CAISO Working Group

The CAISO Working Group meets monthly on the first Monday of the month, 11am-12pm PT.

Table of Contents

• Aliso Canyon Gas-Electric Coordination Initiative (Stakeholder Process)

Background

On March 1, 2016, Southern California Gas Company (SCG) and San Diego Gas & Electric Company (SDG&E) submitted a Joint Motion to the CPUC proposing daily balancing requirements in response to the abrupt reduction in its gas storage capacity at its Aliso Canyon facility. As a result of this Joint Motion, the CAISO initiated an expedited stakeholder initiative to evaluate market mechanisms or other tools the CAISO could provide to its resource mix to support reliability and ensure markets are not adversely impacted.

This is important to the CAISO and to gas-fired generators that seek reasonable representations of gas costs in their start-up and commitment costs. CESA is in 'monitor only' mode because energy storage is unaffected on the most part by this set of rules.

Phase 1

On May 4, 2016, the CAISO Board approved the Revised Draft Final Proposal that better aligns CAISO markets with current gas system conditions and reserves transmission capacity as necessary to take into consideration gas or electric system conditions. These temporary provisions include:

Publishing 2 day-ahead TD-2) RUC schedules to Scheduling Coordinators

Improving DAM gas-price index using an approximation of next day gas index

Adjusting the RTM gas-price index to include a scalar on the next day gas index

Including after-the-fact cost recovery filing right opportunity to seek energy costs incurred above mitigated price

Ability to enforce gas constraints for either capacity or imbalance limitations

On May 24, 2016, the CAISO activated Phase 1 of market mechanism changes, including timing of re-bidding commitment costs.

On June 1, 2016, FERC conditionally accepted the CAISO’s gas-electric coordination Tariff Revisions.

According to the Q3 Market Issues & Performance Report, the Aliso Canyon gas-electric coordination measures did not have a significant impact on market performance.

Phase 2

On July 6, 2016, the CAISO activated Phase 2 but filed a Petition with FERC to delay the use of Intercontinental Exchange (ICE) gas prices to calculate commitment and default energy bids for affected resources in the SCG and SDG&E systems, pending confirmation that the gas prices conform to the FERC's policy statements on gas prices.

On August 4, 2016, the FERC granted the CAISO's request. All other Phase 2 changes were implemented as scheduled.

On September 22, 2016, a Draft Final Proposal was published that proposed to extend all temporary provisions without refinement because the 2016 Winter Assessment by the Joint Agencies revealed that there are still risks of capacity shortage with the limited operability of Aliso Canyon. The current Phase 1 measures are set to expire on November 30, but the CAISO intends to extend these provisions through the end of November 2017.

Phase 3

On June 2, 2017, the CAISO issued a Straw Proposal that launched Phase 3 of the initiative. The Straw Proposal proposes to extend the temporary market and operational tools currently in place so that they remain in effect beyond November 30, 2017. Because the market constraint limiting the maximum gas burn of a group of generators has proven to be effective, the CAISO proposes to make it a permanent operational tool that can be used throughout the CAISO andthe Energy Imbalance Market areas. The CAISO also proposes to make permanent the mitigation measures that accompany the natural gas constraint authority. These accompanying measures include the ability to deem transmission constraints uncompetitive when natural gas constraint is enforced and the ability to suspend convergence bidding when it determines constraint is adversely affecting market efficiency.

On August 4, 2017, the CAISO will adjusted the scalars to 175% and 125% for commitment and default energy calculation because of gas curtailments in the Southern California area due to an unplanned pipeline outage. As a part of this initiative, the CAISO applied a scalar to the gas price index used to calculate both proxy commitment costs and cost-based default energy bids in the real-time market. The gas price index used in the commitment cost proxy cost calculation was set to scale the gas commodity price to 175% of the gas commodity price. The gas price index used in the default energy bid calculation was set to scale the gas commodity price to 125% of the gas commodity price. The CAISO has since re-evaluated the need for the gas price scalars. Effective as of trade date August 1, 2017, the scalars applied on the gas commodity price to calculate both commitment costs and default energy bids were lowered to zero until the CAISO determines they are needed based on system conditions.

On October 26, 2017, the CAISO re-adjusted the commitment and default energy scalars back to 100% with conditions in Southern California returning to normal, after several days of high temperatures and gas curtailments. The CAISO will continue to re-evaluate on an event-by-event basis the need for gas price scalars adjustments.

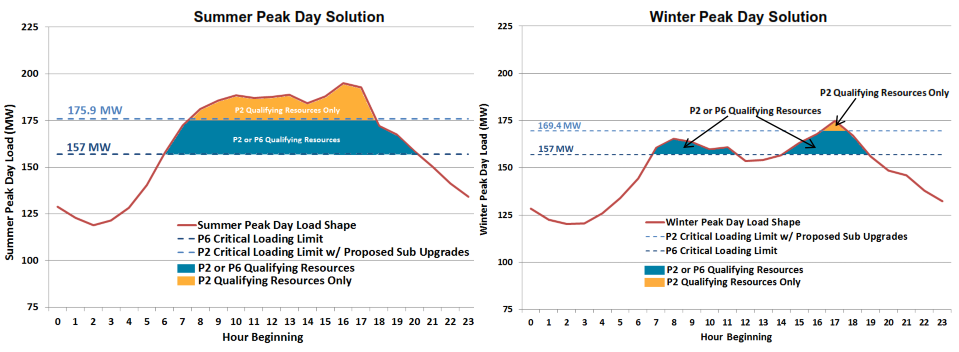

Summer Loads & Resource Assessments

On May 11, 2017, the CAISO issued its 2017 Summer Loads & Resources Assessment that found that it has adequate resources available to handle summer 2017 power use but limitations on gas supply from the Aliso Canyon Gas Storage Facility may present risks in local areas in Southern California in the event of extreme weather. In an assessment of 2,000 different weather and load conditions, the CAISO has an operating reserve margin of 19.5% under a “normal” year (greater than the 15% required by the CPUC).

The analysis also showed the following:

The summer peak, which accounts for expected rooftop PV growth, is projected to be about 46,877 MW, which reflects a modest 0.6% demand growth from 2016

About 52,785 MW of net qualifying capacity will be available this summer

About 3,090 MW of new resources have been added since last summer (June 2016 to June 2017), including about 2,302 MW of solar, 699 MW of natural gas and 80 MW of battery energy storage

Above-average hydroelectricity will be available for use after a heavy 2016-2017 snow and rainy season, translating to statewide average water content measuring, as of April 28, at 158% of the April 1 average

However, since this is a system assessment, not one on potential local capacity issues, this report may not reflect all of the potential risks associated with the Aliso Canyon facility’s restrictions.

• Review of Reliability Must-Run (RMR) and Capacity Procurement Mechanism (CPM) Initiative (Stakeholder Process)

Background

This initiative will review the RMR tariff, agreement and process, and will seek to clarify and align the use of RMR procurement versus backstop procurement under the CPM tariff. The initiative is planned to proceed in two phases. The first phase will have a limited scope and focus on developing a must-offer obligation for RMR units. The second phase will have a broader scope and address potential additional refinements to the RMR tariff, agreement and process, and strive to unify RMR and CPM procurement under a single procurement framework.

CESA is focused on this initiative to the degree that any reforms to backstop procurement processes may create undue reliance on them instead of more forward-looking planning frameworks, like the CPUC’s RA program. As more gas plants become uneconomic, CESA will need to monitor this initiative to ensure ratepayer benefits and savings from considering energy storage resources are taken into account instead of executing potentially costly RMR agreements to keep gas plants online.

Issue Paper & Straw Proposal

On January 30, 2018, a stakeholder meeting was held to discuss the Issue Paper and Straw Proposal for this new initiative. The scope of the initiative is proposed as focusing Phase 1 on making RMR Condition 1 and 2 units subject to a must offer obligation (MOO) for energy and ancillary services, since RMR resources currently do not include a MOO similar to RA resources and thus lead to RMR resources being barred from participating in the CAISO markets during many hours. The Department of Market Monitoring (DMM) requested this issue be in scope due to the market price distortions and economic inefficiency of not having an MOO for RMR resources. The CAISO plans to seek Board approval of its Phase 1 proposal at the May 16-17 Board of Governors meeting. Meanwhile, Phase 2 will run in parallel and will focus on the following key clarifications and/or reforms to the CAISO’s backstop procurement mechanisms:

Clarify when RMR is used versus CPM procurement.

Explore whether RMR and CPM can be merged.

Review allowed rate of return on capital (currently set at 12.5%) for RMR and CPM.

Explore expanding RMR and CPM tariff authority.

Consider whether both RMR Condition 1 and 2 units are needed.

Review cost allocation of RMR and CPM.

Expand RMR designation authority to include flexibility needs.

Stakeholders were split on whether RMR units should have a must-offer obligation, with those opposed (IEP, NRG, PG&E, and WPTF) to this Phase 1 proposal arguing for the need for further study, more detailed plans, and/or a focus on RA improvements and broader RA reforms.

On March 13, 2018, a Draft Final Proposal was released that finalized the scope of this initiative to take place across two phases (see also stakeholder meeting). Phase 1 recommendations are included in the draft final proposal, which, among many things, proposes that a must-offer obligation for energy and ancillary services will be added for RMR units. Condition 1 RMR units will be required to submit energy and ancillary service market-based bids up to the full RMR capacity during all hours that the unit is physically available, while Condition 2 RMR units will be required to submit energy and ancillary service cost-based bids during all hours that the unit is physically available. Otherwise, the CAISO will submit cost-based bids up to RMR capacity, similar to how it approaches RA units that fail to submit bids. The CAISO-generated energy bids will include startup costs, minimum load costs, and energy costs, while CAISO-generated ancillary service bids will be priced at $0/MW per hour. The current penalties in the RMR agreement (Section 8.5) will be used to incent performance and the CAISO may impose a 25% reduction of daily Annual Fixed Revenue Requirement if bidding requirements are not fulfilled. The CAISO aims to ensure that RMR units function equivalently to RA units. Key changes from the straw proposal include the following:

Revised Condition 2 RMR must-offer obligation to state the Scheduling Coordinator (SC) has primary responsibility for submitted bids and not the CAISO

Provided detail on components of bids submitted by SC and CAISO if the SC does not submit bids (for both Condition 1 and 2 units)

Added information on implementation plan

Clarified pricing of AS bids by SC and CAISO

If the CAISO submits bids to meet must-offer obligation, residual unit commitment (RUC) availability bids for full RMR capacity will be submitted at $0

The Phase 1 proposal also includes recommendations (as requested by stakeholders) to provide notifications to stakeholders when a resource informs the CAISO that it may retire. If a resource owner sends such a notice to the CAISO, this information (including affected unit and requested retirement date) will no longer be considered confidential and will be sent to other market participants.

On April 12, 2018, FERC issued an Order that rejected the CAISO’s proposed tariff revisions to its CPM to eliminate the current market-based compensation methodology in favor of a cost-based methodology. FERC determined that the resource-specific cost-based compensation offered by CAISO under the risk-of-retirement program is likely to exceed what a resource could earn under a bilateral RA contract. Stakeholders commented that adding a spring request window could distort prices and interfere with the bilateral RA process. FERC concluded that, without more comprehensive reform, any incremental improvement that may result from CAISO’s proposed revisions are outweighed by the potential for deleterious effects on the competitiveness of capacity procurement under CPUC’s RA program. As a result, the CAISO determined that it will not take any Phase 1 items to the CAISO Board in May 2018 as previously planned. Phase 1 items were included in Phase 2 of this initiative instead.

On May 30, 2018, a working group meeting was held to discuss the scope and approach for Phase 2 of the initiative, which as noted, will include Phase 1 items as well. During the meeting, the CAISO provided more overview of the current backstop processes, where the CAISO generally tries to procure through the CPM before resorting to the RMR agreement but resources going offline or intending to retire may front-run both the CPM and RA processes. The CAISO also said that it will now notify stakeholders when it receives a notice that resource plans to retire – a new policy that will be implemented by July 1, 2018. The meeting also featured presentations by SCE, PG&E, and Calpine. SCE recommended that the CAISO institute must-offer obligations for RMR resources consistent with RA resources and accordingly make available the RA attributes of RMR resources. PG&E, meanwhile, called for general updates to the RMR agreements to reflect the must-offer obligations and RA attributes of RMR resources as well as the consideration of transmission solutions to address any local capacity deficiencies. Finally, Calpine proposed a suite of incremental changes that would require annual RA showings and deficiency auctions in the summer before backstop procurement would be initiated in the fall. The CAISO proposed March 2019 as the target date to take its RMR and CPM proposal to the CAISO Board. Given contentiousness and potentially litigious nature of making any changes to the RMR and CPM tariffs, the CAISO also asked stakeholders if a settlement approach should be used to reach agreement and institute changes.

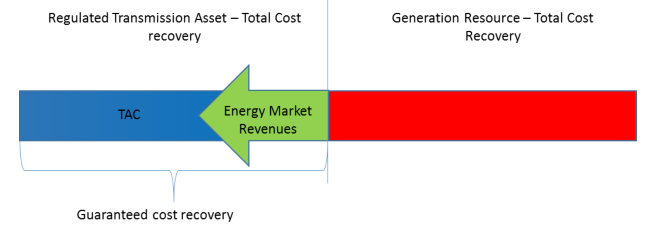

On June 27, 2018, a Straw Proposal was issued (see also stakeholder meeting) that clarified how the CPM will be used to backstop the RA program with voluntary, shorter-term procurement based on bids submitted into the CPM auction (or going-forward fixed costs [GFFCs] if a bid is not submitted), while the RMR will be used to address resource retirements and special reliability needs (e.g., voltage support, flexible needs) with mandatory, longer-term procurement based on cost-of-service. Specifically, related to these two procurement mechanisms, the Straw Proposal proposes the following:

Change CPM compensation where resource can file for compensation based on GFFCs of its unit using same cost categories and 20% cost adder used for CPM reference unit and keep market revenues

Delete references in CPM tariff on existing authority to designate a resource needed for "Year 2" with a bridge in Year 1 and add that same authority to the CAISO's RMR tariff to allow consideration of need for Years 2 and 3

Clarify authority to designate RMR for System or Flexible RA needs

Update allowed rate of return in RMR tariff by pursuing one of six potential options (currently at 12.25%)

Set default cost-of-service RMR agreement with a MOO where resource will have all of its cost of service paid and must credit back market revenues earned above its cost of service (same as Phase 1 Draft Final Proposal)

Require submission of a retirement letter to be considered for an RMR designation

Remove Ancillary Service bid insufficiency test and revise dispatch provisions for RMR units

There are a few areas that still need to be worked out. First, the CAISO proposed to update the allowed rate of return in RMR tariff by pursuing one of six potential options. The current rate of return is set at 12.25% and has not changed in many years, though the effective rate of return has decreased in "post-tax" terms. Several options include benchmarking the rate of return, having an independent expert develop a formula for this rate, requiring market participants to propose and justify a rate of return, or using a blended rate from recent transmission projects. Second, the details of how all RMR resources being subject to the RAAIM need to be worked out. The CAISO could establish that RMR resources have a greater performance obligation than RA or CPM capacity, and they were considering having RMR resources only subject to the RAAIM. Third, in light of load migration, the CAISO was asked by stakeholders to review the annual CPM cost allocation mechanism. The current policy is to use year-ahead load forecasts for local collective deficiency CPM costs and credits allocation, but alternative proposals include doing this allocation prior to each RA month or after each month in a "true up" based on true load.

On July 5, 2018, at the request of stakeholders, the CAISO established a new policy to provide an early heads up of potential CAISO backstop procurement designations to increase transparency. The changes were reflected in the Generator Management BPM. Thus, if a resource owner sends a notice of intent to retire or "mothball" (i.e., make unavailable on a permanent or long-term basis) to the CAISO that qualifies under this policy, the information will not be considered confidential.

On July 10, 2018, the CAISO held a stakeholder call to discuss the proposed amendment to the pro forma RMR agreement reflecting the changes above. The new interim pro forma RMR agreement provides the CAISO with additional (interim) authority to terminate the RMR contract and immediately redesignate resources for RMR service. Under the existing RMR contract, the CAISO may not decline to extend the term of the contract and immediately redesignate unless special circumstances apply. The CAISO clarified that these changes will not affect existing RMR agreements.

On July 26, 2018, the CAISO Board approved two new RMR designations for the Ellwood and Ormond Beach generating stations and limited, interim modifications to RMR agreements to enable the CAISO to terminate current agreements and re-designate the units based on a comprehensive agreement.

On August 14, 2018, a stakeholder call was held to discuss the revised draft tariff language of the pro forma RMR agreement. In doing so, the CAISO has attained some additional flexibility to maintain grid reliability through its expanded backstop procurement authority.

On August 2, 2018, the CAISO held a public stakeholder call to discuss its intention to procure capacity using its CPM authority, which can be exercised under the “significant event” provisions of the tariff. The CAISO viewed the release of an alternate forecast from the CEC for the RA program, which was revised upward to 1,247 MW for September 2018, to be a “significant event” (pursuant to CAISO Tariff Section 43.2.4). The intent was to procure CPM capacity starting to cover the 1,247-MW forecast amount plus the associated planning reserve margin through the CPM intra-monthly competitive solicitation process. The Significant Event CPM designations would have an initial term of 30 days, commencing September 1, 2018.

On August 27, 2018, a working group meeting was held to discuss some updates to the RMR settlement and invoicing process, bidding rules for RMR and CPM units, and certain changes under consideration to the pro forma agreements. The CAISO also responded to stakeholder’s comments and agreed to support the allocation of System and Flexible RA credits from RMR resources, so long as the resources have an approved EFC value, fulfill Flexible RA MOO requirements, and are subject to RAAIM during Flexible category hours. However, several stakeholders including the CPUC, ORA, and IOUs did not support the CAISO extending its authority to designate resources as RMR to Years 2 and 3, which was viewed as bypassing or undermining the bilateral RA market. The CAISO staff also discussed their narrowing down of various options considered for changing the compensation for CPM and RMR resources. First, the CAISO proposes that CPM resources should only be able to file for going-forward fixed cost (GFFC) compensation using cost categories and a 20% adder used for the soft-offer cap reference unit – thus allowing CPM resources to keep all market revenues earned and no longer mixing GFFC and cost-of-service methodologies. Second, the CAISO proposes for RMR resources to either retain the current 12.25% rate of return, update the 12.25% rate of return to a new 10.5% fixed rate based on changes to the tax code and PTOs rate of return, or have resources propose a rate of return in FERC filings for each RMR unit. Finally, feedback from stakeholders on the proposal to make RMR resources subject to a MOO and RAAIM were discussed. In general, the IPP parties expressed that forcing Condition 2 units to bid cost-based offers at all hours and be subject to a MOO may impact energy and ancillary service market prices and. They also generally did not support an RAAIM for RMR units because they must self-schedule, have no ability to substitute, and should not be subject to making offers in all hours, which is contrary to Condition 2 expectations.

On September 19, 2018, the Revised Straw Proposal was posted, and a stakeholder meeting followed on September 27. Since the Straw Proposal, the CAISO clarified its processes for CPM and RMR designations. If a resource declines a CPM designation, the CAISO will offer the next most effective resource a CPM designation. In the event no other resources are available, the CAISO will not go directly to offering the resource an RMR designation but instead will inform the resource that the resource must submit a formal retirement notice if the resource wants to be considered for an RMR designation. In addition, to address concerns of excessive compensation, the CAISO clarified that the CPM pricing formula for resources that file at FERC for CPM price above the soft-offer cap price ($75.68 kW-year) will be such that all market revenues earned above the approved cost-of-service price will be clawed back. As a result, some of the key features of how the CAISO will conduct backstop procurement is summarized below:

The CAISO will notify stakeholders when a resource that is 100 MW or greater informs the CAISO that it is planning to retire, mothball or otherwise make the entire resource unavailable, which then makes the resource eligible for RMR designation.

The CAISO has the authority to procure resources under both the RMR and CPM mechanisms, where RMR procurement will be used to address resource retirements and CPM procurement will be used to backstop the RA program.

To align RMR performance incentives and penalties with those that apply to RA and CPM resources, all CPM and RMR resources will have a similar MOO and be subject to the RAAIM mechanism, while RMR resources will be allocated Flexible RA credits.

The CAISO will move the existing ROR CPM procurement authority from the CPM tariff into the RMR tariff so that there is one procurement mechanism for ROR situations.

To address the concern that CPM compensation may be excessive for CPM prices above the soft-offer cap, the CAISO proposes to claw back all market revenues earned above the cost of service paid to such a resource.

The CAISO proposes to update the RMR pro forma agreement so that the default would be a full cost-of-service agreement where the resource would have all of its full cost-of-service paid and must credit back all market revenues earned above that amount, but at the CAISO’s discretion, and in limited circumstances, a resource may be able to negotiate an agreement where the resource is not paid all of its full cost-of-service and may keep market revenues earned above its cost-of-service.

The CAISO proposes to update the pre-tax rate of return for RMR resources so that it is based on a simple average of a blend of the rates that are being received by the three large IOUs in California.

One area that the CAISO is seeking further feedback is on whether the RMR Condition 1 should be eliminated and only offer RMR Condition 2 for eligible resources. Specifically, Condition 1 provides the possibility for a resource to recover more than full cost-of-service and may provide incentives to select cost recovery method that provides greatest revenue. Condition 1 may also be useful to help parties reach consensus when negotiating an agreement and avoid lengthy and costly rate case and there may be circumstances where this option aligns better with grid needs.

On November 1, 2018, the CAISO held a working group meeting that, among other things, summarized the comments it received in response to the Revised Straw Proposal. Many parties supported the delay of this initiative for up to six months to allow CPUC RA proceeding to play out, but the CAISO responded that the scope of the CPUC RA proceeding is sufficiently different from this initiative to allow this initiative to proceed independently and argued that these important CPM and RMR enhancements need to be put in place as soon as possible. Concerned with the insufficient notification period of resources that require backstop procurement, some parties advocated for a change of the notification period from the current 90 days to as much as 365 days, but the CAISO disagreed and said that changing the period would not resolve all the concerns around ‘front-running’ the RA program.

Specifically, around the Revised Straw Proposal, some parties proposed that the CAISO establish an economic test to prevent economic resources from receiving RMR designations and employ a mitigation test to guard against market power. However, the CAISO found that such an economic test to be inappropriate, especially as no other ISO or RTO has such a test in place, and that a FERC-approved market power mitigation test is already in place for both CPM and RMR. The CAISO also responded to stakeholders that the CPM or RMR compensation does not need to be fundamentally changed since FERC has already recently found them to be just and reasonable.

On December 12, 2018, the CAISO posted the Second Revised Straw Proposal and held a stakeholder meeting. The CAISO made some major changes to the previous Revised Straw Proposal, including some of the following:

Changes the size threshold from 100 MW to 45 MW for informing stakeholders through a market notice of an update to the announced retirement and mothball spreadsheet.

Provides a new process to mitigate the potential for front-running the RA program and provide for a longer runway for resources to make business decisions where a resource can submit its retirement notice by February 1 each year.

Eliminated the Condition 1 RMR option.

Removes the fixed rate of return that is currently in the RMR pro forma agreement and requires that resource owners specify and support a rate of return for their resource in their FERC filing.

Clarifies that the RMR pro forma agreement will specify that a resource must agree to fulfill the RA flexible capacity requirements to qualify for flexible RA credits.

Changes the pricing formula for a resource that files for a CPM price above the soft-offer cap price whereby the resource can file at FERC based on its GFFC plus a 20% adder.

On January 23, 2019, a Draft Final Proposal was published and held a stakeholder meeting.

On March 27, 2019, the CAISO Board of Governors approved the Draft Final Proposal.

On July 26, 2019, the CAISO submitted a supplemental filing to FERC to provide additional information on how the CAISO is seeking authority to use RMR agreements for System and Flexible RA capacity needs, beyond the traditional use of this backstop mechanism for Local RA needs. This filing was a follow-up to its original filing to FERC on April 22, 2019 seeking to broaden its RMR authority. The CAISO requested that FERC issue an Order by September 23 to be able to make the appropriate RMR designations for the upcoming RA year.

CPM Soft-Offer Cap Initiative (Stakeholder Process)

Background

On July 24, 2019, a Straw Proposal was published that proposed the following:

Leave the CPM soft-offer cap at the current level

Consider other options to determine a soft-offer cap in the future

Apply a 3-pivotal supplier test for 12-month designations

Allow the CAISO to file changes to CPM bids above the soft-offer cap

The CAISO staff is aiming to have a final proposal for CAISO Board vote in Spring 2020.

Reliability Services Initiative (Stakeholder Process)

Background

On May 30, 2019, an Issue Paper was published to consider updates to the CPM soft-offer cap value (see also stakeholder call on June 17, 2019), which must be done every four years in accordance with the CAISO’s tariff obligation. The current soft offer cap is $6.31/kW-month; resource owners can offer available capacity into the CAISO’s competitive solicitation process (CSP) to supply CPM capacity, if and when needed, up to this cap without further CAISO or regulatory review. The CAISO uses Going Forward Fixed Costs (GFFC) for a combined cycle resource plus 20% to calculate the soft offer cap, which was designed to be high enough to cover costs for marginal resources on the system. The representative resource initially used in the 2014 CEC report for the soft offer cap was a 550 MW resource, but the current CEC report includes analysis for a similar 700 MW combined cycle plant. The system has changed considerably since 2014 and perhaps a new resource or a blend of resource types is appropriate to set the soft offer cap going forward. The CAISO will examine 12-month CPM compensation as well to address stakeholder concerns about exercising market power.

Policy Development

On July 24, 2019, a Straw Proposal was published.

CAISO CPM & RMR Designations

Recent Activities

On September 1, 2018, the CAISO issued a Significant Event CPM designation in light of an alternate load forecast presented by CEC staff. The initial load forecast was the basis of establishing RA requirements throughout the year. This alternate forecast is not officially adopted by the CEC. Under its CPM authority, the CAISO can designate resources under CPM pursuant to the “significant event” provisions of the tariff. The CAISO viewed the release of an alternate forecast from the CEC for the RA program, which was revised upward to 1,247 MW for September 2018, to be a “significant event” (pursuant to CAISO Tariff Section 43.2.4). The CPM term is for the month of September under the tariff, subject to adjustment and the payment provisions set forth in the CPM tariff provisions. Per section 43A.3.5 of the CAISO tariff, the 30-day term may be extended for an additional 60 days if the CAISO determines that the significant event will extend beyond 30 days. The CAISO has not yet made that determination. Considering the differential in forecasts, along with the September RA showings, the CAISO concluded that it would designate 2,946 MW of additional capacity. Based on the intra-monthly Competitive Solicitation Process, the CAISO has provided CPM designations to 45 resources for that total amount of capacity.

On September 21, 2018, the CAISO notified participants that the September significant event designations were extended by 60 days and expects the significant event will last through the end of the 2018 year.

On November 12, 2018, the CAISO issued an Exceptional Dispatch CPM designation to address a non-system reliability need for 60 days. The Exceptional Dispatch for 12.46 MW was issued to address a potential thermal overload on a 60-kV line in the PG&E service territory for the next contingency event.

On July 6, 2018, the CAISO posted a list of announced retirement and mothball generating resources as part of a new process to provide stakeholders information regarding notification requests to change a resource status from active to retired, mothballed, or otherwise unavailable to the grid. “Mothballed” refers to the unit not being available for dispatch, though the unit could return to operation. By contrast, “retired” refers to the unit that will not be able to return to operation. The document contains the status of the CAISO grid reliability review, deliverability retention status, and major milestones for maintaining deliverability for these resources. Notably, the CPUC instructed SCE to negotiate bilaterally with NRG to keep the two Ormond Beach Generating Station units (1,516 MW in combined capacity) and the Ellwood Generating Station (54 MW) online to maintain short-term reliability in the Big Creek-Ventura local areas, as the CPUC and stakeholders work through RA reforms. These units provided notification on February 28, 2018 of their intention to retire with a proposed offline date of October 1, 2018 for Ormond Beach and January 1, 2019 for Ellwood. Additionally, Calpine also notified the CAISO on June 28, 2018 of its intention to retire two other plants in PG&E service territory by January 1, 2019 and May 1, 2019.

• Commitment Cost Enhancements (Stakeholder Process)

Background

A commitment cost is a concept used by the CAISO to ensure all the costs of a resource are known. The CAISO's optimization considers the costs (known as ‘commitment costs’) of turning a market resource ‘on’ and readying or ‘committing’ it to participate in its market when deciding whether to schedule a unit for energy or ancillary services.

The CAISO started this initiative because it believes that the current bidding rules do not always provide suppliers with flexibility to reflect costs and business needs, especially in light of the Energy Imbalance Market (EIM) expansion, increasing instances of constrained conditions, and growth of its fleet to include increasingly diverse supply resource. If the market overly limits supply offers, the CAISO is concerned this could undermine market efficiency and discourage participation by non-resource adequacy resources and Energy Imbalance Market resources. Efficient resource commitment by the CAISO market relies on the ability of suppliers to submit supply offers that reflect suppliers’ willingness to sell based on expectations of costs. This in turn also ensures that market participants recover these costs.

Under current rules, CAISO’s supply offers include up to four components that represent the total production cost of the unit their willingness to provide energy at a given price. In the below, the first three costs are considered "commitment cost offers" while the last one is considered an "energy offer":

Startup costs associated with bringing a unit online from being shut down into a mode it can produce energy

Transition costs associated with moving from one configuration to another for multi-stage suppliers (MSG)

Minimum load costs for operating the unit at the minimum operating level (Pmin) where a unit cannot drop below without compromising the unit’s operation including run hour costs and costs of producing energy up to Pmin

Incremental energy costs associated with producing energy above Pmin

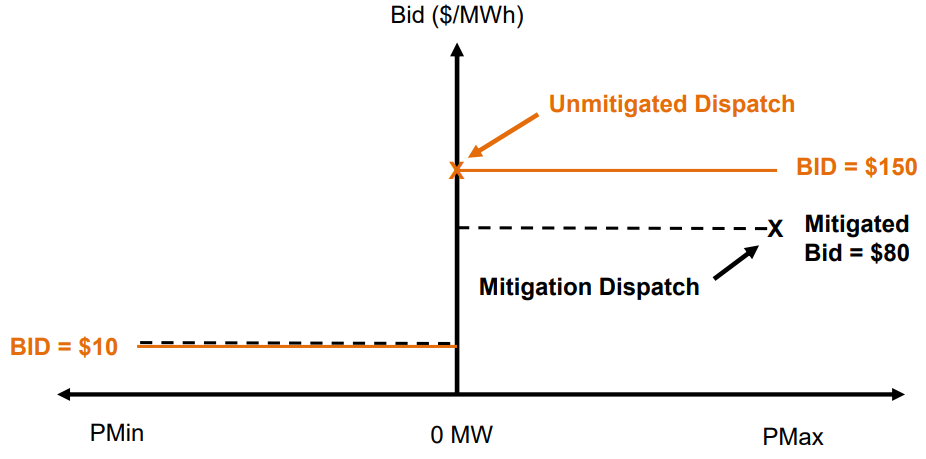

The CAISO allows market-based energy offers limited by an offer cap and subject to a local market power mitigation test that identifies potential for uncompetitive conditions. If uncompetitive conditions are identified, the CAISO will replace market-based energy offers with the administratively calculated default energy bid (reference level for energy). For its commitment cost offers regardless of whether there is a potential for uncompetitive conditions, the CAISO applies a cost cap effectively only supporting suppliers submitting cost-based commitment cost offers subject to a validation. The validation determines if the cost offers are within a reasonable range of CAISO’s expectations of unit's costs - i.e., 125% of proxy costs. If suppliers submit cost-based commitment cost offers in excess of this range set by the cost cap, the commitment cost offers are adjusted down to the maximum allowable level.

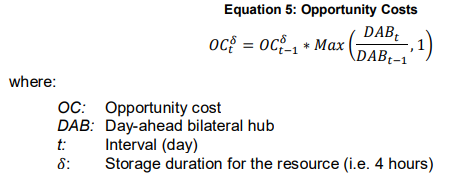

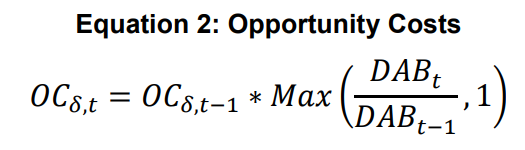

This initiative is a continuation of the Commitment Cost Enhancements Phase 2 initiative, which focused on understanding the opportunity costs associated with committing a conventional (gas) generation unit that has a limited number of starts per year. The CAISO sought to represent these start-limitations as an opportunity cost that could be included in its commitment costs.

Phase 3 (Stakeholder Process)

In Phase 3, the CAISO will develop a methodology for calculating use-limited resource opportunity costs and creating opportunity cost adders for bidding into the CAISO market using the proxy cost option. Upon implementing these changes, the registered cost option will be eliminated and all use-limited resources will be required to use the new methodology.

CESA has worked with the CAISO to emphasize that many energy storage resources may have commitment costs. CESA is clarifying some of these costs (e.g., station power) and has been pressing the CAISO to allow for energy storage resources to represent commitment costs. Currently, PDR resources can do this, but NGR resources cannot. The CAISO delayed the implementation of only allowing resources categorized as ‘use-limited’ to represent opportunity costs in their commitment costs to allow Demand Response Auction Mechanism (DRAM) I winners to complete their pilots before rules were changed and to comply with the Resource Adequacy Availability Incentive Mechanism (RAAIM), which requires the current ‘use-limited’ category.

On February 17, 2016, the CAISO published a Draft Final Proposal on Phase 3 changes.

On June 15, 2016, the CAISO held a workshop on commitment costs related to energy storage and other resources. CESA presented at this workshop on where and how risk exposures to PDR and/or NGR resources may shift under the CAISO’s proposed rules that limit the ability for resources to exit the market by taking outages. CESA discussed the risks of these new exposures, which warrant further consideration and safeguards, although the risks are not immediately extreme. As such, CESA supported the CAISO's efforts to keep some versions of the old rules for managing these exposures until the full suite of new solutions is developed.

On July 27, 2016, the CAISO held another workshop to work through further details on opportunity costs, outage cards, and use-limit data. The workshop detailed the types of documentation that could be provided to validate limitations on the four types of supply-side DR – i.e., DRAM, third-party direct participation, utility DR programs, and utility aggregator-managed DR programs. Critically, the CAISO wants resources to express use-limitations through their bids and commitment costs and the new functionality seems to allow this sufficiently.

While CCE3 is ready to proceed and be finalized, CESA recommended that there be clear and workable paths to represent commitment costs in PDR and NGR models, and that use-limited status should be reasonably easy to achieve for energy storage resources.

See CESA's comments on August 10, 2016 on the July 27, 2016 workshop.

On November 17, 2016, the CAISO released a CCE3 Revised Action Plan. The CAISO has now detailed the types of documentation that could be provided to validate limitations on the four types of supply-side demand response – i.e., DRAM, third-party direct participation, IOU DR programs, and IOU aggregator-managed DR programs. Critically, the CAISO wants resources to express use-limitations through their bids and commitment costs and the new functionality seems to allow this sufficiently.

On June 30, 2017, the CAISO issued a Straw Proposal that addresses the bidding flexibility framework described in the Issue Paper and evaluated with stakeholders in March and April working calls. This proposal was discussed at the July 6, 2017 stakeholder meeting and proposes to do the following:

Support hourly minimum load offers

Apply settlement rules when no minimum load offer present

Add negotiated option for commitment cost reference levels

Apply supplier provided ex ante reference levels adjustments subject to verification requirements

Re-calibrate penalty price parameters to support possibility of energy offers at $2,000/MWh

Support market-based commitment cost offers subject to market caps

Apply dynamic market power mitigation

Apply results of market power mitigation on commitment costs to default assessment for exceptional dispatches

• Day-Ahead Market Enhancements (Stakeholder Process)

Background

The CAISO has observed that the current Day-Ahead Market (DAM) is limited due to subsequent runs of the Integrated Forward Market, which clears the market on the next trade day based on bid-in demand, and of the Residual Unit Commitment (RUC), which procures incremental capacity to address shortfalls between the IFM and the CAISO net load forecast and to ensure additional resources (through a must-offer obligation of economic bids) will be available in real-time. However, the CAISO found that the RUC does not address upward uncertainty by de-committing resources – i.e., if IFM clears above the net-load forecast.

This initiative has thus been established to make DAM enhancements to reduce the burden on the real-time market to resolve imbalance and net load forecast uncertainty.

DAME is focused on co-optimizing supply based on both cleared demand and demand forecast and on developing a day-ahead imbalance reserve product. The CAISO is targeting Q2 2021 for EIM Governing Body briefing and ISO Board decision. A separate Extended Day-Ahead Market (EDAM) Initiative is focused on extending day-ahead market to EIM entities decision:

Bundle 1: Transmission provision, resource sufficiency evaluation, and distribution of congestion rents

Bundle 2: Accounting for GHG costs, ancillary services, full network model enhancements, and administrative fee

Bundle 3: Price formation, convergence bidding, external resource participation, and other items

Straw Proposal will be posted in July 2020 and scheduled for Q2 2021 EIM Governing Body and ISO Board decisions.

Issue Paper

On February 28, 2018, the CAISO issued its issue paper and straw proposal on proposed DAM enhancements (see also March 7, 2018 stakeholder meeting). To reduce the burden on volatility in the real-time market, the CAISO proposed 15-minute scheduling granularity in the IFM (as opposed to the current one-hour blocks) to address granularity issues between the DAM and 15-minute market (FMM). While bid submissions and scheduling may remain hourly, resources now have the option to be committed intra-hour at the beginning of any 15-minute interval. In addition, the CAISO proposed the development of a day-ahead imbalance reserve product to ensure sufficient real-time bids to meet imbalances in the real-time market and add ramping headroom in the day-ahead solution. Similar to the Flexible Ramping Product (FRP), the CAISO will then be able to commit some fast-ramping resources to be ready to meet any uncertainty needs. The CAISO will seek to procure 100% of the imbalance reserve requirement, which is based on potential imbalance between IFM and real-time. Penalty prices based on the real-time flexible reserve product penalty price will be used to seek market solutions when there are inadequate imbalance reserve bids. Bids for up and down imbalance reserves will replace the current RUC availability bids. Finally, by integrating IFM and RUC, the CAISO believed that the day-ahead imbalance reserve product will be procured relative to the CAISO’s net load forecast, not based on bid-in demand.

Straw Proposal

On April 11, 2018, a revised straw proposal was issued reflecting revisions based on stakeholder comments received on the issue paper and straw proposal. This is a follow-up to the straw proposal where the CAISO proposed 15-minute scheduling granularity in the IFM (as opposed to the current one-hour blocks), the development of a day-ahead imbalance reserve product, and the integration of the IFM and RUC. As compared to the initial straw proposal, the CAISO proposed a revision to have a single product for both the upward and downward directions for the 15-minute and 5-minute imbalance reserve products in response to stakeholder comments. The 5-minute need can be addressed by distributing portions of the imbalance reserve requirement to sub-regions while the regional requirement will be set at the total need to address FMM imbalance and the FMM flexible ramping product uncertainty requirement. The FMM flexible ramping uncertainty requirement will then be distributed to the various sub-regions where only 5-minute dispatchable resources will be eligible to meet the sub-regional requirement. Additionally, the CAISO provided additional information in a draft technical paper explaining the formulations for the new day-ahead market, provided data analysis of historical imbalance, proposed methodologies to determine the imbalance reserve requirement, and provided a settlement and cost allocation worksheet

Overall, the CAISO provided some revisions and provided additional data analysis for justification for the proposed changes in this initiative. With these changes, the CAISO aimed to ensure sufficient real-time bids to meet imbalances in the real-time market, add ramping headroom in the day-ahead solution, and address granularity issues between the DAM and FMM.

On June 19, 2018, a workshop was held on June 19 to discuss updates to the Revised Straw Proposal.

On July 2, 2018, a stakeholder call was held on July 2 to discuss the new Day-Ahead Flexible Ramping Product (DA-FRP) requirement, which will replace the imbalance reserves, as detailed in the design elements matrix. Currently, the Real-Time Flexible Ramping Product (RT-FRP) settles forecasted movement and uncertainty awards, but the CAISO now proposes that the DA-FRP align resources to be settled for scheduled energy as well as up and down uncertainty awards. The DA-FRP will be procured using a demand curve consistent with the current RT-FRP procurement. RA resources will still need to submit bids into the real-time market even if it does not receive a DA-FRP award, while non-RA resources that have a DA-FRP award have a real-time must-offer obligation.

On August 27, 2018, the CAISO posted a Second Revised Straw Proposal and held a stakeholder meeting on September 4, 2018 that proposed to allow 15-minute scheduling granularity for all market participants, eliminate the use of forecasts to shape hourly bids, and move the DAM submission deadline to 9 am (from 10 am) to allow for additional processing times. Imports and exports along the interties can be schedule with 15-minute granularity or in hourly blocks, and similar 15-minute granularity applies to load submissions, though there is no requirement for 15-minute meters. For ancillary services, the CAISO clarified that ancillary services will be awarded using a single dynamic ramp rate, limited by certified ancillary service capacity. Currently, Appendix K requires spin and non-spin to sustain output for 30 minutes, and NGR awards must be supported by 30-minute state of charge. The regulation ramp rate used in the automatic generation control (AGC) can be lower than the dynamic ramp rate, which will also be used to dispatch spin, non-spin, and regulation services during a contingency event. Finally, the CAISO is planning an update to the technical appendix describing the integrated IFM and RUC, the day-ahead flexible ramping product, and improved reserve deliverability.

The CAISO notified stakeholders that it is delaying posting of the Draft Final Proposal until it completes further internal assessments on the technical feasibility of changing DAM scheduling from hourly to 15-minute granularity. Concurrent with the stakeholder initiative, the CAISO has been conducting performance testing on the DAM solve time under 15-minute scheduling granularity. The results to date have raised concerns on whether the system performance levels can meet the required market timelines. In Q4 2018, the CAISO will continue to attempt to resolve the system performance issues and will also evaluate additional implementation approaches that require less computer processing resources. The time to perform additional technical studies does not change the planned implementation date of fall 2020.

On November 30, 2018, CAISO held a stakeholder working group meeting as part of Phase 2 of this initiative. This meeting discussed alternatives to combining the IFM and RUC process (i.e., keeping IFM and RUC markets separate) and to discuss incorporating the FRP into the day-ahead market. The two proposed alternatives include:

Alternative 1 (conservative): Keep the current DAM application sequence and add the FRU and FRD procurement in the IFM and provide additional unit commitment and fixed AS, FRU, and FRD in RUC

Alternative 2 (aggressive): Change current DAM application sequence, co-optimize Energy, AS, FRU, and FRD in RUC and have fixed unit commitment and AS, FRU, and FRD in IFM

The CAISO explained that Alternative 1 would require minimal change to the RUC and to the deviation settlement, which is lower regulatory risks and is easier to implement since it is closer to the status quo and provides a hedge for forecast error by liquidating virtual schedules in the FMM, but may lead to less efficient unit commitment and RUC capacity. By contrast, Alternative 2 has the advantages of more efficient unit commitment and RUC schedules to meet real-time conditions, but the downside is that it would introduce a cost for variable energy resource forecast error.

On May 2, 2019, the CAISO held a stakeholder call to discuss next steps for the initiative. As a result of both implementation complexity and stakeholder comments, the CAISO proposed to revise the scope of this initiative to defer consideration of day-ahead market 15-minute scheduling and to instead focus on the development of a flexible ramping product to address uncertainty that can materialize between the day-ahead and the real-time markets.

On June 20, 2019, a technical workshop was held to review the proposed options for developing a new day-ahead product that will address ramping needs between intervals and uncertainty that can occur between the day-ahead and real-time markets.

On August 13, 2019, the CAISO held a stakeholder working group meeting on to review comments received from the June workshop and continue discussions on the proposed design options.

On February 10, 2020, a stakeholder meeting was held to discuss the proposed day-ahead market design and solicit stakeholder feedback on design elements, which are intended to co-optimize and value energy and capacity in an efficient market solution.

On February 11-12, 2020, a two-day workshop was held for the Extended Day-Ahead Market (EDAM) Initiative to focus on topics related to transmission provision, resource sufficiency evaluation, distribution of congestion rents, accounting for GHG costs, ancillary services, Phase 2 of the full network model, administrative fee for EDAM, price formation, convergence bidding, and external resource participation.

On March 5, 2020, a web conference was held to discuss the remainder of the straw proposal for the DAME Initiative, including a discussion on the proposals for the congestion revenue rights and local market power mitigation topics

• 2018 Interconnection Enhancements (Stakeholder Process)

Background

Periodically, the CAISO holds stakeholder processes to adjust the resource interconnection study process. This year, the CAISO identified a robust set of issues that include the following:

Affected systems

Time in queue limitations

Negotiation of generator interconnection agreements

Study deposits

Self-build option for standalone network upgrades

Allowable modifications between Phase 1 and 2 studies

Conditions for issuance of study reports

Interconnection agreement insurance

Interconnection financial securities

Funds forfeiture for withdrawal

Full Capacity Deliverability "Option B" clarification

Issue Paper

On August 10, 2017, the CAISO requested stakeholders to submit potential topics to be included the next iteration of this wholesale interconnection process enhancement initiative. CESA requested that the CAISO consider creating an expedited process for the utilization of full interconnection service at existing generating facilities by co-located energy storage systems and re-evaluate methods for modeling energy storage resources in worst-case scenarios.

See CESA's comments on August 30, 2017 for consideration by the CAISO in its 2018 initiative

On January 24, 2018, the CAISO held a stakeholder meeting to discuss an issue paper for the new 2018 Interconnection Process Enhancements Initiative. This initiative will evaluate potential changes needed to enhance the CAISO generator interconnection procedures and agreements. The CAISO requested topic suggestions from stakeholders in August 2017, which were considered for inclusion in the scope of this initiative. In its issue paper, the CAISO expressed its intent to include many topics in the scope, including the few key ones highlighted below:

Enhancements to the transmission plan deliverability (TPD) allocation process around rules for parking and cost allocation for upgrades.

Review of the effectiveness and potential changes to the balance sheet financing option to demonstrate commercial viability.

Clarification to the annual full capacity deliverability option as well as options to transfer deliverability.

Consideration of solutions to prevent gaming of cost responsibility through processes to convert projects to energy only deliverability status or to re-enter the queue for full capacity.

Address tripping rules, ride-through requirements, and other inverter settings for inverter-based generation.

Consider a cut-off for project technology and fuel type changes.

Consider increasing the repowering study deposit from $10,000 to $50,000.

Reevaluate short circuit duty contribution criteria for repower projects.

CESA focused on two topics that we proposed as topics to consider in the 2018 IPE Initiative. The CAISO staff noted that it did not plan to consider those topics in its scope, but we reinforced the inclusion of these topics in our comments (as summarized below):

CESA recommended that the CAISO provide further clarity and transparency on the repowering process around “repower-and-retire” scenarios, as the current rules and processes may unreasonably cause the repowered energy storage resource to retire along with its paired existing generating facility.

CESA proposed that the CAISO provide clarifications on how deliverability is allocated between system and flexible capacity deliverability.

See CESA's comments on February 7, 2018 on the Issue Paper

Straw Proposal

On May 9, 2018, the CAISO issued its straw proposal and held a stakeholder meeting that narrowed down the list of 42 potential topics in the issue paper to 24 topics to be addressed in this initiative. On the issue of replacing entire existing generator facilities with energy storage, the CAISO responded to CESA’s comments that charging was never studied for the traditional generator and thus the CAISO cannot permit a 100% replacement through the modification process due to material changes to the electrical characteristics that were studied. Instead, the CAISO held firm that whole-change energy storage replacement requests must go through the cluster study process as a new project. Despite contesting CESA’s view on 100% replacement through the modification process, the CAISO agreed to further explore and provide clarity around the rules for the addition of energy storage and define better guidelines or “rules of thumb”, including in “repower-and-retire” scenarios where energy storage is added to an existing generating facility, which then retires. The CAISO noted that it would assess the reliability impact of the system without the original generating facility and just the energy storage remaining. If there is no reliability issue, the CAISO explained that it may allow the energy storage system to remain interconnected and operational, with available full capacity deliverability status (FCDS) or partial capacity deliverability status (PCDS) that could be transferred from the retiring unit to the energy storage resource; otherwise, the energy storage resource may also need to disconnect.

Additionally, the CAISO reviewed its interconnection data and found that it has thus far approved up to 10% conversion to battery storage from an existing project via the modification process. The CAISO affirmed that a bright line should not be established, and approval of partial replacement requests should be determined on a case-by-case basis due to the impact to the short circuit duty and assurance that energy storage is dispatched at the CAISO’s direction. The CAISO provided examples of how the modification process does not restudy on-peak deliverability and how energy storage additions could only be added as energy-only resources.

CESA successfully advocated to persuade the CAISO to consider these various modifications and “repower-and-replace” scenarios, which has significant impacts for many members developing hybrid energy storage projects. Even though 100% replacement through the modification process is not considered tenable, the CAISO may consider in this initiative how partial repowering could be allowed in the modification process to facilitate the retirement of existing generating facilities while keeping the added energy storage online. While adding energy storage to the rest of the interconnection capacity available to the original generating facility would require a full cluster study process, greater clarity on partial repowering may still deliver significant development cost savings by leveraging the modification process.

CESA expressed great appreciation for the CAISO in reassessing its initial position by including our repower-and-replace scenario issue in the scope of the initiative, but we offered comments on few areas of clarity needed:

CESA seeks to work with the CAISO to understand whether there are pathways for the reliability assessment for repowered energy storage facilities to remain online after the original generation facility retires.

CESA notes that non-battery storage technologies when used for repowering are capable of providing the critical inertial response, short circuit duty, and voltage support that the retiring synchronous generator provided.

CESA seeks clarity on the implications of FERC Order No. 845, specifically around the one-year grace period for these scenarios, in this initiative.

See CESA's comments submitted on June 8, 2018 on the Straw Proposal

On July 10, 2018, a Revised Straw Proposal was issued that responded to stakeholder comments on a number of topics within its scope. For CESA’s “repower and retire” scenario, the CAISO generally indicated that the current Generator Management Business Practice Manual (BPM) already addresses many of the issues raised by CESA, including the case-by-case determination through the material modification assessment (MMA) process of whether by what percentage of generation resource capacity a repowering with energy storage could be allowed. The CAISO recommended that CESA work through the BPM change management process for any requested changes and added that it will implement the proposed retirement clarifications through the Generator Management BPM. Finally, the CAISO explained that it is working on a compliance plan for Order No. 845 concurrently with the IPE Initiative.

On July 26, 2018, the CAISO Board approved seven changes to the generator interconnection process, including the requirement for resources to provide a copy of their PPA to demonstrate commercial viability and an increase to interconnection study deposits to $50,000 from $10,000.

CESA supported the CAISO and noted that CESA will work through potential changes to the reliability assessment through the BPM change management process and echoed our views on developing an Order 845 compliance plan for the repower-and-retire scenario.

See CESA's comments on July 31, 2018 on the Revised Straw Proposal

On August 28, 2018, the CAISO published an Addendum to the Revised Straw Proposal that addressed stakeholder comments with slight modifications to the proposal on a couple of items. Specifically, the CAISO proposed to not establish cost responsibility for any assigned DNUs for projects that obtained a transmission plan deliverability (TPD) allocation but had their PPA terminated at no fault of the interconnection customer or did not receive a PPA after being shortlisted. Previously, the CAISO proposed to require the interconnection customer to retain cost responsibility in these cases. Additionally, the CAISO clarified that projects will be eligible for reimbursement of funding provided for the construction of DNUs if a project that is required to retain the cost responsibility for assigned DNUs after conversion to energy only, and does fully fund its allocated portion of the DNU assigned to it and achieves commercial operation.

Final Proposal

On September 17, 2018, the CAISO held a public stakeholder meeting on to discuss the Draft Final Proposal for this initiative. In response to stakeholder requests to combine the generator interconnection agreement with the affected PTO upgrade facilities agreement, the CAISO said it will defer the issue of combining the generator interconnection agreement with the affected PTO upgrade facilities agreement to the next IPE process and proposed changes to the maximum cost responsibility for network upgrades. Next, the CAISO discussed the technical aspects of the proposal on ride-through requirements for inverter-based generation. The Generator Interconnection Agreement (GIA) is proposed to be revised to:

Eliminate momentary cessation for transient low voltages, and transient high voltages where V < 1.20 pu

Allow momentary cessation for V ≥ 1.20 pu

Eliminate inverter trip for momentary loss of the phase lock loop

Establish inverter TRIP return time range

Coordinate inverter controls with plant level controller

Identify minimum level of diagnostic equipment

The requirements for diagnostic equipment for plants with net export greater than 20 MW include the following:

Plant level data: monitor plant voltage, current and power factor, and any plant protective relay trips

Inverter level data: record ride through events and phase lock loop status

Time synchronization of data (1 mSec)

Data retention: retain data for 30 calendar days

Data reporting: provide data within 10 calendar days

Install a PMU or equivalent (minimum 30 samples per sec), but no real time telemetry is required

On November 13, 2018, the CAISO published an addendum to the Draft Final Proposal to reconsider its proposal for maximum cost responsibility of network upgrades and to explore new issues around interconnection request acceptance and validation criteria. Specifically, the CAISO proposes to specify minimum requirements for an IR application to be deemed complete:

If an IR application is not deemed complete by the close of the cluster application window, it will not move on to the validation process.

The CAISO will respond to IR submissions within five business days with a determination of IR deemed complete, or IR deemed incomplete and identify deficiencies in IR application.

Final submissions and attempts to cure must be submitted by April 15, and if the CAISO exceeds the 5 business day response timeline, the interconnection customer will be provided a day-for-day extension to the April 15 deadline.

On November 27, 2018, the CAISO held a stakeholder meeting discuss an addendum to the Draft Final Proposal.

On January 3, 2019, a second addendum to the Draft Final Proposal was discussed on a stakeholder call. The CAISO proposed the following modifications on maximum cost responsibility for network upgrades:

Proposes to adjust the maximum cost exposure (MCE) downward with the maximum cost responsibility (MCR), pursuant to Appendix DD, Section 7.4, with the understanding that it could increase with the MCR if the situation were to occur

Identifies each Interconnection Service Reliability Network Upgrade (ISRNU) as ‘allocated ISRNU’ and ‘non-allocated ISRNU’ for the purposes of defining cost responsibility within the current cost responsibility (CCR) and MCR

Retain the GIA as the point at which a PTO becomes responsible for network upgrade costs and appropriately align the execution of GIAs in the projects development process by removing the execution of a GIA from the TPD retention requirements

Provide clarification as to the impacts of a project that needs to fund a precursor network upgrade (PNU) or conditionally assigned network upgrade (CANU) early in order to achieve COD or deliverability.

Clarify that the RNU reimbursement cap can be impacted from a CANU-to-ANU [assigned network upgrade] conversion

The second addendum did not make any modifications to the proposals for interconnection request acceptance criteria and interconnection request validation criteria that were included in the first addendum. The CAISO believed the proposal will more efficiently and effectively assist interconnection customers during the interconnection request validation process and scoping meetings. The proposal also provided greater flexibility to the CAISO when large volumes of complex interconnection requests are received by enabling the CAISO to give interconnection customers more time if the CAISO misses any of its validation timeline requirements.

On April 1, 2019, FERC issued an Order that approved the CAISO’s Feb. 7, 2019 filing of tariff revisions to the Generator Interconnection and Deliverability Allocation Procedures in Appendix DD of the CAISO Tariff on April 1. The revisions enhance the generator interconnection process by: (i) clarifying what constitutes a “complete” interconnection request and what constitutes a “valid” interconnection request; (ii) extending the validation period, for curing deficiencies in submitted data, from May 31 to June 30; (iii) removing the requirement that interconnection requests must be valid before the ISO can schedule scoping meetings; and (iv) providing interconnection customers with day-for-day extensions to deadlines when the CAISO cannot meet its response deadlines for documentation submitted before May 31.

On April 25, 2019, the CAISO held a stakeholder call to discuss the proposed tariff revisions in compliance with FERC Order No. 845.

Energy Storage Interconnection (Stakeholder Process)

Background

The scope of this proceeding is to address energy storage interconnection issues to the CAISO-controlled grid, with a short-term focus on existing rules and opportunities to streamline them and a long-term focus on policy issues that may require more comprehensive examination. Not in scope of this initiative is interconnection below the CAISO-controlled grid and market/rate issues. Distribution-connected and customer-sited projects are not the focus of this initiative. The CAISO also modified the interconnection request reform to include technical data relevant to energy storage projects.

Issue Paper & Straw Proposal

On April 7, 2014, a stakeholder call was held to discuss the existing processes for interconnecting generators to the CAISO-controlled grid. This meeting also provided an introduction to the preliminary scope of the initiative, which is to ensure a one-stop, streamlined process for energy storage interconnection and identify improvements to the GIDAP that could be implemented prior to the Cluster 8 window. The CAISO will examine alignment between study methodologies with energy storage configurations and use cases, while assessing impacts of both discharging and charging given system, local, and flex RA rules. Most stakeholders supported consolidating the interconnection process for grid-connected storage under the GIDAP in order to avoid the inefficiencies of a bifurcated process that separates a storage facility into generation and load. As part of the GIDAP, the CAISO clarified that the facility would then have its charging and discharging cycles subject to CAISO dispatch instructions, including curtailment instructions to manage congestion or other operational issues on the system. The CAISO in particular opposed including unrestricted charging load in its retail load forecast, as it would, among other things, incent the approval of TAC-funded upgrades to support unrestricted charging, contradicting the potential for energy storage to increase T&D utilization and reduce the need for upgrades.

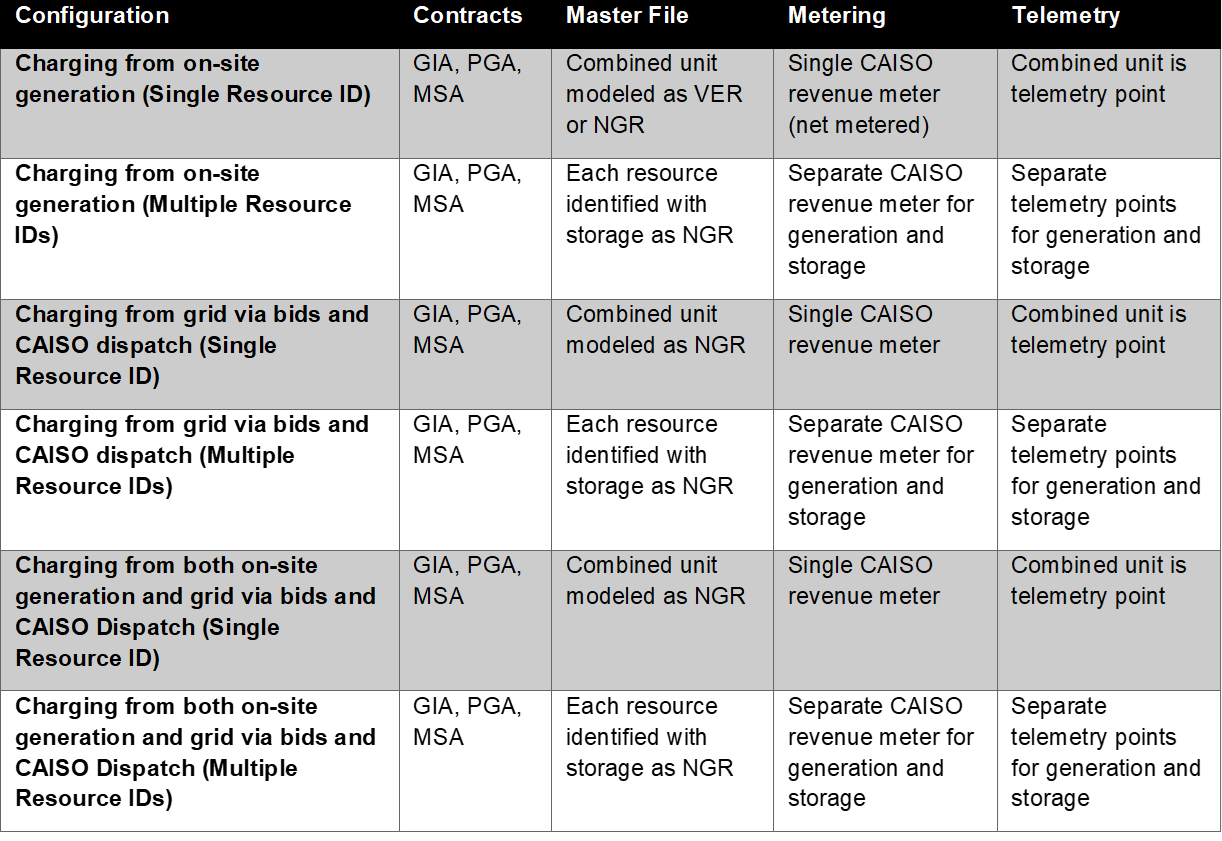

On June 24, 2017, an Issue Paper & Straw Proposal was issued that discussed how the existing GIDAP rules can accommodate energy storage projects in the Cluster 7 queue that want to be treated as generators for both aspects of their operation - i.e., produces positive output during discharge mode and negative output during charging mode. The CAISO observed that there is insufficient time to identify, seek approval, and implement changes to the GIDAP tariff for Cluster 7, and that this initiative would be used to inform the design of changes for future clusters. The CAISO identified the following topics as being within the scope: GIDAP interconnection study process, modification request process, ISP-BTM expansion process, deliverability study methodology, and new/streamlined agreements. Issues not in scope of this initiative were determined to be rate treatment for energy storage charging, energy storage as a non-transmission alternative, metering/telemetry rules, and market design. The CAISO also determined that it would examine three categories (CAISO grid-connected, distribution-connected, and customer-sited) and three configurations (standalone, paired with generation, and paired with onsite load) for consideration in this initiative.

On August 4, 2014, the CAISO made its FERC Order 792 compliance filing to revise its tariff to specifically define electric storage devices as "generating facilities" that can take advantage of generator interconnection procedures (see definition of the term "Generating Facility" in CAISO Tariff Appendices A, EE, and FF).

On August 13, 2014, a stakeholder meeting was held to provide an update that no changes to the GIDAP have been identified as necessary to accommodate standalone storage and storage combined with onsite generation interconnection to the CAISO grid. Changes to pro forma interconnection agreements to address charging functions are still under consideration. In addition, the CAISO indicated that this approach is not intended to determine what payments or charges beyond the interconnection process should be applicable to the charging mode. Considering energy storage resources must qualify for System or Local RA to provide Flex RA, the CAISO will study the resource for System and/or Local RA deliverability (as already done) and perform whatever additional study regarding its flexibility. The CAISO may need to modify a resource's Pmin due to transmission constraints. A future "unbundling" of flexible capacity (i.e., not delivering during peak system conditions) from system/local capacity may offer alternative interconnection options for flexible-only status. The CAISO also noted the need for additional study methodologies for storage facilities wishing to only provide Regulation Energy Management (REM).

Final Proposal

On November 18, 2014, a Draft Final Proposal was issued that confirmed that only few changes to the GIDAP have been identified as necessary, as discussed above. One notable change is that the Draft Final Proposal discussed how Non-Generator Resource (NGR) model resources are settled at the locational marginal price (LMP) for both discharging and charging, are not allocated a Transmission Access Charge (TAC), and treated similar to other generators for the settlement of station power. The CAISO also discussed how it will not adopt a charging deliverability study given that there is no specific system condition when energy storage must be able to charge, and it is difficult to demonstrate that what is not possible under one set of conditions proves that it is not possible under any conditions. The CAISO held the position that there is some reasonable window for charging available.

• Energy Storage and Distributed Energy Resources (ESDER) (Stakeholder Process)

Background

Following a road-mapping exercise, the CAISO combined many potential identified barriers to market participation by energy storage and aggregated distributed energy resources (DERs) into a catch-all initiative. Many critical items are lined up for consideration and resolution in this multi-phase initiative.

The Energy Storage and Distributed Energy Resources (ESDER) Stakeholder Initiative is the primary policy development mechanism to advance the opportunities for DER (including EV) for participating in the ISO Markets. Stakeholder initiatives typically take 1-2 years of policy development followed by system implementation. Initiatives are open to all stakeholders and the CAISO encourages participation and comments as the policy is developed.

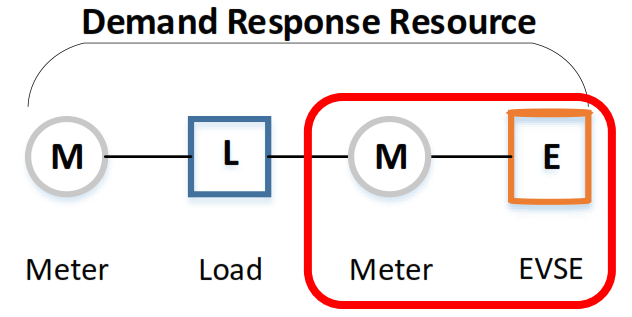

The ESDER initiatives focus largely on modifications to the Demand Resource (DR) and Non-Generator Resource (NGR) participation. ESDER Phase 3 (Fall 2020 implementation) will have an enhancement to measure EV performance separately from traditional facility loads, such as HVAC and lighting, which should better capture the response of EV’s to their traditional baseline energy consumption.

DERs can participate in the Proxy Demand Resource (PDR) and Reliability Demand Response Resource (RDRR) load curtailment products for energy, spin and non-spin products at a facility/utility line of service aggregation level on a non 24x7 basis. More information is located here.

The CAISO Distributed Energy Resource Provider (DERP) framework allows for the aggregation of BTM devices meeting CAISO participation requirements (size, communication, visibility, performance, and measurement). The DERP framework allows for the provision of all CAISO wholesale market products, including regulation under the NGR model. However, given the complexities of transmission and distribution dispatch coordination, costs, and interconnection of resource aggregations that export beyond the meter, these types of resources are not participating in the CAISO markets today. More information is located here.

Phase 4

On February 6, 2019, the CAISO published its Issue Paper for Phase 4 of this initiative and held a stakeholder call on February 13, 2019 that proposed to address the following topics:

Reviewing the CAISO’s market optimization of NGRs (i.e., real-time state of charge [SOC] management, effects of multi-interval optimization) and NGR participation agreements

Considering bidding requirements to optimally use energy storage resources, including local market power mitigation measures

Reflecting the operational characteristics of PDRs, including weather-sensitive DR resources

Consideration of MUA rules and application to CAISO market participation – e.g., 24x7 settlement rules for NGRs

In response, CESA recommended that the Phase 4 scope be expanded to better focus not only on key NGR model changes for IFOM resources, but also to better accommodate solar-plus-storage resources as well as key capabilities for BTM and MUA participation structures. CESA specifically recommended the following scope:

Establish RA counting for DERP model

Develop ‘less-than-24-hour’ participation requirement for DERP (e.g., by creating a baseline)

Incorporate weather adjustments to MGO baseline

Incorporate ‘spread bids’ for energy storage in the Day-Ahead Market

Review outage rules for NGRs and DERPs

Review RAAIM formulas for NGR and DERPs

Improve the management of customers in PDR groupings

Address various scheduling and dispatch limitations for NGRs

Value solar exports in the NGR and/or PDR models

See CESA’s comments on March 4, 2019 on the Issue Paper

On May 20, 2020, the Draft Final Proposal was published to discuss the following key changes:

Applying market power mitigation to storage resources

State-of-charge (SOC) biddable parameter for storage resources, including end-of-hour (EOH) and end-of-day (EOD)

Vetting qualification and operational processes for variable-output demand response resources

Two items were not covered because they remained unchanged, including the maximum daily run time parameter for DR and the streamlining of market participation agreements for NGR participants.

On August 21, 2020, a Final Proposal was published that only included changes to the EOH SOC biddable parameter proposal and the removal of an end-of-day (EOD) SOC until the short-term unit commitment (STUC) process can recognize the latter. Another simplified example of the BCR proposed settlement is provided.

• ESDER Phase 1 (Stakeholder Process)

Background

In Phase 1, the CAISO carved out critical wholesale market rules for Proxy Demand Response (PDR) metering, which allows for more optimal participation of behind-the-meter resources.

Phase 1 also established key CAISO approaches for multiple-use applications and for enhancements to the Non-Generator Resource (NGR) participation model. NGR will likely be used by larger energy storage systems coming online and participating in CAISO markets in coming years.

Draft Final Proposal

On December 23, 2015, the CAISO published its Revised Draft Final Proposal that:

Established a metering generator output (MGO) performance evaluation methodology: The MGO performance methodology baselines the energy storage device's "normal dispatch operations" and only provides credit for discharge above the baseline for the hours in which it was dispatched as a PDR resource. See Demand Response User Guide on page 164.