despite calls from the Joint DR Parties for these dual participation rules to be reexamined, PG&E explained that these rules are in place to avoid conflicting signals due to multiple dispatches for the same intervals for the same capacity, ensure accurate baseline calculations, and avoid double payments. However, the decision declines to make a determination at this time and instead directed a workshop to make a final determination on this issue in a future decision in this proceeding.

On February 20, 2018, SDG&E filed an advice letter that implemented their new day-of two-hour notification product in their Schedule CBP.

On March 27, 2018, PG&E filed a supplemental advice letter that resolved the protests from the Joint DR Parties, who opposed PG&E’s modifications to increase the frequency of test events from two events in a calendar year to having an option to call one test even in each month of the DR season. Specifically, PG&E responded to the concerns expressed in the protest by creating an option for PG&E to call up to one CBP test event per month only during months where DR resources did not receive a market award in that month. The test event is not to exceed two hours in duration, will be based on the current approved price trigger, and will occur between the 20th day and the last day of the test event month.

On April 30, 2018, a webinar was held to review the IOUs' proposed evaluation, measurement, and verification (EM&V) plans. SCE proposed to conduct process-related evaluations approximately every two years, while "mature" DR programs that deliver consistent load impact results can be evaluated less frequently.

On May 17, 2018, a workshop was held to discuss how the IOUs can make the parameters of their DR programs to be uniform while ensuring a positive cost-effectiveness analysis. This first meeting discussed the process and scope of this effort and discussed areas of potential alignment across the three IOUs’ Base Interruptible Program (BIP), including the testing protocols, excess energy charges, notification options (15- and 30-minute options), and incentives. The next follow-up discussion is on June 26 to continue the discussion on BIP and to begin the discussion on the Capacity Bidding Program (CBP).

On May 22, 2018, an Amended Scoping Memo was issued in R.13-09-011 that added the CPUC Energy Division’s evaluation of the DRAM pilots into the proceeding to the existing scope for the 2018-2022 DR Applications (A.17-01-012, A.17-01-018, and A.17-01-019). Because of the complexity and the inconclusive preliminary results from the evaluation, Commissioner Guzman-Aceves wrote in the Amended Scoping Memo that the issues must be addressed in a formal proceeding as opposed to an informal resolution process. In addition to the DRAM pilot evaluation, this proceeding still requires additional time to complete several unresolved issues, including:

Guidance for pilots to promote DR in disadvantaged communities and transmission-constrained local capacity areas

Guidance to implement the new automated DR (ADR) incentive policy

Completing the record with respect to dual participation rules

Management of and potential changes to the 2% reliability cap

Final CBP price trigger method

On November 26, 2019, SDG&E submitted a PFM of D.17-12-003 that would allow it to shift DR budget funding amounts across program categories via advice letter. Specifically, SDG&E highlighted how some programs are below what was forecast, causing substantial unspent funds from certain program allocations. In addition, SDG&E has found unanticipated administration and IT expenses related to CAISO market integration.

On May 12, 2020, D.20-05-009 was issued that granted SDG&E’s PFM because it agreed with SDG&E that allowing fund-shifting requests via Tier 3 Advice Letter will provide an administratively efficient path to seek modifications to authorized budgets. The decision explained that the IOUs are in the middle of the first five-year budget cycle and there are claims of unforeseen and unavoidable expenses, such as the growth of third-party DR providers and ongoing changes in the CAISO’s ESDER Initiative.

On April 1, 2020, each of the IOUs submitted advice letters providing their mid-cycle update on their 2018-2022 DR program portfolio. PG&E reported a $39.8 million decline in cumulative DR expenditures for 2018 and 2019. Until further policy guidance is provided, PG&E argued that there is little value in initiating other pilots and argued that its existing Excess Supply Pilot and Supply Side Pilot should sunset after the end of current funding. Meanwhile, SCE reported 3% to 4% year-over-year program enrollment declines for its DR program portfolio (totaling 912 MW in 2019). The Constrained Local Capacity Planning Areas & Disadvantaged Communities Pilot has completed planning and is anticipating launch in Q2 2020. Finally, SDG&E mostly focused on the need to align DR programs with that of other IOUs and proposed to close the Armed Forces Pilot and Overgeneration Pilot due to customer feedback and cost-effectiveness concerns.

Several general comments or recommendations were offered in response. PAO recommended that the IOUs reduce their DR budgets from the approved levels in 2020 and 2021 to the actual 2019 spending level since the programs are unlikely to achieve high customer participation in the near future than in 2019. The IOUs, however, requested that the CPUC Energy Division reject this proposal because there are true-up mechanisms already in place to return unspent funds for incentives. Meanwhile, CEDMC argued that IOUs’ retail CBP and BIP should be revised to exclude PSPS events when calculating performance during a DR event. PG&E disagreed, noting that the CAISO has existing processes for outages to reflect adjusted CAISO baselines when PSPS events are called. SCE argued that PSPS events are not DR events and treating them as such would then cover all service interruptions, while SDG&E argued against making this change due to implementation challenges. CEDMC also argued for assessing the accuracy of a non-residential 5-in-10 baseline with a 40% adjustment cap, holding workshops to develop specific improvements on the technology incentive programs, developing pilots to test shift, shimmy, and shape DR products, and other modifications. The IOUs generally argued that these issues were out of scope or premature.

2018 and Beyond Demand Response Programs

On May 20, 2016, a Ruling sought responses to questions on the Interim Phase 1 Results of LBNL’s 2015 California Demand Response Potential Study, which shares key findings on how DR can meet system and local peak RA capacity needs, including the role that battery storage could play in driving down costs for DR in California. Comments filed by parties will be used to further develop a record to support a decision providing PG&E, SDG&E, and SCE guidance for developing DR applications for 2018 and beyond DR activities and budgets.

See CESA's comments on July 1, 2016 on guidance for 2018 and beyond DR programs.

On September 29, 2016, D.16-09-056 was adopted that provided guidance to the IOUs for 2018 and beyond DR programs. D.16-09-056 resolved and closed Phase 2, while resolving some Phase 3 issues but keeping Phase 3 open. Specifically, D.16-09-056:

Modifies D.14-12-024 to rescind data collection requirements for fossil-fueled backup generators in DR programs

Adopts a new goal and set of principles for DR programs that emphasize environmental objectives, customer choice, market competition, performance-based contracts, and cost effectiveness

Defers the determination of the utility role in future DR programs until there are outcomes of market-driven competition

Sets initial guidance and evaluation criteria for transitioning DRAM from pilot to full-program status

Establishes a five-year budget cycle with a 2020 mid-cycle review

Significantly, D.16-09-056 requires that the IOUs establish a new model for fast-response programs to meet future flexible capacity and ancillary service needs, starting with an Application for this newer model to be submitted by October 2018 for a 2020 start date.

Overall, this is a very positive outcome for CESA members. CESA strongly supported the Proposed Decision and offered limited comments on the importance of third-party market competition and in expediting the procedural timeline for guidance on fast-response DR programs.

See CESA's comments on September 19, 2016 on Proposed Decision for 2018 and beyond DR programs

Reliability Cap

D.10-06-034 adopted the Reliability Cap Settlement.

On March 30, 2018, the IOUs filed a report on the February 14, 2018 reliability cap workshop. The amount of headroom under the 2% (of the all-time system peak) reliability cap is determined on the basis of MW of capacity provided by each existing DR program as calculated annually based on load impact protocol studies and then allocated among the three IOUs. The cap established the maximum amount of RA (not the amount of "reliability" resources) that could count toward the IOUs' RA requirement. With increasing levels of third-party participation, the workshop report noted that there is uncertainty as to whether DRAM participation would count toward the reliability cap if the permanent DRAM is required to submit economic bids in the wholesale market. The IOUs hold the view that DRAM resources receive RA value based on their contract capacity (not their actual MW delivered) while other DR programs are evaluated through load impact protocols that look at historical performance. The Joint DR Parties held a different view that only participation in RDRR is counted toward this cap. If the IOUs determined that they are within 95% of its individually-allocated reliability cap, it will suspend enrollments in either BIP or RDRR.

The IOUs proposed to allocate any headroom that is available to maximize the ability of existing DR resources to be integrated into the CAISO markets and to do so through "request windows" and lotteries to allow equal treatment of directly-enrolled customers in DR programs and aggregated customers, but with priorities set for resources that would "de-island or address a local need identified by the CAISO. The Joint DR Parties, on the other hand, proposed that availability under the cap be offered first to new third parties that want to aggregate customers to participate in BIP before being offered to customers participating through an IOU. They argued that this policy aligned with D.16-09-056, which expressed the CPUC's "preference for services provided by third parties" at competitively-determined prices.

On June 15, 2018, a Ruling was issued that posed questions for stakeholder feedback on whether to modify the 2% reliability cap. The Ruling detailed the CPUC’s research that found that RDRR resources are being called upon less frequently and thus posed questions to the stakeholders on whether to adopt additional flexibility in the trigger by allowing its use anytime within the "Warning stage" or even prior to the Warning stage - e.g., Alert notice and/or Restricted Maintenance Operations. In responses, the CAISO, IOUs, and ORA supported allowing dispatch of RDRRs any time within the Warning stage. However, the CAISO did not support greater dispatch flexibility in exchange for re-opening the settlement agreement to increase the amount of RDRRs that qualifies as RA since RDRR bids are not optimized in the CAISO markets unless the CAISO declares a Warning or Transmission Emergency. Specifically, the CAISO noted that RDRRs are dispatched very late in its emergency operating procedure process after exceptionally dispatching non-RA resources.

CLECA, which represents large industrial customers, argued that infrequent use of RDRR should be expected given how the RA construct plans for 1-in-10 conditions and that the CPUC must make a distinction between market-based and out-of-market RDRR dispatches. For market-based RDRRs, CLECA expressed concerns with the trigger for exceptionally dispatching RDRRs before system reliability issues occur given the volatility of the market with the possibility of sudden price spikes, preferring instead to have adjustments to other committed resources before resorting to RDRRs in the market. Overall, CESA believes that the frequent dispatch of RDRRs without sufficient alerts or consideration of alternatives is what is driving CLECA, which may lead to overly frequent disruption of certain customer loads when RDRRs have been dispatched not more than once per year from 2010-2017.

On October 25, 2018, a PD was issued that determined that the 2% cap should remain unchanged, confirmed use of RDRR anytime within the Warning Stage, and directed the prioritization of third-party customers in the allocation of any remaining MWs under the reliability cap. The CAISO explained that for In-Market dispatch even after the CAISO calls a Warning Stage and the RDRR is made available for In-Market dispatch, the locational marginal price must reach the RDRR strike price before RDRR load is dropped, unless an exceptional dispatch is issued. The CAISO dispatches RDRR very late in its emergency operating procedure process, only after exceptionally dispatching non-resource adequacy resources, despite the fact that RDRR are RA resources. However, due to concerns about the frequency of notices, the PD did not propose to allow RDRR to be triggered prior to the Warning Stage at this time.

Meanwhile, the PD supported third-party prioritization because third parties represent a much smaller share of BIP customers and the CPUC seeks a level and competitive playing field. The PD also adopted a process to calculate the available headroom under the cap as well as the following procedures: (1) the annual LIP report should be the document where the available headroom for the IOUs, both individually and collectively, should be assessed; (2) if the LIP Report indicates one or more of the IOUs has exceeded its cap, the IOU should suspend enrollment of additional MW that will count against the cap; (3) allocation of available headroom should be based on the value of the MW, with MW that can de-island existing megawatts given the highest value and those that would be islanded if enrolled given the lowest value; and (4) MW procured through the pilot auction mechanism count toward the reliability cap.

CESA provided limited comments that, given the limited third-party DR opportunities, it is prudent to allocate the remaining capacity under the reliability cap to third-party resources. In comments to the PD, the CAISO clarified that the PD’s determination would allow the release of RDRR into the CAISO’s bid stack upon declaration of a Warning Stage event, resulting in the RDRR to be available for economic dispatch through the CAISO’s market optimization at a bid price of $950-$1,000/MWh or for exceptional dispatch.

On December 10, 2018, D.18-11-029 was issued without any material changes from the PD. In response to comments to the PD, the decision noted that a complex de-islanding requirement may result in “unintended consequences” including unreasonable costs for a small amount of capacity, and thus declined to adopt this requirement as it relates to the reliability cap. In addition, given that SDG&E is well below subscribing 50% of its reliability cap, the decision determined that SDG&E be allowed to use a first-come, first-served approach until it reaches 50% of its cap to address cost-effectiveness concerns and preserve the desired level playing field.

On June 29, 2020, pursuant to D.17-12-003 that found SDG&E’s DR programs as not cost-effective, SDG&E submitted an advice letter reporting on the cost-effectiveness of its DR programs and its efforts to make mandated improvements. However, no single program in its portfolio was found to be cost-effectiveness subject to the TRC, falling far below a ratio of 1 for all years administered. SDG&E cited the change in the RA hours from 4-9pm and the smaller industrial base as causes for the results. PAO protested the advice letter and called for SDG&E to file an application within 90 days of the disposition proposing significant modifications to its DR programs.

DR Programs in Disadvantaged Communities

On June 15, 2018, a Ruling was issued that posed questions for stakeholder feedback on DR programs in disadvantaged communities. Since existing gas generation capacity is disproportionately located in DACs and because a previous DR potential study demonstrated the potential value of locally-focused DR resources, the CPUC attached a staff proposal to the Ruling for stakeholder comment that would support the creation of new DR programs targeted to DACs (referred to as “DAC-DR” programs). The staff proposal included guidance on DAC-DR pilot plans and established the objective to identify actionable policy recommendations for DR programs through these pilots. Pilot locations were determined based on the proportion of DACs within communities and cities within 20-30 miles of a gas peaker plant and ranked according to CalEnviroScreen’s poverty and pollution burden scores, while granting SDG&E some flexibility in developing DR programs to not target specific locations. The candidate locations include: Huron, Selma, and Fresno for PG&E; Colton, San Bernandino, and La Puente for SCE; and Chula Vista and National City for SDG&E. Budgets for these pilots as authorized under D.17-12-003 would be $1 million each for PG&E and SCE and $0.5 million for SDG&E.

Only SDG&E opposing the staff proposal as being too prescriptive for a territory like that of SDG&E while being skeptical on the attainability of the goals. Otherwise, all other parties supported the staff proposal with a few key recommendations for improvement or modifications. SCE proposed a specific pilot to replace existing heat pump water heaters powered by fossil fuels with DR-enabled electric water heaters. PG&E proposed a pilot concept of an environmental DR program. Many of the third-party DR providers (Nest, Ecobee, Olivine, OhmConnect), meanwhile, favored using existing DR programs and cost-effectiveness methodologies to focus participation on DAC customers and supporting third parties through access to customer data and additional value and compensation (e.g., environmental value, RA capacity). Common recommendations among all parties were also offered to study barriers to customer participation, develop more concrete and measurable outcomes, take advantage of synergies with energy efficiency program participation, customize event and outreach messaging, and broaden the locational requirement to local capacity areas (LCAs). PG&E and ORA, on the other hand, noted one reservation about whether DR resources targeted in DACs would equate to reduced or avoided dispatch of fossil-fueled generation located in the DAC due to scale or technical power flow reasons.

On December 10, 2018, D.18-11-029 was issued that established guidelines for pilots targeting residential and small commercial customers residing in DACs. The guidelines would consider supply-side DR programs and direct the development of new and innovative program designs. The decision also adopted the use of Olivine’s proposed locations, the test objectives from the CPUC’s Staff Proposal, and an advice letter process for submittal and approval of the pilot proposals.

DR Program Alignment

On June 26, 2018, a meeting was held on to discuss possible areas of alignment for the IOUs’ BIP programs, including around 15-minute notification options, testing protocols, excess energy charges, and incentives. Stakeholders generally agreed that BIP incentives would be difficult to align across the three IOUs because the incentives are paid based on the avoided cost benefits attributed to the load impacts of DR responses, as well as administrative and overhead costs of implementing the program – both of which likely vary by IOU. For similar reasons, excess energy charges were determined to be a non-ideal candidate to align across the three IOUs. CLECA and CPower put forth proposals to consider aligning pre-enrollment testing and retesting protocols that assess and re-assess the firm service level (FSL) of a customer to determine the DR response amount. PG&E was considered a best practice to which the other IOUs could align, though the multiple retest requests by PG&E protocols that would potentially force a customer to de-enroll, increase FSL, or incur excess energy charges was highlighted by CPower as an improvement area. SCE noted that they do not have such protocols but plan to model their protocols after that of PG&E. Finally, CLECA proposed that both PG&E and SDG&E consider developing a 15-minute notification option modeled after SCE. These proposals will be included for discussion in their filing on the 2018-2022 DR program mid-cycle review.

On August 7, 2018, a meeting was held to discuss improvements in alignment and consistency of CBP parameters and protocols. Potential areas for improved alignment included dispatch options, dispatch notification and event-hour windows, enrollments dates and forms, and minimum bid requirements of 100 kW.

On September 12, 2018, stakeholders considered the differences in CBP program parameters and protocols and discussed potential alignment proposals. Stakeholders first focused on day-ahead versus day-of dispatch options. Though no formal alignment proposal was made, a preference was expressed to align the IOUs’ CBP programs around offering both options but to also maintain current options for dispatch windows (event hours). For the day-ahead option, stakeholders also recommended alignment on a common notification time. Next, regarding the program season and enrollment, stakeholders discussed how the IOUs should align on year-round seasons and use the same enrollment platform provider, if possible. Finally, the group discussed some of the challenges around LSE-specific criteria for the 100-kW minimum bid in CBP, which is a greater challenge for PG&E’s program due to the larger number of LSEs and sub-LAPs. However, with the expected PDR product rule changes, this issue should be resolved prior to the 2020 DR program year.

On December 10, 2018, D.18-11-029 was issued that determined that the open season for BIP will remain in November (rather than to April) to more closely align with the release of the Load Impact Protocols (LIP) Report in April of each year. The rules of the open season are also modified to only permit disenrollment and decrease in participation of DR of existing customers. In the same decision, the CPUC approved SDG&E’s proposed CBP price trigger established using the Opportunity Cost Method, especially given that the CPUC has previously found that the trigger based on energy price (rather than heat rate) to be reasonable and SDG&E has submitted filings explaining its method accordingly. The Opportunity Cost Analysis Method is defined as a way to identify a minimum price trigger that relies on targeting a pre-specified number of economic event hours within the respective program maximums, such that events would remain available for reliability purposes.

CAISO Wholesale Baselines

On October 24, 2018, the IOUs filed a joint notice of FERC approval of the wholesale baselines submitted by the CAISO,. The new baselines include weather-matching and control group methodologies that were developed in Baseline Analysis Working Group of ESDER Phase 2.

On January 3, 2019, the IOUs issued prehearing conference statements to determine whether to revise the baselines accordingly for the utility-run DR programs as well. Each of the IOUs indicated that evidentiary hearings would not be needed and instead a workshop and commenting process would suffice. SCE expressed how it is unclear how applicable the BAWG baselines are to utility-run DR programs given the following issues:

The FERC-approved baselines apply at the aggregate level and has not been studied to be used at the disaggregated level.

There is no resolution around whether the same baseline for wholesale settlement should also be used for retail settlements (i.e., interplay between retail and wholesale baselines).

It is unclear whether each customer would have the choice of baseline, or whether the IOU or aggregator would play the role of choosing the baseline option.

PG&E raised similar issues to be scoped in but also added their concern about the administrative complexity of allowing multiple baseline options and thus recommended limiting the number of options.

DR Measurement, Evaluation, & Verification Plans

On June 1, 2018, SCE filed an advice letter that published its five-year plan for conducting measurement, evaluation, and verification of its 2018-2022 DR programs. Specifically, SCE detailed how it will conduct its annual load impact studies and how it will perform process evaluations that will identify program design and delivery improvements for selected programs in its DR program portfolio. The CPP and SDP are some of the programs identified as potentially benefiting from process evaluations, which are not conducted on an annual basis, because significant design modifications that occurred since their last process evaluation during the 2012-2014 cycle. These study plans do not include DRAM or energy storage enabled DR, such as through the LCR and PRP agreements.

Base Interruptible Program (BIP)

On June 14, 2019, SDG&E submitted an advice letter that proposed a number of enhancements and clarifications to the tariff. Importantly, given the small number of large C&I customers in SDG&E’s territory, SDG&E proposed to reduce the minimum committed load of 1 MW for aggregation participation in BIP down to 100 kW to encourage greater aggregator participation. Additionally, SDG&E clarified that the firm service level of any customer cannot be less than zero, which has the effect of not counting customer usage below zero in the case of battery storage in the baseline calculation.

On April 1, 2020, in its mid-cycle update advice letter, PG&E proposed to modify the eligibility requirement for the BIP from 100-kW maximum demand to 100-kW average demand during the peak TOU hours in the previous 12 months: While this impacts certain participants with seasonal load, a majority of participants during 2018-2019 BIP events had load below their Firm Service Level (FSL) before the start of an event, suggesting “peaky” rather than consistent loads with the potential for load reduction when events are called upon. There is no mechanism for ensuring that there is a probability that participants drop load during a BIP event. PG&E also proposed to modify Excess Energy Charges for BIP participant underperformance: PG&E proposed a claw-back option requiring a BIP customer to pay back a portion of its incentive payment using a to-be-determined formula, or a pass-through of any CAISO energy market charge when BIP customers underperform.

In protests, CLECA and CEDMC opposed PG&E’s BIP eligibility changes on procedural grounds as well as for reducing customer enrollment. CEDMC added that PG&E’s proposed solution would not resolve the need for 24x7 emergency capacity, noting that loads are typically not consistent and that underperformance should reflect the commensurate harm from BIP participation. Due to the need for a more collaborative approach, PG&E offered to suspend this proposal to develop an alternative eligibility requirement.

On April 1, 2020, in its mid-cycle update advice letter, SDG&E proposed to update the BIP measuring hours for monthly average peak demand would shift from 1-6pm to 4-9pm to reflect the latest availability assessment hours.

Capacity Bidding Program (CBP)

On November 15, 2018, the IOUs filed advice letters that proposed methodologies for updated price triggers pursuant to Resolution E-4918, which directed the IOUs to reduce the impact of outlier prices on CBP trigger mechanisms. PG&E performed harmonic means analysis to achieve five economic events during an operating month, which led it to propose a new $95/MWh trigger price (up from $85/MWh). SCE described how it used the price filtering method that resulted in significantly reduced number of day-ahead market events for the higher trigger prices in October to May, but it did not reduce the number of day-ahead market events for June to September or the number of real-time market events for any trigger price. Using the opportunity cost analysis methodology, SCE developed the following proposal for updated trigger prices.

Unlike the two other IOUs, SDG&E did not propose a methodology for reducing the impact of outliers in the data and instead proposed to allow for more flexibility by which the program is dispatched. Specifically, SDG&E proposes to slightly increase the price trigger from $74/MW to $80/MW for the CBP day-ahead 11am-7pm and 1pm-9pm product options, since prices are generally increasing year-over-year. For the CBP day-of 11am-7pm and 1pm-9pm options, SDG&E proposes to maintain the current price triggers of $95/MW and $110/MW, respectively, because the increase in real-time prices from 2010-2018 was much small than for day-ahead prices. SDG&E plans to mitigate the impact of outlier months by adjusting the price trigger to be dispatched for the four highest price days of that month and to avoid exceeding program limits (maximum of 24 hours per month).

On December 20, 2019, SCE proposed four changes to its CBP tariff:

Shift the dispatch window to encompass the RA Availability Assessment Hours (AAH): SCE proposed to shift the current six-hour dispatch window from 1-7 pm to 3-9pmto be more in line with current AAH.

Change day-ahead (DA) event notifications: SCE proposed to change the DA event notification from the previous business day to the previous calendar day. This change will allow SCE to notify customers the next calendar day avoiding impacts on Fridays and holiday weekends and ensures that DA events reflect market awards, rather than those on Mondays and days after holidays being based on forecasted prices.

Modify the CBP Capacity Payment Band: SCE proposed a change to the formula to match that of PG&E and SDG&E to assess penalties on delivered capacity that is less than 60% of nominated capacity (instead of less than 50%), as follows: (Capacity Rate) * [Delivered kW – 0.6 * (Nominated kW)]

Add new marketing requirement language to the CBP aggregator agreement: This is intended to ensure third parties do not use SCE’s name and logo in communications without their expressed approval.

On March 4, 2020, PG&E submitted a supplemental advice letter to allow for electronic enrollment to facilitate residential enrollment into CBP as part of a pilot, leveraging an upgrade to its IT system. If successful, PG&E indicated that it could convert electronic enrollment as a permanent option in the 2022-2026 DR applications.

On April 1, 2020, in its mid-cycle update advice letter, SCE proposed to expand CBP to residential customers. Instead of waiting for the pilot phase, SCE proposed to allow residential customers to enroll due to lower implementation costs. Furthermore, instead of performing an evaluation at this time, SCE proposed moving forward with inclusion of a 5-in-10 baseline to SCE’s CBP tariff. Finally, SCE’s analysis found that the May-October and November-April day-ahead market triggers should be increased from $75/kWh to $80/kWh and from $65/kWh to $75/kWh. For administrative efficiency, SCE proposed $75/kWh as the year-round price trigger.

In protests, CEDMC recommended that SCE align BIP minimum load eligibility to be consistent with PG&E (instead of SCE’s current 200-kW monthly maximum demand threshold), adopt the $80 summer and $75 winter price triggers instead of year-round $75 price trigger, and offer a CBP Elect product similar to PG&E that allows for differentiated hourly bids. SCE disagreed and found that customers have not expressed any issues and how additional changes would require additional funding.

On April 1, 2020, in its mid-cycle update advice letter, SDG&E proposed to shorten the CBP Day-Of notification time to 40 minutes prior to event; SDG&E argued that this would align the notification times of all IOU CBP programs. SDG&E also detailed the baseline analysis that will be conducted with 5-in-10 baseline option to SDG&E’s CBP tariff option.

Automated Demand Response (ADR)

Background

The ADR Program provides customer incentives to emerging and enabling technologies to install automated technologies that allow automated response to a DR event or price signal without the customer taking an action (i.e., qualifying energy management control systems that can respond to signal from a DR Automation Server). Eligible technologies, equipment, processes, and products include energy efficient devices, energy storage, EV charging stations, and controls that interoperate using generally-accepted industry open standards or protocols. The program currently uses a $200/kW incentive level and calculates the incentive amount based on a building end-use load shed test, with the customer eligible for incentives up to 75% of the project cost, if their building performs adequately. A condition of incentive payment is to participate in one of qualifying DR programs (e.g., CPP, AMP, CBP, DRAM). Battery storage is eligible if used for DR event participation only, according to SCE. The IOUs generally argue that LCR contracts and SGIP-funded projects are not eligible for ADR incentives.

ADR Guidelines

On February 20, 2018, the IOUs filed a set of proposed guidelines to implement the ADR incentive policy adopted in D.17-12-003. The policy requires that the IOUs provide ADR technology incentives to participants of any supply-side DR program or activity that is not required to be analyzed for cost-effectiveness (i.e., pilot).

On April 20, 2018, a teleconference was held in accordance with D.17-12-003 that directed the IOUs to file a set of draft guidelines that clarifies the undefined aspects of the ADR device policy, including eligibility frequency and eligible devices and whether ADR incentives are intended for all supply-side DR programs and subject to other CPUC policies (e.g., cost-effectiveness, MUA rules, and competitive neutrality cost causation principle). Each IOU reviewed each of their draft guidelines documents and sought common understanding with parties on definitions and guiding principles. Parties voiced no objection to the definitions, background, purpose of the guidelines document, or the guiding principles proposed by the IOUs. CESA was active in these discussions as some of the IOUs are considering ineligibility for both ADR incentives and LCR contracts, a critical barrier to MUAs for BTM energy storage resources.

On May 8, 2018, an in-person workshop was held to continue discussions on the guidelines for implementing the ADR incentive requirement. The workshop began with clarifications on terminology and criteria for controls eligible for ADR incentives. Parties developed the following definition of an ADR control: "the ability to receive an automated DR signal to enable the customer to participate in a DR event for current models of DR without any manual customer intervention". Parties also agreed on one requirement for controls in all three classes of customers: "the control must be able to receive an Open ADR compliant ADR signal". The IOUs believe that either BTM energy storage systems do not qualify as an eligible technology for ADR or that ADR-funded energy storage systems would be ineligible for SGIP incentives, LCR contracts, or participation in other DR programs. For LCR contracts where all costs are included in the bid, the IOUs expressed several concerns how allowing ADR eligibility would result in ratepayers paying twice for the same product (contract + ADR incentives), how the incentive for the control should be calculated, how the resource can be ensured of being available when called, and how settlement is done for two resources that operate behind the same retail meter. AMS contended that these issues overlap with the issues of dual participation.

Discussions in the workshop then shifted to customer choices for receiving ADR incentives and cost-effectiveness analysis of ADR incentives, which ORA pointed out has been excluded in the evaluation of DR programs. Parties agreed that because the BIP is a reliability program and is subject to a cost-effectiveness analysis, it is not applicable to the newly adopted ADR incentive policy, and that the CPUC did not establish a requirement that the IOUs must provide ADR control incentives for supply-side programs subject to cost-effectiveness analyses. The IOUs also developed a matrix of the programs to which they consider the ADR incentive policy applicable.

On May 23, 2018, the IOUs responded to the CPUC data request to help them understand which DR programs and pilots are eligible for participants to also receive ADR incentives. The IOUs clarified that CBP and DRAM participants are all eligible to receive ADR incentives, with selective eligibility for certain IOU customers on CPP rates. The IOUs observed that no ADR program has funded incentives for battery storage controls and only one IOU has received an application from an energy storage provider. The IOUs also noted that battery storage systems should already include controls and communications to automatically manage the frequent charge and discharge functions of the battery, which are also costs that should be eligible for SGIP incentives.

On June 15, 2018, a Ruling was issued that included a number of questions related to the eligibility of resources receiving ADR incentives to participate in other DR programs, as well as in DR contracts and SGIP incentives external to the DR programs and portfolio of the IOUs. CESA argued that eligibility of ADR incentives with battery storage systems should apply for all types of supply-side DR and that deeming a whole LCR or SGIP project as ineligible for ADR incentives is unreasonable as the ADR incentive should be allowed for the eligible control portion of the energy storage resource. Specifically, CESA noted that LCR contracts and SGIP incentives may not fund ADR-compliant controls and recommended that the ADR Program could report specific line item or component costs for the eligible controls needed to achieve ADR compliance - similar to how eligible equipment costs are reported for SGIP and SGIP incentive payments are adjusted based on other funding sources.

See CESA’s response on July 20, 2018 on the ADR Ruling

Other parties also filed responses. Many DR providers sought to broaden eligibility for ADR incentives to controls that enable response to ‘signals’ more broadly and to avoid specifying a communication protocol (e.g., SDG&E favored broadening the eligibility definition to include “connectivity to the manufacturer’s cloud” for ADR incentives), while PG&E and SCE generally favored not just ADR compliance but ADR certification. Due to the infrequency of dispatches, PG&E and ORA opposed ADR incentives being made available to RDRR resources. While SDG&E did not support the ADR incentive eligibility for LCR/DRAM contracts, PG&E held the view that the incrementality and compensation decision should be made on a case-by-case basis. PG&E, SCE, and ORA also made the case for adopting a flat or fixed incentive level for ADR controls since the current incentive structure is based on a load shed test that may result in overpayment. CESA responded to these comments by stating that energy storage resources should not be subjected to different formulas for calculated ADR incentives and that overcompensation of energy storage resources receiving ADR incentives can be avoided by appropriate disclosure of line cost items.

See CESA’s replies on August 3, 2018 on the ADR Ruling

On October 25, 2018, a PD was issued that proposed to adopt a new ADR control definition and ADR policies to be included in the revised ADR Control Incentives Guidelines and Adopted Policies. CESA commented on the PD that energy storage systems should be eligible for ADR control incentives and the stakeholder process is reasonable.

See CESA’s comments on November 14, 2018 on the Proposed Decision

On December 10, 2018, D.18-11-029 was issued without any material changes from the PD. ADR control is now defined as: “The ability to receive an automated demand response signal to enable the customer to participate in a demand response event without any manual customer intervention. We note and recognize that many controls either allow or require the customer to acknowledge the signal before it begins equipment shutdown and that customers have override authority when a signal is received.” Notably, email or text communication in addition to an automatic signal does not disqualify a customer from ADR control incentives. In the revised ADR Control Incentives Guidelines and Adopted Policies, the decision concluded the following:

Neither requiring or prohibiting ADR control incentives for supply-side DR programs

Not allowing RDRR resources to be eligible for ADR control incentives, tracking incremental load reduction provided by ADR controls

Not considering ADR a “program” that could be developed by CCAs under the Competitive Neutrality Cost Causation Principle (i.e., the decision distinguished ADR as an incentive program that is neither a load-modifying or supply-side program, but to enable participation in those programs)

Requiring controls to be Open ADR 2.0 compliant and located onsite or at the cloud level for residential and small business customers

Requiring controls to be Open ADR 2.0 compliant, located onsite for commercial and industrial customers, and verifiable by IOU for anticipated kW load drop

Requiring deemed incentive to be based on average kW load drop for control in the small or medium business customer sector for such customers

The decision punted on issues related to the frequency of ADR control incentives and calculating incentives cost-effectiveness to a separate annual IOU proposal process on April 1 of each year. For DR resources procured outside of the IOU portfolio, the decision decided to have ADR incentives be a contract term and thus determined such resources to be ineligible for ADR control incentives. Furthermore, the decision adopted a stakeholder process to pursue further technical refinements to the adopted guidelines, including developing an overall strategy proposal for battery storage controls that concludes in an ADR Battery Storage Stakeholder Report.

On January 10, 2019, an initial stakeholder meeting was held to address questions about ADR and battery controls, pursuant to D.18-11-029. Industry representatives Some of the key fundamental questions include:

What controls do batteries come with when they are manufactured that allow them to communicate with entities using them for demand charge and TOU management? What does SGIP provide in the way of controls?

Are batteries ready and able to participate in DR programs, and if so, how? If not, why not?

What do battery manufacturers and industry stakeholders need from the ADR program, and why?

The objective of this conference call was to familiarize stakeholders with the SGIP program and Title 24 update requirements for DR controls and their intersections with the ADR programs to address fundamental questions about battery storage controls. In presenting on the state of ADR controls, the CPUC was seeking information on what battery installers need from the ADR program. CSE, one of the SGIP PAs, presented on how the program does not have any requirements on what controls or communication platform systems to use, as there are no requirements that SGIP-funded energy storage systems be able to respond to external signals. The type of controller and communication platform does not impact the incentive calculation, which is based on energy rating and capped at 100% of eligible system costs. Two energy storage systems with the same energy rating would get the same incentive regardless of whether one had an OpenADR-certified controller. The system controller is assumed to be included in either the “capital costs” or “electricity storage device” among the eligible project costs. SGIP can cover the cost of communications and controls, but there is no program requirement for participants to use the funds for that, and there are no specifications on eligible controls if they do. SGIP doesn’t keep records at a level of detail to show which projects used their incentive for controls. At this time, SGIP covers about 41% of a project’s cost on average, CSE reported. When a SGIP customer is enrolled in a DR Program, SGIP counts the battery discharges that are made for a DR program event toward the annual required total. Furthermore, beginning January 1, 2020, the Title 24 building code will require all residential battery installations to meet a list of requirements, including the ADR control requirement to qualify with applicable performance compliance credit. The ADR control requirement would require the control to be OpenADR certified on site or at the cloud.

Select industry representatives were also on the call to help the CPUC understand what controls and communications come with battery storage when installed and how they work for customer bill management (i.e., automated response, OpenADR interoperability). The battery integrators on the call discussed how they do not necessarily need any ADR control or communications incentive to participate in DRAM or in IOU DR programs since they manage batteries from their clouds. Battery integrators on the call discussed how they are primarily interested in value stacking to achieve a better cost-benefit ratio for energy storage and are less concerned about any incentives for controls and communications needed for DR programs, which would only make DR program participation slightly more attractive.

On January 31, 2019, the first stakeholder meeting was held to discuss the battery integrators’ and IOUs’ positions on the need for control incentives for battery storage. The CPUC staff discussed how the ADR Control Incentives Program had not originally contemplated battery storage since they generally manage their assets from the cloud to aggregate smaller loads. The IOUs also suspected that battery storage providers would likely not want utility control of the asset as part of receiving the ADR incentive. There is still a lack of clarity on whether a battery’s energy management system (EMS) could qualify for ADR incentives, which is an area that CESA sought clarification. Otherwise, even though it looks like battery storage may not be a good fit in this program, given the burdensome requirements (e.g., utility control, evaluation, reporting) relative to the small cost of ADR controls and small incentive amount, CESA pushed for the final report from the IOUs to instead broadly focus on the barriers of DR program participation from battery storage resources.

On April 15, 2019, the IOUs published a final report providing an update on battery storage participation in ADR programs. The IOUs stated that they do not support offering ADR incentives for battery storage controls since stakeholders indicated that they preferred changing rate structures and DR program designs over a change in ADR guidelines and because battery manufacturers and integrators are already equipped with ADR-like controls. Given the challenges of isolating the incremental or ADR-only portion of costs and avoiding double payment, the IOUs supported prohibiting battery storage from accessing ADR incentives.

On May 1, 2019, each of the IOUs submitted their annual ADR process proposal where objectives are revised so that technologies such as battery storage, EV charging stations, and smart thermostats are not deemed eligible for ADR incentives, since they already come with controls with automated communication capabilities to support receiving and acting upon DR signals. For ADR incentive amounts, while PG&E and SDG&E proposed changes to their current 60/40 model, SCE proposed to maintain their current ADR Program structure until 2021:

PG&E proposed an ADR incentive equal to 15% of eligible ADR control costs for the non-residential sector and a deemed ADR incentive based on the average market cost of an eligible ADR control, starting in 2020. PG&E argued that this percentage-based methodology would eliminate costly engineering calculations and thus diminish the program’s administration burden.

SCE proposed to maintain that 60% of the ADR incentive is paid upon installation and verification of the load reduction and 40% is paid based on DR performance in the first year. Instead, SCE recommended that the incentive structure should be evaluated. In their view, a deemed dollar per device approach may be easier for customers to understand and may help ADR implementors with more accurate cost-benefit analysis.

SDG&E proposed to pay an incentive of $67/kW for installation and then an incremental performance payment of $67/kW per year for the next two years based on performance verified by SDG&E.

In addition, a number of other details were proposed:

Frequency of existing incentives: PG&E proposed to set the frequency of existing ADR control incentives to 7.5 years based on technology useful life. SDG&E proposed that the duration of the incentive should be consistent with the amortization period used in the cost-effectiveness test. SCE proposed to base the duration based on the technology useful life and the period of the cost-effectiveness test.

DRAM eligibility: PG&E proposed a continuation of the policy that ADR program incentives cannot be used for RDRR resources in the DRAM, while SDG&E proposed ineligibility of ADR program incentives for all DRAM resources due to firewall restrictions. SCE proposed both ideas, which depended on the solution.

Incentive cost-effectiveness: PG&E proposed to revisit the calculation for cost-effectiveness given the challenges in attributing incremental load reduction to the ADR controls and the need to include other costs such as program administration beyond just the incentive costs. SCE and SDG&E proposed to include incentive amounts as capital costs in DR program cost-effectiveness tests.

Generally, PG&E recommended that the CPUC revisit the ADR Program objectives since technology manufacturers are already starting to incorporate automated communication capabilities into their technologies. SCE also highlighted how there is reduced customer participation in its ADR Program in recent years.

On June 4, 2019, a workshop presenting the IOUs’ proposals was held as part of the first year of the annual ADR review process to resolve the following issues related to their ADR programs:

Review of the approach to calculate control incentives

Implementation of the policy that RDRR are not eligible to receive ADR control incentives

Determination of the frequency of control incentives

Calculation of incentive cost-effectiveness

Development of a list of residential ADR-enabled end-use devices to be considered by PG&E for eligibility for an ADR incentive

Development of criteria to determine the order for PG&E to evaluate load impacts attributable to the devices

Each of the IOUs highlighted the low participation levels of customers in their ADR programs, while PG&E highlighted the need to potentially assess whether other technologies need ADR incentives – similar to the process undertaken for battery storage resources – given that many technologies use low-cost cloud-based solutions. While a bit out of scope, broader policy questions were raised by CESA and PG&E on the purpose of ADR incentives as a technology incentive or as an enrollment incentive, given that many technologies may already have cloud and communication capabilities and may generally have lower equipment costs.

On July 12, 2019, D.19-07-009 was issued that proposed to maintain the current ADR policy that battery storage controls are not eligible for ADR incentives. The PD justified this determination based on workshops and IOU reports submitted on how battery storage providers are not interested in ADR incentives and how there are challenges related to determining the incremental portion that may not be funded through other programs. On the ADR issue, the decision was unchanged from the May 31, 2019 PD, which CESA responded to by arguing that a path to potential eligibility for ADR control incentives for new technologies is needed to streamline access to these incentives as new technologies emerge.

See CESA’s comments on June 20, 2019 on the Proposed Decision

On September 3, 2019, the IOUs submitted an advice letter that proposed the following resolutions to the technical issues included in D.18-11-029:

No changes are proposed for the calculation of control incentives until further research is performed and completed.

Since D.19-07-009 excluded RDRR from DRAM, the IOUs discussed how they no longer need to develop a proposal to ensure control incentives do not go to RDRR.

Customers should be eligible for ADR incentives once every 7.5 years for controls of the same end use but may receive another incentive before the 7.5-year time period elapses if ADR controls are unable to communicate and receive DR signals due to changes in communications protocols.

ADR incentives should be allocated in line with the forecasted load reduction with new ADR participants in each program.

ADR incentive costs will be allocated to ADR-eligible programs based on a forecast of the cumulative incremental ADR-enabled kW in each eligible program over the program cycle, multiplied by the estimated $/kW incentive for that program.

PG&E noted that it will resume stakeholder processes and conduct further research on developing a list of residential end-use devices to be considered for eligibility for the ADR incentive.

ADR Program Refinements

On March 27, 2020, Opinion Dynamics, on behalf of PG&E, published a final report sharing the results of the assessment of control technologies that were submitted in response to its RFI for the PG&E’s residential ADR program. PG&E launched this study to potentially expand the list of technologies that qualify for rebates under its 2020-2022 residential ADR program. The focus was on automated control technologies for the residential sector that leverage the standard of OpenADR to support customers on DR programs. The study team received control technology applications from 14 manufacturers, ranging from AC and plug-load controls, AI-based energy management platform, energy management automation control system devices, EV charging control, smart thermostats, and water heater controls.

Based on the combined assessment, Opinion Dynamics did not recommend any of the final candidate technologies to the current OpenADR program due to a lack of demonstrated field testings of OpenADR communications from the utility down to the end device, and/or because of insufficient experience implementing controls at a utility-scale comparable to PG&E’s service territory. However, the team recommended that PG&E begin two technology demonstrations with water heater controls and EV chargers through the Demand Response Emerging Technologies (DRET) Program. In addition, despite the lack of OpenADR compliance at the end-use device level, Opinion Dynamics highlighted the potential of leveraging aggregators with OpenADR communication abilities. While single end-use devices can provide reliable estimates of the expected control impacts and be incorporated into the current program with minimal changes in program design, multi end-use home energy management systems could offer the advantage of aggregating demand impacts in a consumer-friendly manner with less need for PG&E to evaluate each end-use technology.

The conservative conclusions from the study were disappointing in that promising EV charging control and water heater control technologies were largely screened out due to PG&E’s preference for technologies with large-scale deployments numbering in the tens of thousands, not those that only have a history of field trials numbering in the hundreds. This was despite the positive references regarding their utility pilots and the consultant recognizing the load-shifting potential.

On May 1, 2020, the IOUs jointly submitted a technical proposal to identify a new approach to calculate ADR incentives for non-residential customers. To this end, the IOUs jointly proposed to adopt a new deemed incentive structure design for the non-residential ADR Program. To support this design, PG&E, who is leading this effort, will explore different options, including one based on technology costs, end-use load flexibility, enrollment, manufacturer, or distributor. Upon completion of the study, the IOUs will submit the research results and detailed proposal in an advice letter on September 1, 2020.

Customer Data Access

Click-Through Process Authorization

On August 25, 2017, Final Resolution E-4868 approved, with modifications, the click-through authorization processes proposed by the IOUs that streamlines, simplifies and automates the process for customers to authorize the Utility to share their data with a third-party Demand Response Provider (DRP). Currently, third-party DRPs are authorized to receive customer data from the IOU through a paper or PDF version of the Customer Information Service Request Demand Response Provider form (CISR-DRP Request Form) that the customer signs and the IOU verifies for the customer’s identity – a time consuming and complex process. By contrast, a click-through authorization process enables a customer to authorize the IOU to share the customer’s data with a third-party DRP by completing a consent agreement electronically. The approved click-through authorization process includes:

Expanded dataset that customers may authorize the IOU to share with third-party DRPs

New website for reporting real-time or near-real-time performance metrics that are consistent across the IOUs

Flexibility in the click-through design to accommodate any future expansions of the function

Various technical and functional specifications, such as timelines for delivering the data and using alternative authentication measures

The Final Resolution also forms a stakeholder Customer Data Access Committee (CDAC) to address ongoing implementation issues. Overall, this is an important development for DRPs given that it makes it easier and quicker to enroll customers, smartly offer DR services using this customer data, and settle bids for CAISO wholesale market participation. The IOUs have until April 2, 2018 to implement Phase 1 of the click-through authentication and authorization process to ensure that the process is ready in time to help increase enrollments in third-party DR provider programs and to support 2018 deliveries in the DRAM program. The IOUs have modified their Rule 24 tariff to implement a new click-through functionality for customer data access and to reflect a new Customer Information Service Request for Demand Response Providers (CISR-DRP) form.

On October 26, 2018, Resolution E-4914 was issued that approved SDG&E’s click-through authorization process, including its electronic mail notification, an expanded data set, a shorter data set within ninety seconds, and a funding request of up to $800,000 to incorporate the updated CISR-DRP Request Form into the online process.

On May 17, 2019, Resolution E-4974 was issued that approved PG&E’s proposal for the scope and definitions of performance metrics to be put on a public website and for the customer online click-through authorization process to allow PG&E to release energy-related data to a customer-designated third-party DRP.

Customer Data Access Committee (CDAC)

On April 19, 2018, a CDAC meeting was held to discuss Phase 1 solutions to allow third parties to access customer data while ensuring that they do not store customer credentials and mitigating actions of bad actors. SCE proposed a two-factor authentication process but raised technical considerations around cyber protections – e.g., how the IOUs will know whether the customer did not authorize the release of data and which categories of data were authorized. In response, PG&E and SCE recommended that they be indemnified for the Phase 1 solution functionality and that third parties track their system performance.

On June 20, 2018, a CDAC meeting was held that continued discussions and provided a ‘deep dive’ on the requirements for Phase 1 solutions, including ID validation, authentication vulnerabilities, and user interfaces for authorizing access to customer data. OhmConnect also presented on Phase 3 solutions improvements that would provide more granular details and further streamline the process for third-party DR providers. PG&E is in the process of analyzing the feedback received on Solution 1, enhancements to Solution 3, and the DER whitepaper.

On September 20, 2018, during the CDAC meeting, each of the IOUs discussed their enhancements to the customer and data access portals. There were a number of enhancements discussed, including SDG&E’s Outage Communication Plan to customers and PG&E’s Expanded Data Set. Some energy storage providers requested machine-readable tariffs, service voltage information, and billing cycle information to configure energy storage systems and better target customers, which the IOUs generally responded as saying they already do. DR providers requested that the enhancements also include information on whether customers are enrolled in conflicting DR programs and description of the disenrollment process. Many of these enhancements are technical implementation and user interface details requested by energy storage and DR providers to support ease of access to data and improve customer experience.

On December 11, 2018, a CDAC meeting was held that provided the IOUs’ update on Phase 3 launch and discussed PG&E’s advice letter to increase Rule 24 capacities up to the 200,000 registration level. PG&E determined that the increase in Rule 24 registration capacities was needed to support the 2019 DRAM pilot and sustained growth in third-party direct participation.

On March 29, 2019, a CDAC meeting was held to provide updates on the Phase 3 launch and to discuss the customer authorization process from click-through or CISR-DRP through the DRP’s registration of the customer location at the CAISO as well as the IOU-DRP process to resolve instances of missing data, data quality concerns, and gaps in data.

On June 27, 2019 a CDAC meeting was held where OhmConnect presented on several ongoing issues, including failed data sharing authorizations (e.g., lengthy click-through outages and insufficient explanation for the outages), data availability and delayed transfer, poor user interface design (e.g., slow mobile pages), and low customer confidence in customer support and process.

On March 10, 2020, CALSSA presented on customer data access issues at the Interconnection Discussion Forum (IDF) call held, where solutions are sought, particularly with SCE’s system, around fixing customer data authorization rules to support customer acquisition and the determination of accurate savings estimates, especially as the CPUC contemplates adopting a solar bill savings calculator. The IOUs responded that there are API-based portals available, such as Green Button Connect, that are designed for DR customers to access 13-month or 36-month historical interval data. The IOUs also highlighted how there are pending applications seeking funding to expand their click-through platform capabilities.

Click-Through Process Applications

Background

On November 26, 2018, each of the IOUs submitted applications pursuant to Resolution E-4868 to provide cost estimates and additional proposals for improvements to the click-through process, including expanding click-through to other types of DER providers beyond DR resources and providing quick-response data delivery. The IOUs, however, generally did not propose to implement every enhancement that was cost estimated in the applications. In response to problems encountered with web metrics vendors, PG&E requested and was subsequently granted an extension to January 31, 2019 to build the click-through web metrics functionality that will measure aspects of the customer authentication and authorization experience. This functionality was originally required to be implemented by November 26, 2018.

On May 27, 2020, a Scoping Memo was issued, after more than a year of inactivity, that identified the scope as covering the reasonableness of the click-through enhancements proposed by the IOUs, their compliance with Resolution E-4868, and compliance with current CPUC privacy rules. CESA is a party in these consolidated applications and is seeking to expand the applicability of click-through enhancements to all DERs, including storage. After evidentiary hearings, a final decision is expected by Q1 2021.

Demand Response Auction Mechanism (DRAM) Evaluation

Background

On September 29, 2016, D.16-09-056 established initial guidance and evaluation criteria for transitioning the DRAM from pilot to full-program status. The CPUC envisioned utility administration of the DRAM as the primary means for sourcing DR in the future. The new guidance for DRAM included:

Capping programs at 2017 budget levels until 2020

Prohibiting utilities from participating in the auction

Establishing the same RA Availability Incentive Mechanism (RAAIM) penalty for DRAM contracts as for RA contracts

Establishing DRAM contract lengths of 1-5 years

Maintaining a 20% set-aside for residential customers

Limiting the size of DRAM based on the competitiveness of bids received, with the utility required to accept all complying bids up to the simple average August capacity bid price